Election-Driven Crypto Surge: $25M BTC Options Trade Marks Record Volume

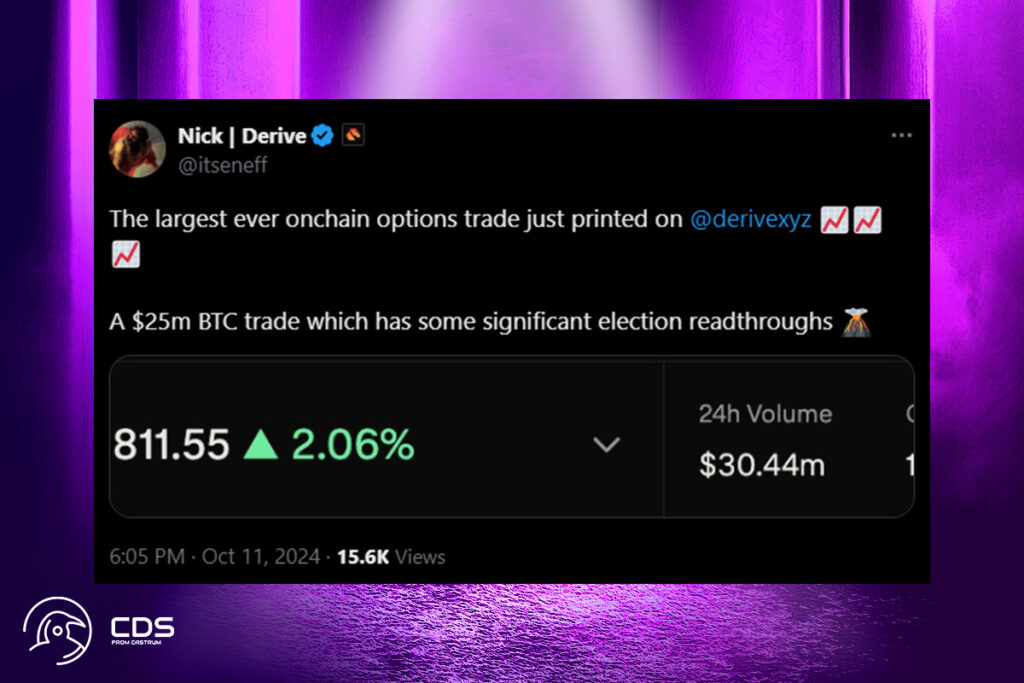

Significant increases in trade volumes in the cryptocurrency market are being driven by greater hedging and betting related to the upcoming U.S. election. An organization adopted a multi-legged bitcoin options strategy early this week on the decentralized derivatives exchange Derive, placing bets on a sustained increase in the price of BTC following the election on November 5. According to an email from Derive, the trade produced a notional trading volume of $25 million, making it the biggest on-chain options transaction wager ever connected to the US election.

$25M BTC Options Strategy with eBTC Collateral Could Yield $1M by Election

Simultaneously, the institution wrote or sold 200 contracts of the $80,000 call and 100 contracts of the $50,000 put, both of which had expiration dates of November 29. The institution also purchased 100 call option contracts with a $70,000 striking price. In order to ensure that it generates passive dividends, the institution put eBTC, or restated bitcoin created using EtherFi, as collateral.

If bitcoin rises to $80,000 by Nov. 29, the strategy—which resembles a ratio call spread financed by a short put position—will make the most money. Options flow on centralized exchanges, which show anticipation for a post-election surge to $80,000 and above, are in line with the positioning.

This $25 million options trade marks a watershed moment for onchain options trading, and it’s one that could have significant implications post-election. The institution has strategically positioned a unique structure with sold puts, bought calls, and eBTC collateral, potentially standing to make $1,020,000 on the structure if BTC hits $80,000 by November 29 – excluding any gains from the eBTC collateral. The trade is a prime example of how onchain options offer scalable, non-correlated yield for any onchain asset,

Nick Forster, co-founder of Derive

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment