Bitcoin and Ether Options Expiry Explained

Bitcoin and Ether– As the cryptocurrency market prepares for the expiration of monthly options contracts this week, short-term volatility may be on the horizon. With Bitcoin (BTC) and Ether (ETH) options worth $4.2 billion and $1 billion, respectively, set to expire on Friday, traders are closely monitoring the situation.

Significant Expiry Details

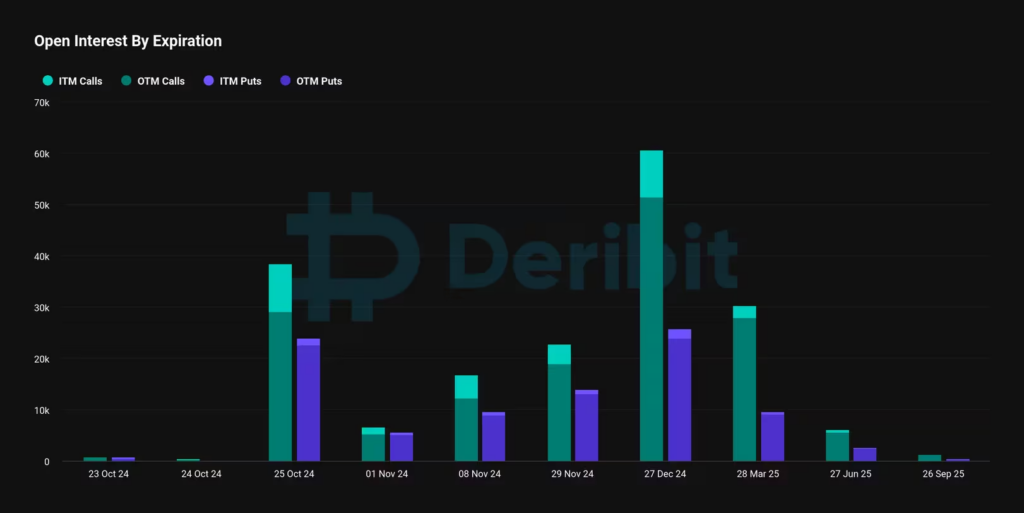

The options contracts will expire on Deribit at 08:00 UTC. Options give holders the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified timeframe. Notably, over $682 million in Bitcoin options—representing 16.3% of the total $4.2 billion—are poised to expire in-the-money (ITM), primarily as call options. An ITM call has a strike price below the current market rate, while ITM puts have strike prices above the spot price.

This situation could lead to increased market volatility as traders with profitable ITM options may seek to close their positions or adjust their bets ahead of the next expiry. The last quarterly expiry at the end of September exhibited a similar distribution of open interest.

Bullish Sentiment Reflected in Options Data

According to Deribit data, the bitcoin put-to-call open interest ratio stands at 0.62 leading up to the expiry, suggesting a relatively bullish market sentiment. In simpler terms, for every 100 active call options, there are 62 put options open. This preference for call options isn’t surprising, given that Bitcoin recently approached the $70,000 mark for the first time since July.

Max Pain Level Influences Market Dynamics

Bitcoin’s max pain level is currently set at $64,000, which is where the majority of options would expire worthless, resulting in maximum losses for option buyers and maximum profits for options writers. As of now, Bitcoin is trading near $67,000, above the max pain level, while Ether is hovering around its max pain level of $2,600. According to proponents of the max pain theory, this suggests that Bitcoin might have room to decline before the expiry, whereas Ether’s potential downside appears limited.

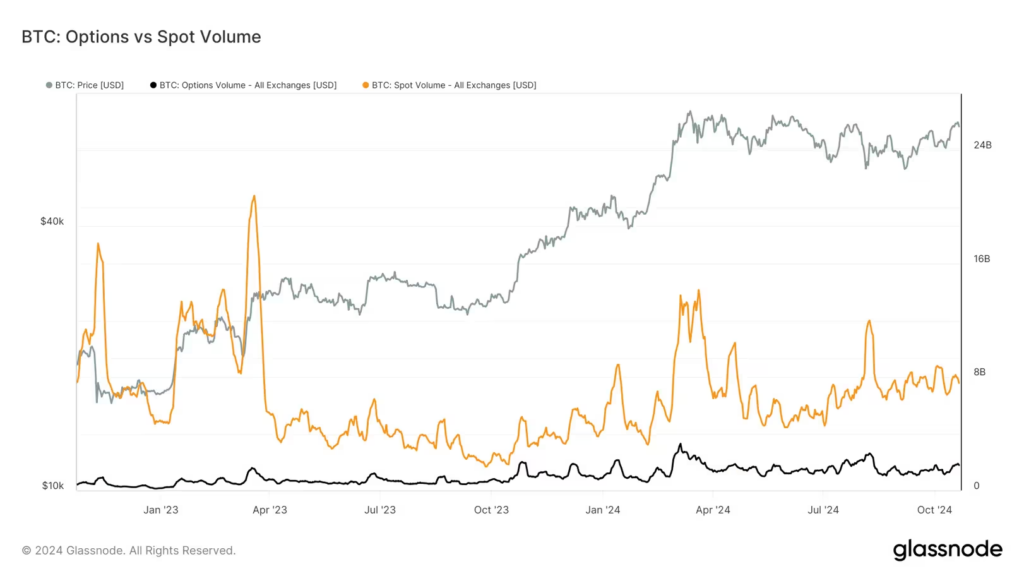

The max pain theory posits that the trading behavior of those with short options exposure tends to drive the underlying asset closer to its max pain level prior to expiry. However, opinions within the crypto community are mixed regarding the max pain effect, with some arguing that the options market remains too small to significantly influence spot prices.

As the expiry date approaches, all eyes will be on the cryptocurrency market to see how these dynamics unfold.

FAQs

What is the significance of the Bitcoin and Ether options expiration this week?

The expiration of Bitcoin and Ether options contracts, totaling $4.2 billion and $1 billion respectively, could lead to short-term market volatility. Traders are closely monitoring the expiration as a significant number of these options are set to expire “in-the-money,” potentially influencing market movements as holders adjust their positions.

What does the term “max pain level” mean in the context of options trading?

The “max pain level” refers to the price point at which the largest number of options would expire worthless, causing maximum losses for option buyers and maximum gains for options sellers. For Bitcoin, this level is currently at $64,000. Understanding this concept can help traders anticipate potential price movements leading up to the options expiration.

Leave a comment