Bitcoin News- Entering an “Explosive” Year in the Four-Year Cycle

Bitcoin News– Bitcoin’s price is currently consolidating below its all-time high of $69,000, which was reached in 2021. Independent trader Bob Loukas believes that Bitcoin is about to enter an explosive phase as it approaches the end of its four-year cycle. In a recent post on X dated October 8, Loukas stated, Bitcoin closes the 2nd year of its 4-year cycle next month, entering the 3rd and historically explosive year of the Cycle. This cycle analysis helps traders identify potential market peaks and troughs based on historical data.

Loukas employs a four-year cycle framework to gauge the Bitcoin market’s highs and lows. By examining past cycles, he hopes to forecast when Bitcoin might reach its peak in the current cycle. Currently, Loukas sees Bitcoin as accumulating within a descending broadening wedge pattern, following a drop from its all-time high of $73,835 on March 14. His analysis suggests that Bitcoin could soon enter a parabolic uptrend, driven by changing investor sentiment and potential interest rate cuts.

The Current Market Landscape

Loukas elaborates on the current market conditions, noting that an eight-month base has been established, sentiment has reset, and interest rates are beginning to ease. He remarked, I mean, the script is perfect. This optimistic outlook comes amidst a backdrop of general market uncertainty fueled by geopolitical tensions, the forthcoming U.S. presidential election, and concerns regarding the health of the U.S. economy. Despite these challenges, Loukas believes that bulls need to maintain the integrity of the eight-month base throughout October. He emphasized the importance of closing above the upper trending line of the broadening wedge pattern to confirm entry into the third year of the cycle.

The notion of Uptober is gaining traction in the crypto community, with analysts and enthusiasts expressing optimism about the possibility of a bull run in 2024. This sentiment is further bolstered by the increasing institutional interest in Bitcoin, especially with the anticipation of new spot Exchange-Traded Funds (ETFs). As Loukas notes, If speculative buying continues, the resulting FOMO could lead to a significant bounce.

Growing Institutional Interest and Market Dynamics

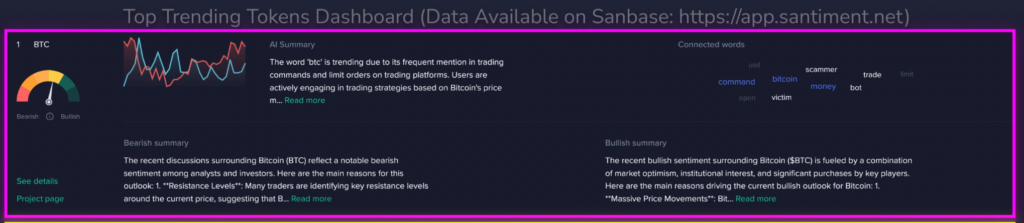

Analysts from blockchain analytics firm Santiment have observed a surge in investor interest in Bitcoin as the fourth quarter approaches. They highlight that both analysts and community members are optimistic about what Uptober could bring, coupled with the potential for a bullish market in the upcoming year. This growing institutional interest suggests that Bitcoin may be on the verge of a breakout, particularly as major players enter the market with new capital.

The re-emergence of net inflows into U.S.-based spot Bitcoin ETFs further supports this optimistic narrative. If institutional demand continues to rise, Bitcoin could follow a positive trajectory throughout the fourth quarter, aligning with Loukas’s predictions about the four-year cycle. The interplay between institutional investments and retail speculation is critical, as increased demand can lead to significant price movements.

A Cautious but Optimistic Outlook

In conclusion, Bitcoin’s current consolidation phase below its previous highs presents both challenges and opportunities for investors. As Bob Loukas articulates, entering the third year of the four-year cycle historically signifies a potential upward trajectory. While there are hurdles ahead, including economic uncertainties and geopolitical tensions, the growing institutional interest in Bitcoin and the anticipated easing of interest rates may pave the way for a bullish market.

Investors will need to remain vigilant, focusing on the monthly close above critical trend lines to confirm the bullish thesis. With the anticipation of rising demand, both from retail and institutional investors, Bitcoin may very well follow the upward momentum that characterizes successful cycles in its history. The next few months will be pivotal in determining whether Bitcoin can capitalize on this potential and whether it can ignite a significant rally as we head into 2024.

Leave a comment