Bitcoin Options – BTC Trading Volume Surges as Market Braces for NFP Release

Bitcoin options expiring on October 5 are currently trading at a significantly higher implied volatility (IV) compared to those expiring later in the month, such as on October 25. This phenomenon, often referred to as an IV kink, suggests that traders are bracing for notable price fluctuations over the upcoming weekend. The current market sentiment reflects concerns surrounding the release of Friday’s non-farm payrolls (NFP) report and the possibility of retaliatory strikes by Israel in the wake of escalating geopolitical tensions.

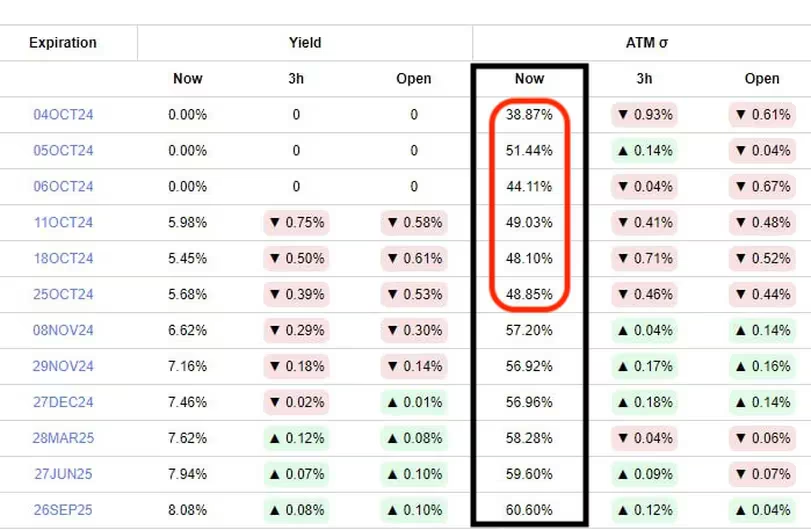

Analyzing the Implied Volatility Term Structure

As of now, Bitcoin’s implied volatility term structure indicates that larger price movements are anticipated for Saturday, October 5, compared to the days leading up to October 25. According to options data tracked by Deribit and analyzed by Arbelos Markets, the term structure typically exhibits an upward slope, where longer-duration options reflect higher implied volatility than their short-duration counterparts. However, the current data reveals a distinct kink in this curve, with October 5 options trading at an annualized IV of 51.44%—notably higher than those expiring on October 6, 11, 18, and 25.

Joshua Lim, co-founder of Arbelos Markets, remarked, “There’s a very noticeable kink in the vol curve—Friday (October 4) is trading around 39 vol and Saturday (October 5) is trading at 51 vol. The market is pricing in a risk premium from the non-farm payrolls data, but more importantly, some probability of an Israeli retaliation post-Rosh Hashanah.”

Focus on Upcoming Non-Farm Payrolls

The U.S. Bureau of Labor Statistics is set to release the NFP report on Friday at 12:30 UTC. Analysts expect the data to show that the economy added 140,000 jobs in September, following August’s weaker-than-expected increase of 142,000. The jobless rate is anticipated to hold steady at 4.2%, while the year-on-year growth rate of average hourly earnings is predicted to match August’s pace of 3.8%.

According to ING, the risks are skewed towards a hawkish repricing of 25 basis points Fed rate cuts in November and December, along with a stronger dollar—unless the upcoming data misses expectations by a significant margin. Following a 50 basis points rate cut last month, markets now expect at least another 50 bps cut by the end of the year.

Geopolitical Tensions Impacting the Market

On October 1, Iran launched at least 180 ballistic missiles at Israel, escalating tensions and increasing the risk of a full-scale war. This geopolitical development has led to broad-based risk aversion, causing Bitcoin to drop over 4% as it tested the $60,000 support level. Investors are currently on high alert, awaiting Israel’s retaliation against Iran, which has contributed to rising crude prices and a stronger dollar index.

Potential Market Volatility This Weekend

As both traditional and crypto markets prepare for a potentially volatile weekend, traders are advised to remain cautious. A possible military action during the weekend—when traditional markets are closed—could provoke significant movements in the digital assets market. This scenario is likely to lead to an unusually turbulent trading environment for both Bitcoin and other cryptocurrencies.

A Weekend of Uncertainty Ahead

With heightened implied volatility, looming economic reports, and escalating geopolitical tensions, traders are bracing for a weekend of significant price action. As the market navigates these uncertainties, staying informed and vigilant will be crucial for investors looking to manage risk effectively.

FAQ

What is implied volatility in Bitcoin options?

Implied volatility (IV) is a metric that reflects the market’s expectations of future price fluctuations in an asset, such as Bitcoin. Higher IV indicates that traders expect larger price swings in the near future.

Why is there a spike in implied volatility for Bitcoin options expiring on October 5?

The spike in implied volatility is attributed to expectations of significant price movements following the release of non-farm payroll (NFP) data and geopolitical tensions, particularly Israel’s potential retaliation against Iran.

Leave a comment