Bitcoin Spike Following Fed’s Unusual Rate Cut, Traders Prepare for Key Price Action

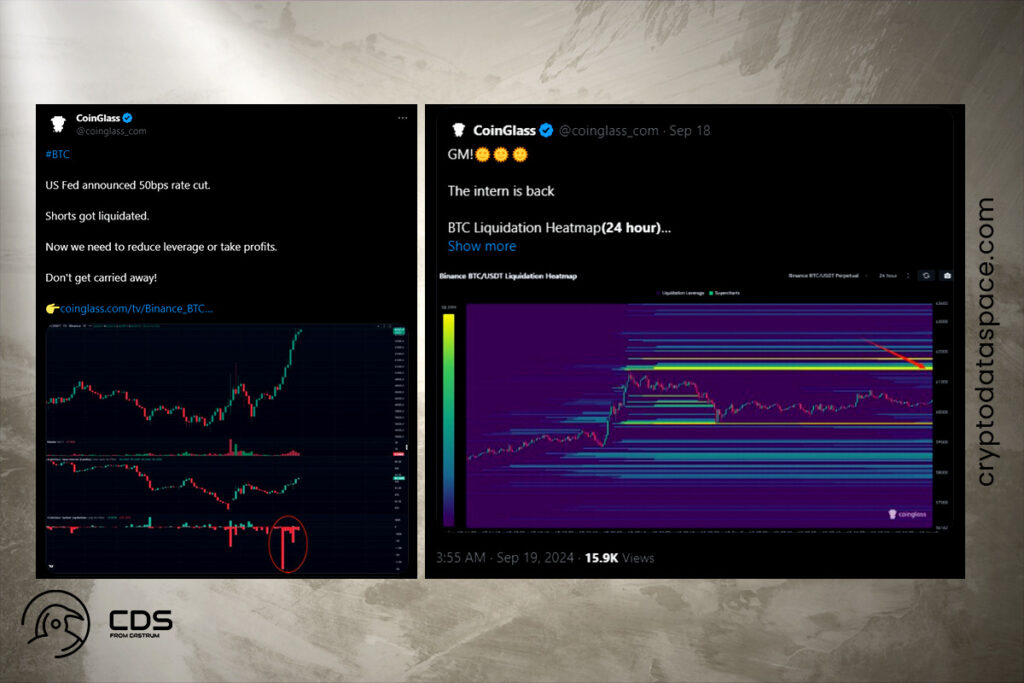

As markets attempted to process the unusual interest rate drop by the US Federal Reserve, Bitcoin experienced a sharp spike. The Fed’s announcement was followed by local highs of $62,600, marking only the third time in history that a rate-cutting cycle has started with a 0.5% reduction. Consequently, short Bitcoin holdings were closed across exchange order books. $201 million is the sum as of this writing for the 24 hours, according to data from the monitoring resource CoinGlass.

Now we need to reduce leverage or take profits,

CoinGlass

It was previously claimed by Cointelegraph that a 0.5% drop would bring BTC prices down below $64,000. In the end, bulls were unable to muster this amount of money as strong resistance remained above.

Bitcoin slowly eating its way through the resistance level. Above $62,500, things will look a lot more constructive, and stops above $65,000 won’t be safe anymore. Going to be an interesting end to September.

popular trader Jelle

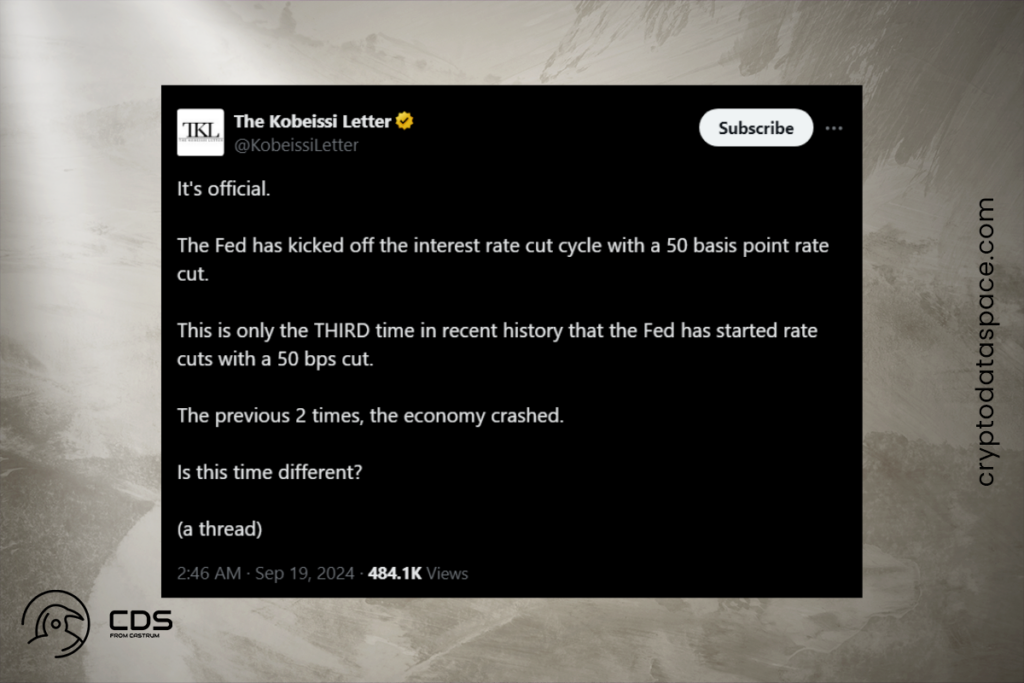

The Kobeissi Letter Flags Risk for US Markets Amid Fed’s 50 bps Rate Cut

Arthur Hayes, the former CEO of BitMEX, was now focused on the Bank of Japan’s upcoming September 20 rate announcement. He proposed that the value of the yen would, therefore, affect the performance of the price of Bitcoin. Zooming out, however, revealed a stark caution for risk-asset traders in the trading resource The Kobeissi Letter. In the end, rate-cutting cycles that start with a 0.5% decrease hurt US markets even though they appear to provide liquidity.

In 2001, the market fell 31% after 2 years and in 2007 the market fell 26% after 2 years. These were major crises,

By contrasting the Fed’s positive tone with the extent of its policy retraction, Kobeissi hinted at a potential conflict.

If the Fed has only started with 50 basis point rate cuts during crises, why start with 50 bps this time? The Fed continues to say the economy is strong and they are calling for a soft landing. But policy decisions are as if we are in a crisis. Something doesn’t add up here.

The Kobeissi Letter

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment