Bitcoin Price Surge: Caution Amidst Increased Market Activity

Bitcoin Price– Bitcoin (BTC) recently surged above $61,000 in anticipation of the U.S. market opening on Tuesday. This spike may indicate a short-term peak for the largest cryptocurrency by market value, especially if trading volume patterns on Binance serve as a guide.

Notable Price Movement and Market Trends

The 6% jump earlier in the day was significant, as BTC has often seen declines immediately after U.S. equity trading begins, according to Velo Data. However, the factors behind this price spike suggest market volatility rather than sustained upward momentum.

Binance Spot Volume and Market Sentiment

Activity on Binance highlights this volatility. In just one hour, a net $85 million in spot volume— the highest seen in over three months—flowed into the exchange, as reported by cumulative volume delta (CVD) figures from Glassnode. CVD tracks the net difference between buying and selling volumes and often provides insights into market sentiment.

Historical Patterns of Volume Surges

Historically, surges in Binance spot volume have coincided with local market tops. Notably, similar spikes on August 8, 15, 20, and 23 were followed by price pullbacks for Bitcoin. True to form, BTC has retreated below $60,000 following this latest uptick, indicating that some traders are using these price increases to offload Bitcoin at a profit.

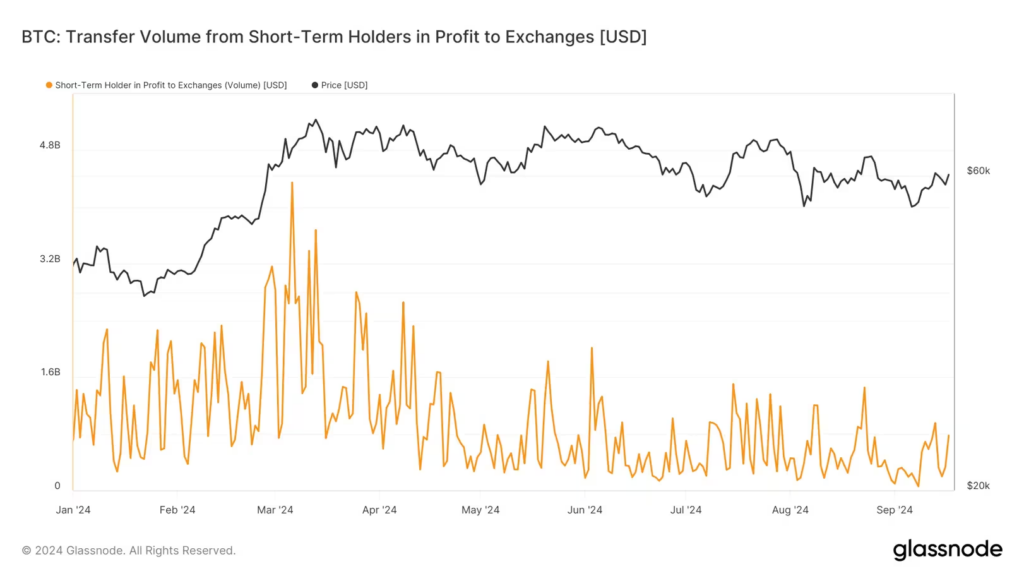

Profit-Taking by Short-Term Holders

A significant amount of $750 million worth of Bitcoin was sent to exchanges from short-term holders—defined as those who have held BTC for less than 155 days. This represents the second highest amount of profit-taking since the end of August, suggesting a more cautious outlook among major participants in the market.

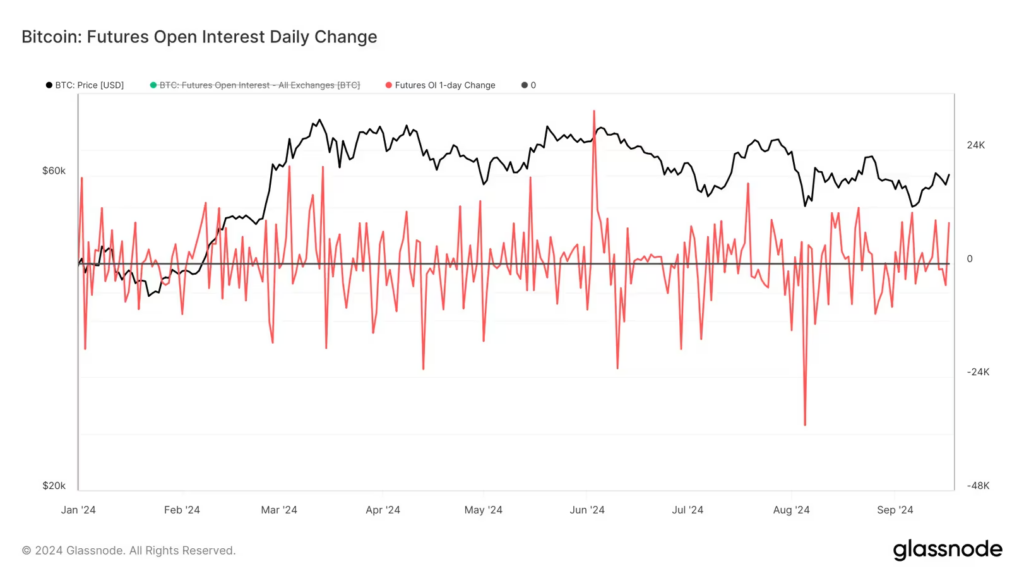

Rising Futures Open Interest (OI)

The overheated market conditions are also reflected in the rise of futures open interest (OI), which measures total funds allocated in open futures contracts. According to Glassnode, over 8,600 new Bitcoin-denominated contracts entered the market. Large spikes in OI typically indicate new capital influx, with traders leveraging positions to capitalize on short-term price movements.

Balancing Opportunities and Risks

While this influx of capital has likely contributed to Bitcoin’s recent rally, it also introduces additional risks to the market. Heightened leverage can amplify both gains and losses, increasing the likelihood of volatility in the near term. As traders navigate these dynamics, the market will remain on alert for potential corrections following significant price movements.

15 Comments