Crypto Credit Markets Eye Fed Rate Cut to Reboot DeFi Yields

According to experts at research and brokerage firm Bernstein, decentralized finance yields are poised for a resurgence with U.S. Federal Reserve rate reduction imminent, including the possibility of a 25 or 50 basis point cut on Wednesday.

With a rate cut likely around the corner, DeFi yields look attractive again. This could be the catalyst to reboot crypto credit markets and revive interest in DeFi and Ethereum,

Gautam Chhugani, Mahika Sapra and Sanskar Chindalia

DeFi provides liquidity on decentralized lending markets, among other use cases, allowing global users to earn returns on stablecoins such as USDC and USDT. The biggest Ethereum lending market, Aave, still offers stablecoin loan yields of 3.7% to 3.9%, even if the frenzy of 2020’s DeFi summer is long gone and the inflated yields of that period with extra app token incentives are long gone.

DeFi Markets on the Rise: TVL Doubles, Wallet Activity Stays Strong, Say Experts

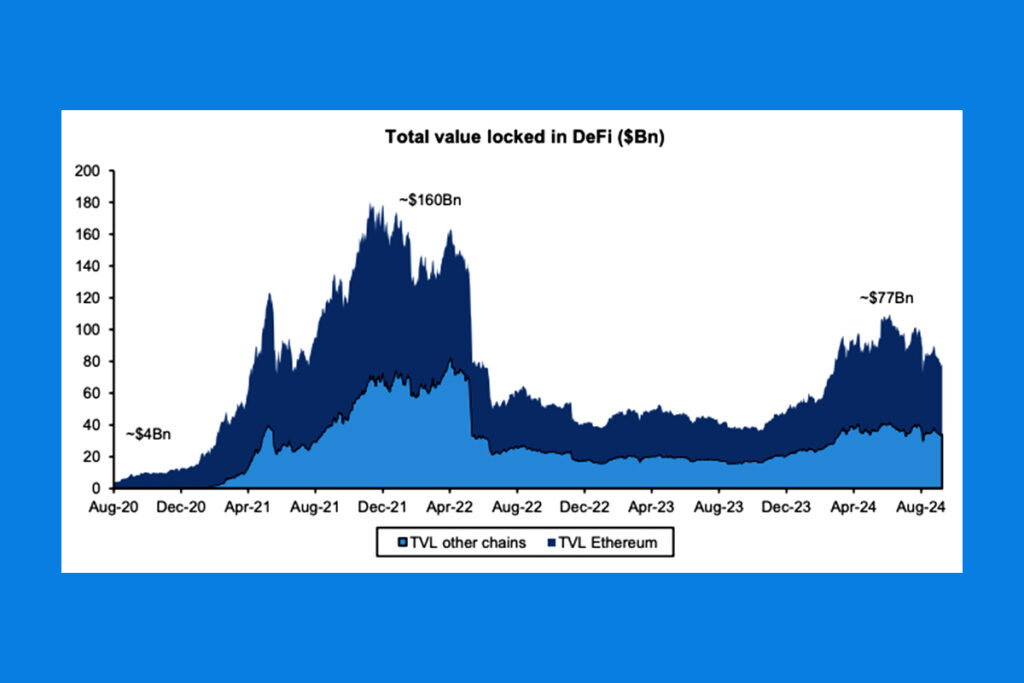

The analysts claim that the cryptocurrency loan markets are reviving as a result of the dovish direction of the rate cycle and the emergence of a new cycle. While still only half of its 2021 peak, the total value locked in DeFi has doubled from the 2022 low to $77 billion, and the number of monthly DeFi users has increased three to four times since the lows, they pointed out.

According to The Block’s data dashboard, stablecoins have also recovered to highs of about $178 billion. Additionally, Chhugani, Sapra, and Chindalia reported that the number of active monthly wallets remains steady at about 30 million. They went on to say that these are all indications of a recovering crypto DeFi sector, which should see additional acceleration as interest rates decline. Stablecoin DeFi yields have the potential to surpass those of US dollar money market funds if cryptocurrency traders’ desire for borrowing increases. According to them, this would rekindle the cryptocurrency credit markets and drive up the value of digital assets.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment