Bitcoin and Ether Drop Amid Political Tensions and Broader Market Risk-Off Sentiment

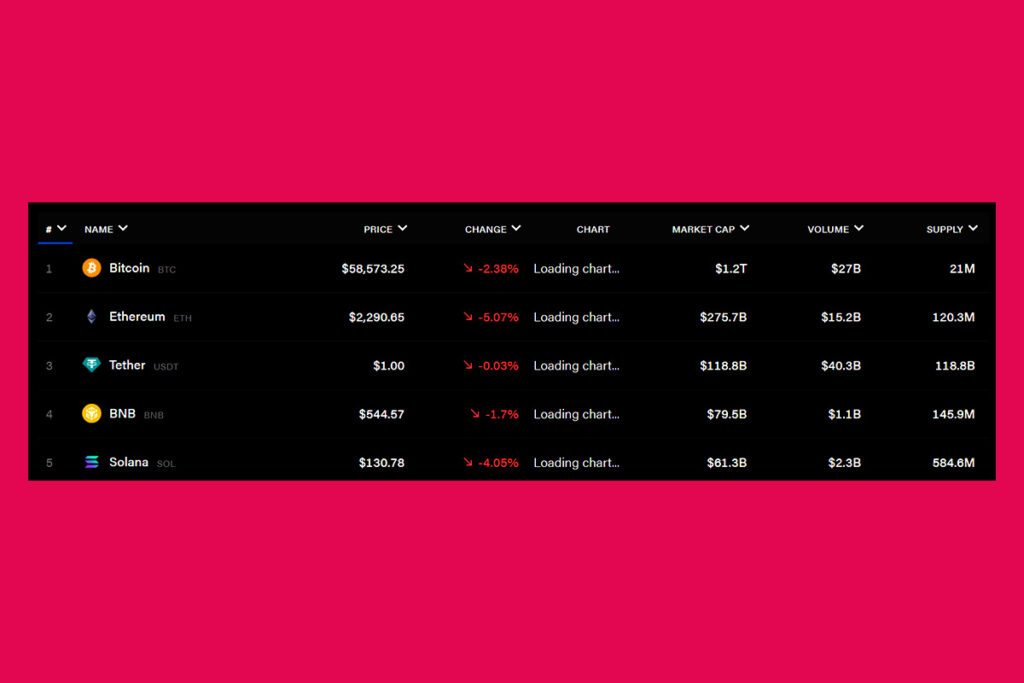

Over the previous day, Bitcoin fell 1.95% to trade at about $58,486 as investors continued to assess the possible effects of the US Federal Reserve’s widely anticipated interest rate drop. The price page of The Block indicates that Ether dropped 4.63% to trade at $2,298. A second assassination attempt on Donald Trump, the current Republican presidential contender and former US president, is reported to have occurred at the same time as the price decreases.

While it is difficult to say that the price drop is directly related to the assassination attempt on Donald Trump, the timing does coincide with a sharper move lower in crypto markets. However, we believe this is more likely due to crypto giving up the gains seen on Friday, which were not experienced by equities, and a broader risk-off movement ahead of the FOMC meeting,

Min Jung, an analyst at Presto Research

Crypto Market Awaits Fed Decision, Analyst Dismisses Trump Assassination Impact on Prices

Tuesday and Wednesday are the upcoming Federal Open Market Committee meeting dates. Investors and officials are expecting an announcement on a rate cut. According to Augustine Fan, head of insights at SOFA.org, the attempted assassination of Trump is not important for macro markets for now.

The truth is that we are still at $58,000 and the bitcoin price hasn’t moved in two weeks outside of a small break to $54,000 and $60,000, so all of this is really noise. The possible reason crypto went up on Friday is due to the massive squeeze in SOFR futures (50 basis point cut) and resulting equity rally, rather than anything crypto-specific. We are failing to see a carry-through of that momentum in today’s session.

Fan

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment