Ethereum Price- Ethereum’s Potential Bear Cycle and How It Might Avoid Capitulation

Ethereum Price– Recently, there have been growing concerns that Ethereum (ETH) could be entering a bear cycle. While this scenario is possible, recent on-chain analysis suggests that ETH might be able to avoid a full-scale capitulation. Here’s a detailed look at the factors at play and what they could mean for Ethereum’s price in the near future.

Ethereum’s Strong Support Levels

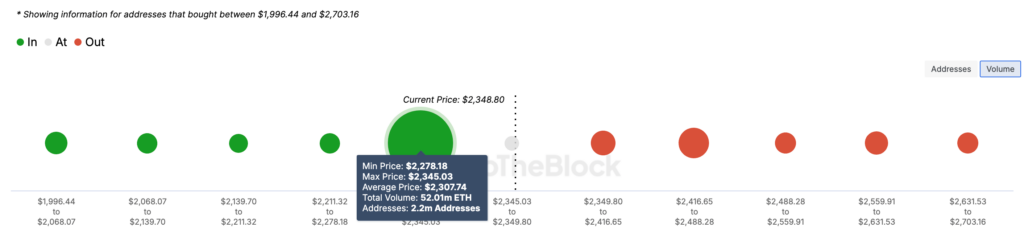

Ethereum’s resilience against a potential bear cycle can be attributed to its strong support levels. According to the In/Out of Money Around Price (IOMAP) metric, which analyzes market participants based on their profit or loss status, significant buying activity has occurred at certain price points. Specifically, 52 million ETH coins were accumulated at an average price of $2,345. This accumulated volume is notably higher than the volumes acquired at higher price levels, ranging from $2,349 to $2,703.

Why Volume Matters

Higher trading volumes at specific price levels typically exert a stronger influence on price movement. When a large volume of coins is purchased at a particular price, those holders are less likely to sell their assets at a loss, providing robust support at that price point. Consequently, with substantial buying volume at $2,345, Ethereum benefits from strong support, which could help prevent the price from falling further.

In contrast, if a large volume of ETH were held at a loss, it could lead to resistance as these holders might sell off their assets to break even. Thus, the significant accumulation at the $2,345 level is a bullish indicator, potentially pushing ETH’s price higher and even approaching $2,800.

Chaikin Money Flow (CMF) Indicator

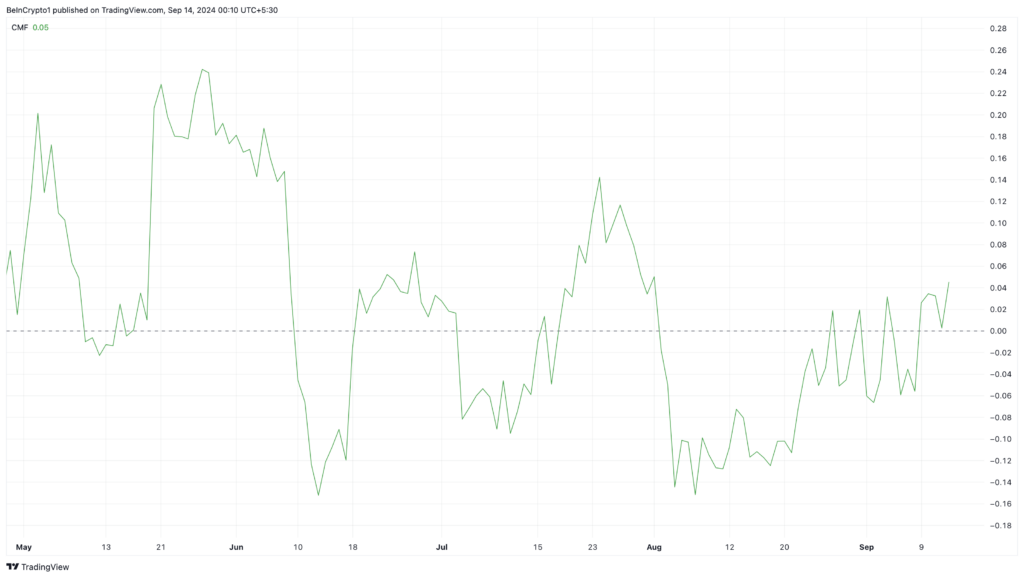

Another crucial factor reinforcing Ethereum’s potential recovery is the Chaikin Money Flow (CMF) indicator. The CMF measures the balance between accumulation and distribution by analyzing the flow of money into and out of the asset. A rising CMF suggests that buying pressure is outpacing selling pressure, indicating a period of accumulation. Conversely, a falling CMF would signal increased selling pressure or distribution.

Current CMF Status

On the daily chart, Ethereum’s CMF has moved into positive territory, signaling that accumulation is currently surpassing distribution. This positive CMF reading is a bullish sign, suggesting that increased buying pressure could help Ethereum recover from recent losses and push its price higher.

Ethereum Price Prediction: Demand and Resistance Levels

In recent trading, Ethereum has experienced a steady upward trend, rising from $2,225 to $2,421. This upward movement suggests that further price increases might be on the horizon. According to technical analysis, a supply zone exists around the $2,700 mark, which could act as a significant resistance level. However, the $2,400 region serves as a strong demand zone, which could support Ethereum’s price and increase the likelihood of surpassing the $2,581 resistance.

Potential Price Targets

Additionally, the presence of a sell wall around $2,744 supports the possibility of Ethereum pushing higher. If ETH manages to clear these resistance levels, its price could potentially reach $2,800 and possibly even $2,991. Traders should, however, remain cautious of potential market volatility. If the broader cryptocurrency market transitions from a bullish to a bearish sentiment, this optimistic forecast might be affected.

Risk of Market Volatility

If the market sentiment shifts negatively, Ethereum’s price could face downward pressure. In such a scenario, ETH might drop to around $2,114. It’s crucial for traders and investors to monitor market conditions closely and be prepared for potential volatility.

Conclusion

In summary, while there are concerns that Ethereum could enter a bear cycle, several factors indicate that the cryptocurrency might avoid significant capitulation. Strong support levels at $2,345 and positive CMF readings suggest that Ethereum has the potential to recover from recent losses and push towards higher price targets. However, traders should be aware of potential market volatility and remain vigilant for any shifts in market sentiment.

FAQs

What is the current support level for Ethereum (ETH)?

Ethereum’s current support level is around $2,345. This level is significant because it represents the average price at which a substantial volume of ETH was purchased. The presence of strong support here could help ETH avoid a bearish trend and potentially push the price higher.

What is the Chaikin Money Flow (CMF) and what does it indicate for ETH?

The Chaikin Money Flow (CMF) is an indicator that measures the balance between buying and selling pressure over a specific period. A positive CMF indicates that buying pressure is greater than selling pressure, suggesting accumulation of the asset. For Ethereum, a positive CMF suggests that buying pressure is increasing, which could help Ethereum recover from recent losses.

Leave a comment