Investor Buying Pressure on Kraken and Coinbase Increases: 250% and 123% Buy-Sell Rates

Comparing the volume of buy-to-sell orders on Kraken and Coinbase, the buy-sell ratio has averaged 250% and 123%, respectively, this month, according to data compiled by London-based CCData. When the ratio is greater than 100%, it signifies net bullish pressure since there are more buying than sales. In light of these data, Kraken and Coinbase are popular destinations for bargain hunters who buy bitcoins at what they consider to be discounts in response to other exchanges’ demand to sell the top cryptocurrency.

The average buy-sell ratio suggests stronger buying pressure on Kraken and Coinbase, with ratios of 250% and 123%, respectively, compared to near-parity on Bybit and Binance, which have ratios of 99% and 97%. Although these observations don’t lead to a definitive conclusion, they imply that Kraken and Coinbase have recently been the preferred venues for accumulation,

Hosam Mahmoud, research analyst at CCData

Kraken & Coinbase Attract Big Transactions, While Bybit and Binance Are Ideal for Small Traders

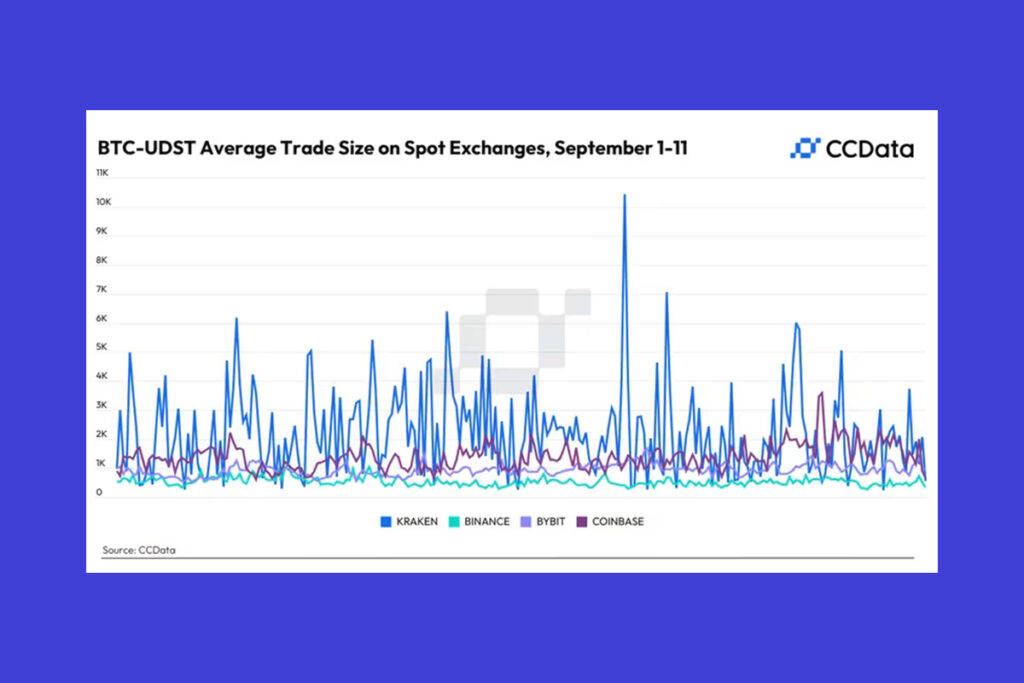

While bargain hunters over Kraken and Coinbase are probably huge investors, instant or day traders over Bybit and Binance are probably retail investors. This is due to the fact that the average trade amount for bitcoin-tether (BTC/USDT) spot pairs this month was $747 on Binance and $898 on Bybit. According to CCData, that is significantly less than the average size of $2,148 and $1,321 on Kraken and Coinbase, respectively.

This indicates that in this timeframe, Kraken and Coinbase tend to attract larger trades, likely from institutional or long-term investors, while Bybit and Binance appear to cater more to smaller, frequent trades,

Mahmoud

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment