Ethereum News – Digital Asset Products Face $726 Million Outflows, Bitcoin and Ethereum Hit Hard

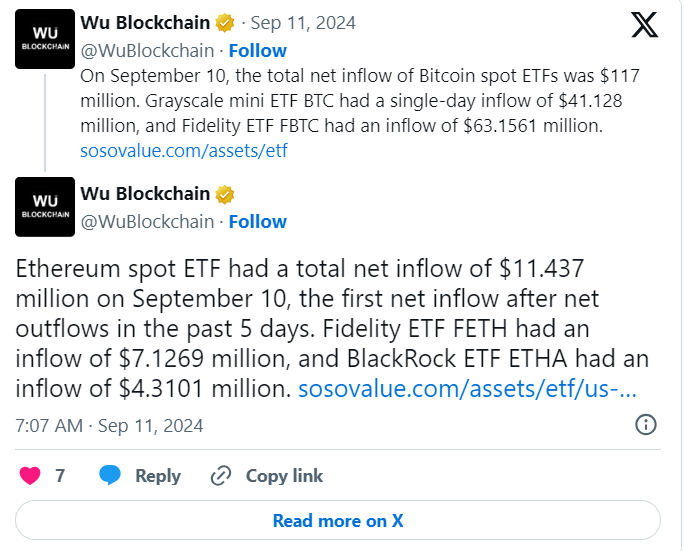

Ethereum News – On Tuesday, US spot Bitcoin exchange-traded funds (ETFs) experienced notable inflows totaling approximately $117 million, marking a significant rebound following a period of outflows. This resurgence is a welcome shift for the market after several weeks of declining investment.

Fidelity’s Bitcoin Fund Leads the Surge

Fidelity’s Bitcoin Fund (FBTC) was at the forefront of this recovery, attracting a substantial $63 million in net inflows. According to Farside Investors, this boost elevates FBTC’s total net inflows to $9.5 billion over eight months of trading. Currently, FBTC holds $10.5 billion in Bitcoin, positioning it as the third-largest Bitcoin ETF, behind BlackRock’s iShares Bitcoin Trust (IBIT) and Grayscale’s Bitcoin Trust (GBTC).

Other Bitcoin Funds Perform Well

In addition to FBTC, other Bitcoin funds also saw strong performances. Grayscale’s Bitcoin Mini Trust (BTC), a lower-cost alternative to GBTC, and ARK Invest’s Bitcoin ETF (ARKB) received $41 million and $13 million in inflows, respectively. However, BlackRock’s IBIT and several other major Bitcoin ETFs did not record any inflows during the session.

Recent Outflows and Market Dynamics

This positive shift follows a challenging period characterized by significant outflows, which began in late August and extended into early September. During this time, over $1 billion was withdrawn from Bitcoin investment products. Notably, BlackRock’s IBIT experienced its second outflow since its launch in January. Despite these setbacks, IBIT remains a dominant player in the market, holding over $20 billion in assets.

Ethereum ETFs Experience Modest Recovery

In parallel with Bitcoin ETFs, US spot Ethereum ETFs also showed signs of modest recovery, registering around $11 million in net inflows on Tuesday. Fidelity’s Ethereum Fund (FETH) attracted $7.1269 million, while BlackRock’s iShares Ethereum Trust (ETHA) saw an inflow of $4.3101 million. Other Ethereum ETFs did not experience any movement.

Market Trends and ETF Launches

Despite recent outflows, crypto-related ETFs continue to dominate the ETF market. Of the 400 new ETFs launched in 2024, the top four are all spot Bitcoin ETFs. Key offerings include BlackRock’s iShares Bitcoin Trust, Fidelity’s Wise Origin Bitcoin Fund, ARK 21Shares Bitcoin ETF, and Bitwise’s Bitcoin ETF Trust. Additionally, the iShares Ethereum Trust ETF has become the seventh-largest ETF launch of 2024, surpassing $1 billion in inflows as of August.

Digital Asset Products Face Largest Outflows Since March

Digital asset investment products have seen substantial outflows, totaling $726 million over the past week, matching the largest recorded outflow since March of this year. Bitcoin was particularly hard-hit, with outflows totaling $643 million. However, short-Bitcoin products saw minor inflows of $3.9 million, suggesting some investors are hedging against further price declines. Ethereum also faced significant losses, with outflows reaching $98 million, largely from the Grayscale Ethereum Trust.

Seasonal Market Trends

Historically, September has been a challenging month for Bitcoin, often referred to as “Rektember” due to its weakened performance during this period. Conversely, October, known as “Uptober,” typically sees more positive price movements, which may influence future market trends.

FAQ: Bitcoin and Ethereum ETF Market Update

What caused the recent $117 million inflow into Bitcoin ETFs?

The $117 million inflow into Bitcoin ETFs on Tuesday was primarily driven by Fidelity’s Bitcoin Fund (FBTC), which attracted $63 million in net inflows. This rebound follows a period of significant outflows from Bitcoin ETFs.

How has Fidelity’s Bitcoin Fund performed recently?

Fidelity’s Bitcoin Fund (FBTC) has seen substantial growth, with total net inflows reaching $9.5 billion after eight months of trading. FBTC now holds $10.5 billion in Bitcoin, making it the third-largest Bitcoin ETF.

What are the notable Bitcoin ETFs experiencing inflows?

In addition to Fidelity’s Bitcoin Fund, Grayscale’s Bitcoin Mini Trust (BTC) and ARK Invest’s Bitcoin ETF (ARKB) also saw inflows of $41 million and $13 million, respectively.

Leave a comment