BTC Price Nears August Lows Due to Nvidia and Global Market Movements

BTC Price Dips – On September 4, Bitcoin (BTC) neared its monthly lows as the cryptocurrency market continued to respond to the turmoil in U.S. tech stocks. This drop follows a significant decline in Nvidia’s stock price, which has influenced Bitcoin and other risk assets.

Bitcoin Hits Monthly Lows

Data from Cointelegraph Markets Pro and TradingView revealed that Bitcoin’s price fell to $55,602 on Bitstamp, marking a level not seen since August 8. After a recovery of up to 40% from its August crash, BTC/USD began to test downside levels, approaching $50,000.

Tech Giant Nvidia’s Impact

The recent decline in Bitcoin’s price can be attributed to the struggles of Nvidia, which saw its stock price plummet following a U.S. subpoena. This led to a broader sell-off in risk assets, including cryptocurrencies.

Gold and Global Markets React

In addition to Bitcoin’s decline, gold—which had recently reached a new all-time high above $2,500—shed up to 1.3% on September 3. Meanwhile, Japan’s Nikkei 225 index dropped 4.2% during the Asia trading session on September 4, further applying pressure to Bitcoin and other altcoins.

Market Sentiment and Technical Analysis

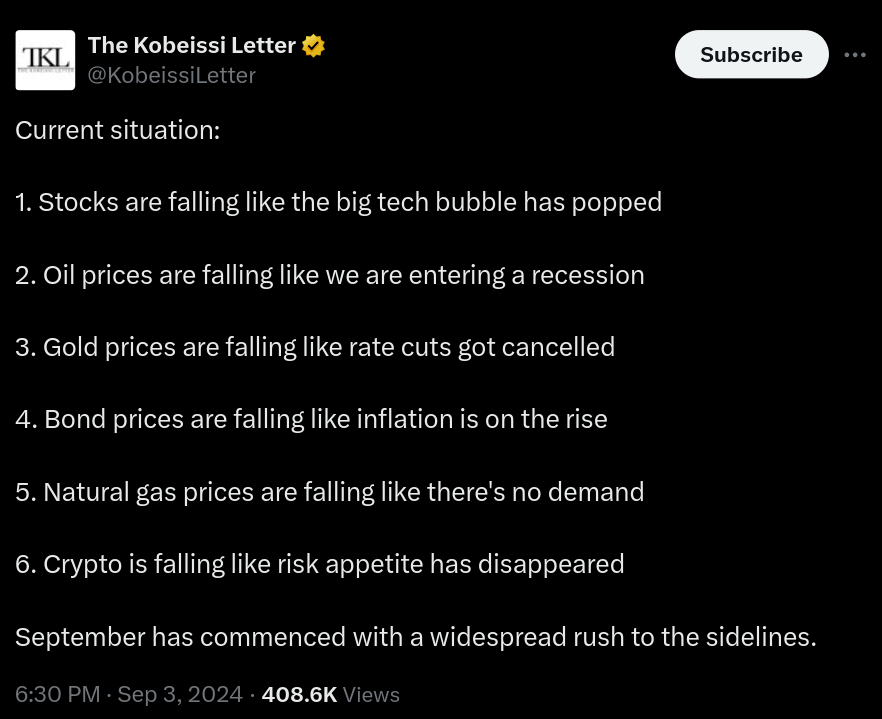

The trading resource The Kobeissi Letter noted that September began with a significant shift to caution among investors. Popular trader CrypNuevo highlighted the ongoing process of filling downside candle wicks, with short-term targets extending to $51,500.

“7-day liquidations hit $57,000, and the $56,600 long wick was filled. The liquidity run and wick fill projection are complete,” CrypNuevo stated. He also noted the potential for a bounce in this price range, but warned that if Bitcoin loses this support, it could further test the daily wick at $51,500.

Potential for Reversal and Volatility

Trader Jelle saw potential for a reversal, observing a possible 12-hour bullish divergence as Bitcoin tests its support level again. He indicated that while the immediate upward movement did not materialize, the current price action suggests a potential relief rally might be imminent.

“Nice wipe on Open Interest (OI) here but no immediate signs of buyers stepping in just yet,” he noted. Credible Crypto also acknowledged the current situation, emphasizing the volatility and potential for a market bounce soon.

Increased Volatility in the Crypto Market

According to data from CoinGlass, total crypto long liquidations reached $200 million within 24 hours of writing. QCP Capital reported that its Volatility Momentum Indicator (VMI) was triggered for both BTC and ETH, signaling an increased period of market volatility. However, the indicator was described as “directionally agnostic,” meaning it does not predict the direction of the market movement.

FAQs About Bitcoin’s Recent Decline

Why did Bitcoin’s price drop recently?

Bitcoin’s price recently dropped due to a combination of factors, including a significant decline in U.S. tech stocks, particularly Nvidia. The tech sector’s turmoil has spilled over into the cryptocurrency market, causing Bitcoin to approach its monthly lows. Margin calls and increased volatility in global markets also contributed to the decline.

What is the significance of the $55,602 price level for Bitcoin?

The $55,602 price level is significant because it marks a low for Bitcoin that has not been seen since August 8. This level indicates a substantial decrease from recent highs and reflects increased market pressure and volatility.

How has Nvidia’s stock performance impacted Bitcoin?

Nvidia’s stock faced a sharp decline following a U.S. subpoena, which led to broader sell-offs in risk assets, including cryptocurrencies like Bitcoin. As Nvidia’s stock tumbled, it contributed to a decline in Bitcoin’s price, highlighting the interconnectedness between tech stocks and the cryptocurrency market.

What other factors are influencing Bitcoin’s current price movements?

Other factors influencing Bitcoin’s price include global market volatility, such as the recent drop in gold prices and the significant decline in Japan’s Nikkei 225 index. Additionally, technical analysis suggests potential support levels around $50,000 and increased market caution.

1 Comment