Cardano Price Surges Following Successful Chang Hard Fork

In the past 12 hours, Cardano (ADA) has seen a notable price increase following the successful implementation of the Chang hard fork. This significant upgrade marks the official introduction of decentralized governance on the Cardano network, granting users complete ownership of the blockchain and the power to influence its future direction. The bold move has earned praise from crypto experts, with Cardano’s founder and development team receiving accolades for their efforts. In contrast, Ethereum has faced criticism for maintaining a largely centralized structure.

Cardano Price Performance Post-Chang Upgrade

In the wake of the Chang upgrade, ADA’s price experienced an initial surge of 2.45%, briefly retracing before climbing higher. Overall, the cryptocurrency has risen 3.23% from its weekly low on September 2.

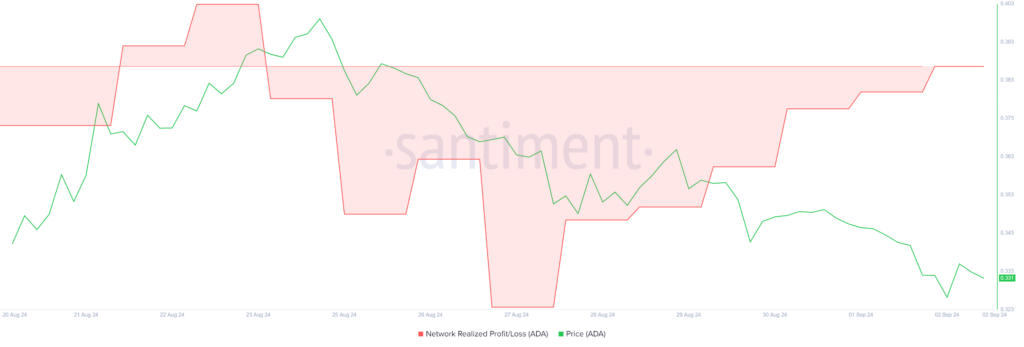

According to data from Santiment, the network’s realized profit/loss saw an increase on August 27, despite a decline in price during the same period. This trend suggests that investors may have been selling their holdings to lock in profits, yet many remain in profit due to a previous price peak on August 24, when ADA reached $0.40.

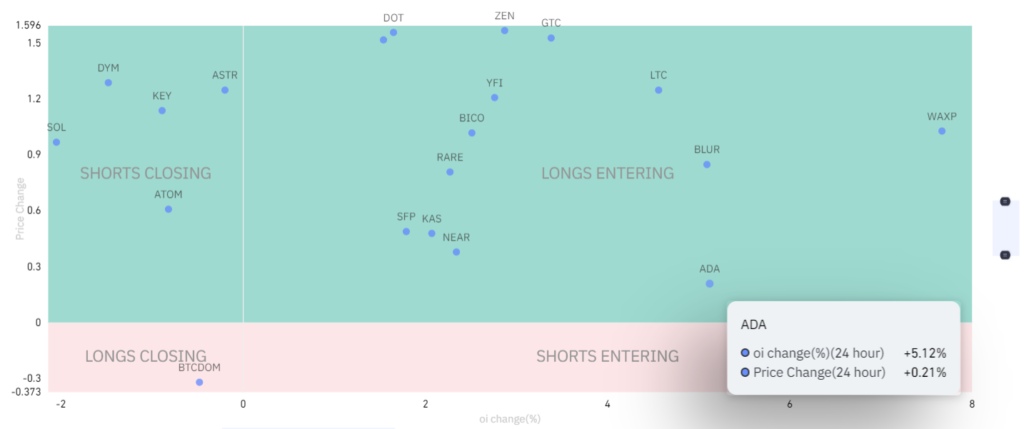

Further data from Coinglass reveals that futures traders are increasingly taking long positions on ADA, indicating optimism that the price will continue to rise.

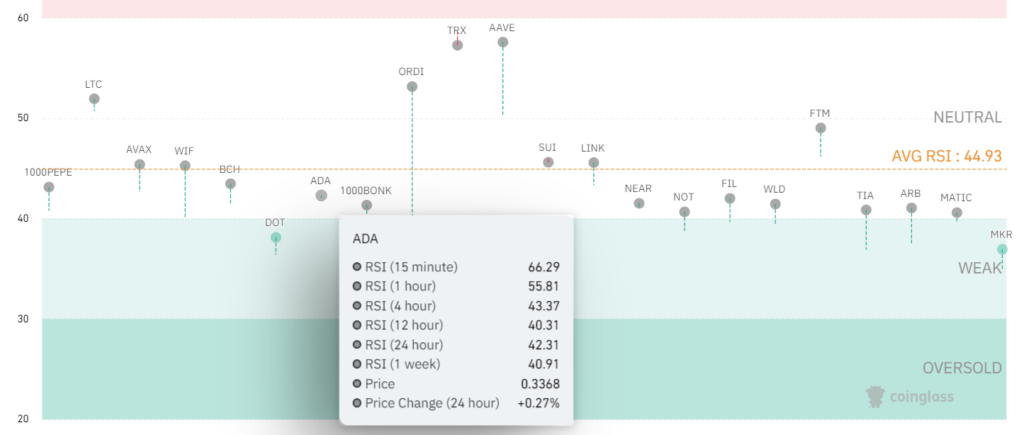

Additionally, Cardano’s Relative Strength Index (RSI) on both daily and weekly charts has dipped to 42 and 40, respectively, indicating that the asset remains in a neutral zone, albeit slightly below the midpoint.

Can ADA Outperform Ethereum and Layer 2 Solutions?

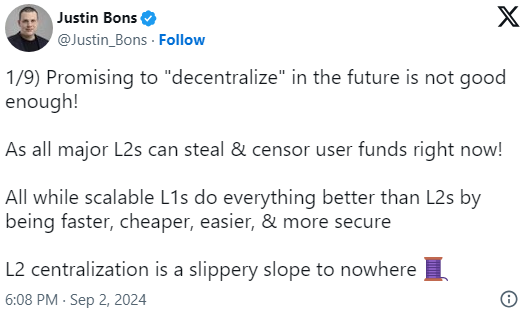

The launch of the Chang hard fork has sparked comparisons between Cardano, Ethereum, and various Layer 2 solutions on social media platforms like X. Justin Bons, founder and CIO of Cyber Capital, criticized the promise of future decentralization from Layer 2 networks, suggesting it falls short of expectations.

Over the past three months, Cardano has outperformed a combination of Layer 2 solutions, including Optimism (OP), Arbitrum (ARB), and Polygon (MATIC).

With Cardano now fully decentralized, the rate of development may accelerate as the community rallies to build a stronger blockchain. While Ethereum’s mainnet boasts over 800,000 active validators, networks like Optimism and Arbitrum depend on a single entity, the Sequencer, for block production.

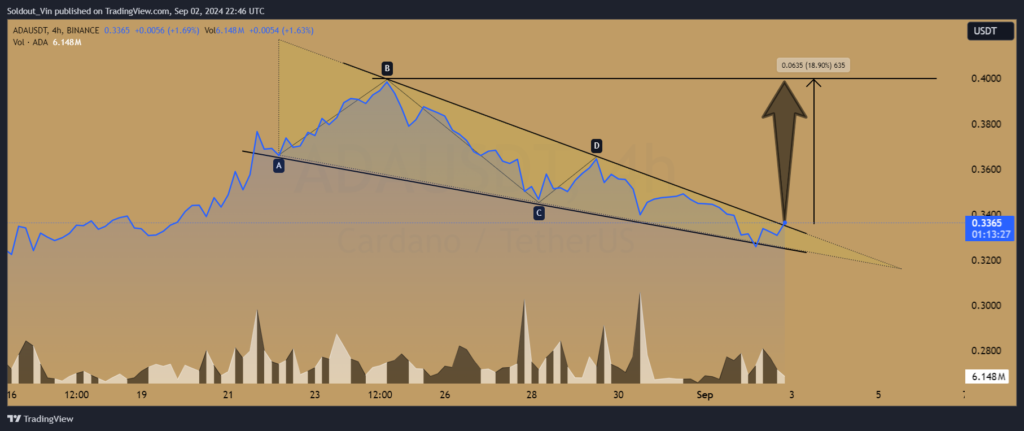

Currently, Cardano’s price is forming a falling wedge pattern on the 4-hour chart, which may lead to a breakout. Such a move could trigger an 18% price increase, pushing ADA above the 50-day exponential moving average (EMA) and towards the $0.40 target, where the first resistance level lies. If this resistance is breached, the price could climb another 11% to $0.44, surpassing the 200-day EMA and shifting the trend from bearish to bullish.

However, should Cardano fail to break out of the falling wedge, it could indicate market weakness, potentially leading to further declines towards the next support levels at $0.3132 and $0.2425.

The successful Chang hard fork has bolstered investor and expert confidence in Cardano. While the price is gradually responding to this development, increased trading volume may be necessary to confirm a breakout.

Leave a comment