MATIC Shows Signs of Potential Bullish Reversal Amid Value Decline

Polygon’s native token MATIC, has faced a sharp decline in value, with a significant drop in network activity since the broader crypto market began its retrace in March. Despite this downward trend, recent data from the crypto analytics platform Santiment suggests that a bullish turnaround may be on the horizon.

Could MATIC Be Poised for a Rebound?

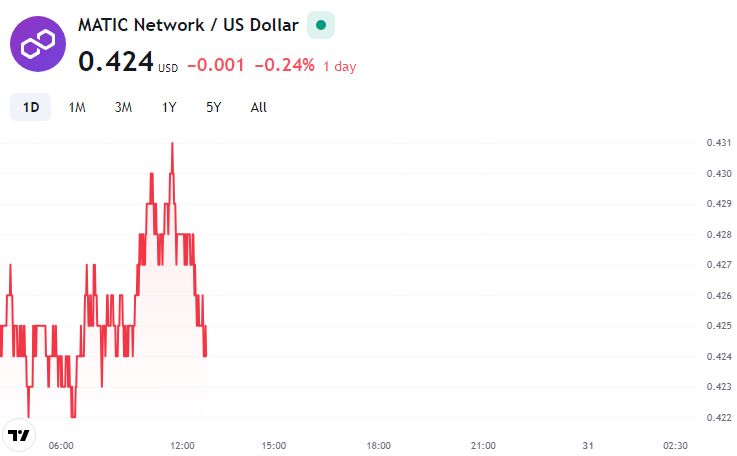

Over the past month, Polygon has seen its value decrease by more than 17%, struggling to stay above $0.52 and eventually dipping to its current price of $0.43. However, this downturn might present a strategic buying opportunity for investors looking to acquire the token at a lower valuation.

According to Santiment, there has been a noticeable increase in dormant token transactions as of August 28th, coinciding with the second-highest number of Polygon addresses interacting with the network this year. On that day alone, 3,369 addresses were active on-chain, with the Age Consumed metric surging to an impressive 69 billion MATIC. These indicators are often seen as early signs of a potential market reversal.

If these trends continue, Polygon may be on the verge of a recovery, potentially signaling the start of a much-needed bullish phase as the network aims to break out of its extended downtrend.

Transitioning from MATIC to POL

The Polygon ecosystem is set to undergo a significant upgrade, with the official transition from MATIC to the POL token scheduled for September 4th. This upgrade marks a key milestone in the Polygon 2.0 roadmap, making POL the native gas and staking token for Polygon’s Proof of Stake (PoS) chain.

The POL token upgrade, which began on the testnet on July 17th, is designed to ensure a smooth transition. The testnet phase focused on identifying and resolving potential issues, giving users and developers time to familiarize themselves with the new system before the mainnet upgrade.

For MATIC holders on the Polygon PoS chain, the conversion to POL will be automatic and seamless, requiring no action on their part. However, those holding MATIC on Ethereum, Polygon zkEVM, or centralized exchanges will need to manually upgrade through a migration contract on Ethereum. Major exchanges like Binance have already announced their support for this upcoming transition.

Leave a comment