Featured News Headlines

Aster DEX Launches Shield Mode as ASTER Faces Selling Pressure

Nearly two months after its launch, Aster DEX continues to push forward with rapid product development aimed at enhancing its trading infrastructure. The latest update introduces Shield Mode, a new feature designed specifically for perpetual futures traders using high leverage.

Shield Mode Goes Live on Aster DEX

On December 15, Aster DEX officially rolled out Shield Mode, marking an important step in the platform’s evolution. The new trading mode allows users to access leverage of up to 1001x while offering instant execution, zero slippage, and no gas fees.

Shield Mode operates through a single, streamlined interface and enables one-tap long or short positions. Orders remain off the order book, and shield-supported trading pairs benefit from zero slippage. According to the team, this feature represents an early foundational layer for future privacy-focused functionalities planned under the Aster Chain ecosystem.

Whale Activity Raises Market Concerns

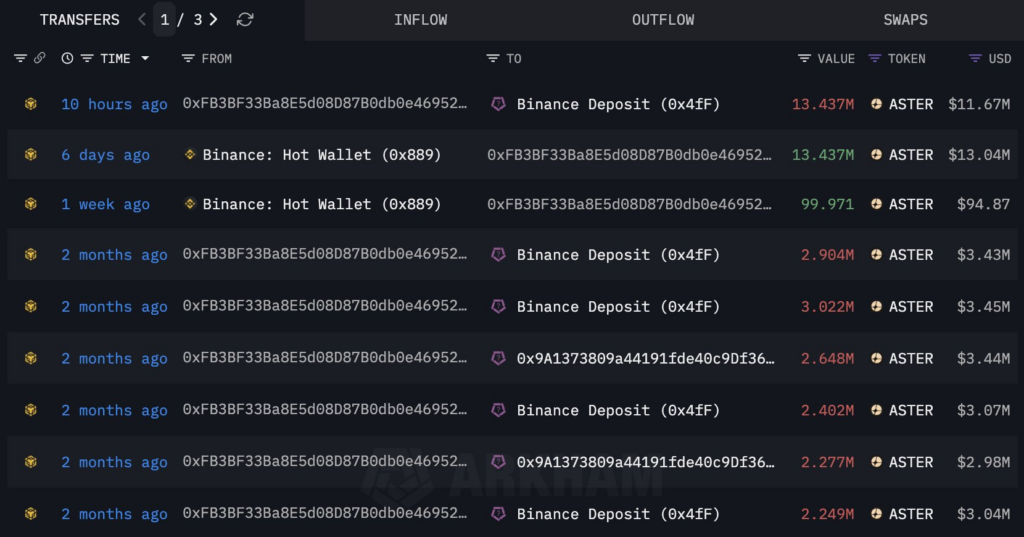

Despite the launch of Shield Mode, ASTER token holders have continued to face downside pressure. Data shared by Lookonchain highlighted another loss realized by a well-known Aster whale, recognized for repeatedly buying at higher levels and selling during downturns.

“The whale sold 13.44 million tokens for $11.67 million after holding them for only six days.”

The tokens were reportedly acquired for $13.04 million, resulting in a realized loss of approximately $1.37 million on this transaction alone. Cumulatively, the whale’s total losses have surpassed $35.8 million. Historically, such loss realization among large holders has been interpreted as reduced confidence in short-term market conditions.

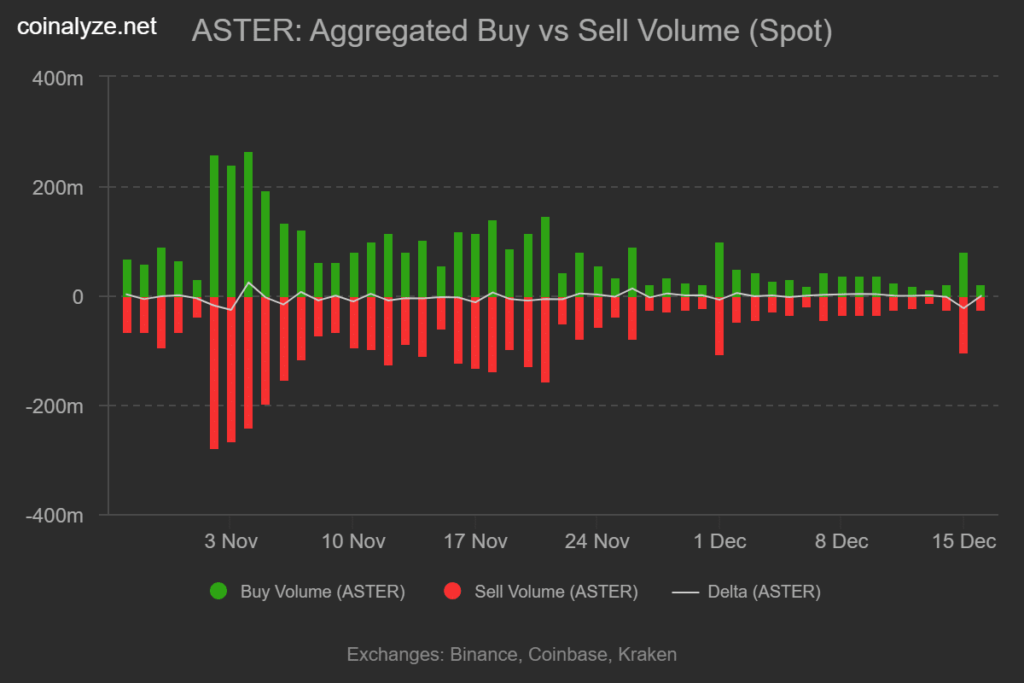

Selling Pressure Dominates ASTER Market

Market data from Coinalyze further supports the bearish narrative. ASTER recorded three consecutive days of net selling, with sell volume reaching 150.82 million tokens versus 123.77 million in buy volume. This resulted in a negative buy-sell delta of 27.05 million, signaling sustained spot market selling pressure.

Price Action Reflects Bearish Momentum

ASTER has been trading within a descending channel since peaking near $1.50 weeks ago and recently touched a low of $0.76. At the time of writing, the token was trading around $0.815, reflecting notable daily declines. Technical indicators such as the Relative Strength Index and MACD continue to point toward strong downward momentum, underscoring the current market sentiment without implying any investment outlook.

#ilangovtr

Basın No: Aster DEX Expands Trading Capabilities With Shield Mode