SUI Price Soars by 20%, Outpacing Broader Market Rally

In Friday’s trading session, the price of SUI surged by 20%, outperforming the broader market, which also experienced an upswing. This rally in the altcoin market followed a 5% jump in Bitcoin’s price, pushing it to $63,850. The increase in SUI’s price has shown resilience above the 50-day Exponential Moving Average (EMA), indicating a possible shift in the short-term trend. The critical question remains: can buyers maintain the $1 support level?

SUI Gains Traction as Transaction Volume and TVL Reach Record Highs

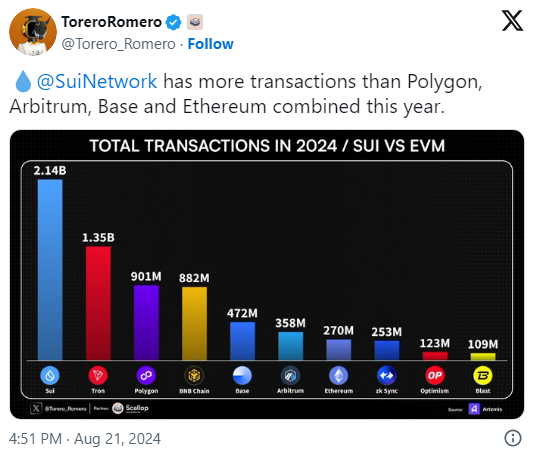

SUI, a layer 1 blockchain network, is rapidly establishing itself as a key player in the blockchain space, particularly in transaction volume. According to data from Artemis, the SUI network has processed an impressive 2.14 billion transactions, surpassing notable networks like Tron, Polygon, and Ethereum.

This high transaction volume suggests that SUI is becoming a go-to platform for decentralized applications (dApps) and other blockchain-based activities. As a result, it is likely to attract more developers, users, and investors, solidifying its market position.

At the time of writing, SUI is trading at $1.025, with its market capitalization increasing to $2.66 billion.

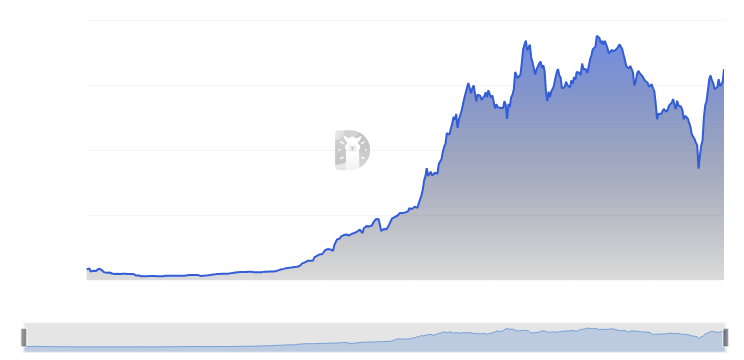

Furthermore, the Total Value Locked (TVL) on the SUI network has experienced significant growth since early August. DeFiLlama reports that TVL has jumped from $342.8 million to $654.2 million, marking a 90% increase. This surge indicates growing confidence in the network, with more capital being locked into its protocols.

SUI Coin Signals Potential Major Breakout

Amidst recent market volatility, SUI has found solid support at the $0.8 level, underpinned by the slopes of the 20-day and 50-day EMAs. This support level suggests an emerging shift in market sentiment.

The recent bullish trend has pushed SUI’s price up by nearly 30%, surpassing the critical $1 mark. A technical analysis of the daily chart reveals the formation of an inverted head and shoulders pattern, a classic bullish reversal signal. This pattern is characterized by three dips, with the central dip (the head) being the lowest, and the two flanking dips (the shoulders) being less pronounced.

If buying momentum continues, SUI could rise another 7%, potentially triggering a breakout above the neckline resistance at $1.1. A successful move past this level could intensify bullish momentum, pushing the price towards $1.2, and possibly reaching $1.43.

However, if selling pressure from overhead resistance persists, SUI could face a reversal, potentially negating the bullish outlook and driving the price back below the $0.8 support level.

Leave a comment