Crypto Market- Bitcoin Holds Steady as Market Awaits Fed’s Jackson Hole Speech: What to Expect

Crypto Market– As investors focus on Jackson Hole, Wyoming, where Federal Reserve Chair Jerome Powell is set to deliver a pivotal policy speech, Bitcoin (BTC) remains relatively flat. This speech is expected to shape market expectations for September, with attention centering on Powell’s analysis of market data and potential signals about future rate cuts.

Current Bitcoin and Ethereum Market Performance

Leading up to Powell’s address, major cryptocurrencies are experiencing muted movements. Bitcoin, the largest cryptocurrency by market cap, is down 0.8% at $60,766.48. In contrast, Ethereum (ETH), the second-largest cryptocurrency, has seen a 0.5% increase, reaching $2,654.94, according to CoinGecko data.

Potential Impact of Powell’s Speech on Crypto Prices

The crypto market is on edge, as Powell’s comments could trigger significant price movements. A more aggressive rate cut or a dovish stance could ignite bullish momentum, drawing investors to cryptocurrencies for potentially higher returns. Conversely, any hints of future tightening or a less accommodating approach might lead to increased volatility and a short-term decline in prices.

Ryan Lee, Chief Analyst at Bitget Research, shared insights with Decrypt, suggesting that the market might gauge Powell’s speech for rate cut confidence and data dependence. He anticipates that the Fed will likely cut rates, but the extent of easing will hinge on forthcoming economic data.

Market Expectations and Scenarios

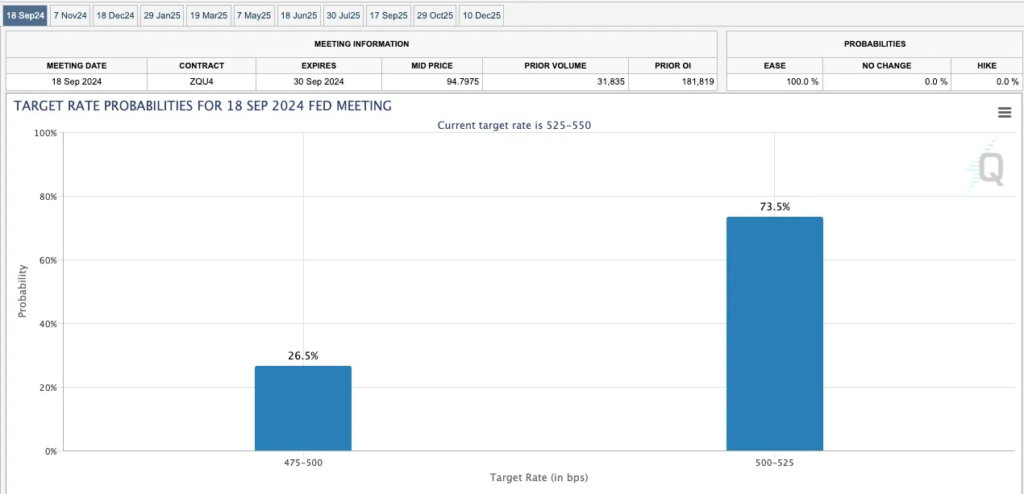

Currently, the market anticipates a 73.5% chance of a 25 basis point cut or a 26.5% chance of a 50 basis point cut in September. The 10-year Treasury yield is approximately 3.85%, and the US Dollar Index stands at 101.44.

Lee outlines potential scenarios: if Powell’s statements are dovish, the dollar index might continue to fall, the 10-year Treasury yield could decline further, and the crypto market might gain momentum. Conversely, a more hawkish tone could have the opposite effect, impacting both traditional and crypto markets.

Leave a comment