First Leveraged ETF MSTX Launches with SEC Approval: Opportunity to Invest in MicroStrategy Shares

The first leveraged single-stock ETF designed to target MicroStrategy, MSTX, has received approval from the Securities and Exchange Commission to debut. The ETF aims to provide a daily return of 175% on MicroStrategy’s stock.

Defiance ETFs, a company that specializes in themed and leveraged ETFs, is the issuer of MSTX. CEO of Defiance Sylvia Jablonski claims that because MicroStrategy is one of the biggest corporate holders of Bitcoin, the leveraged MicroStrategy ETF provides increased exposure to the cryptocurrency.

Given MicroStrategy’s inherent higher beta compared to bitcoin, MSTX offers a unique opportunity for investors to maximize their leverage exposure to the Bitcoin market within an ETF wrapper.

Jablonski

Leveraged ETFs and the Bitcoin Connection: How Possible is MSTX’s Success?

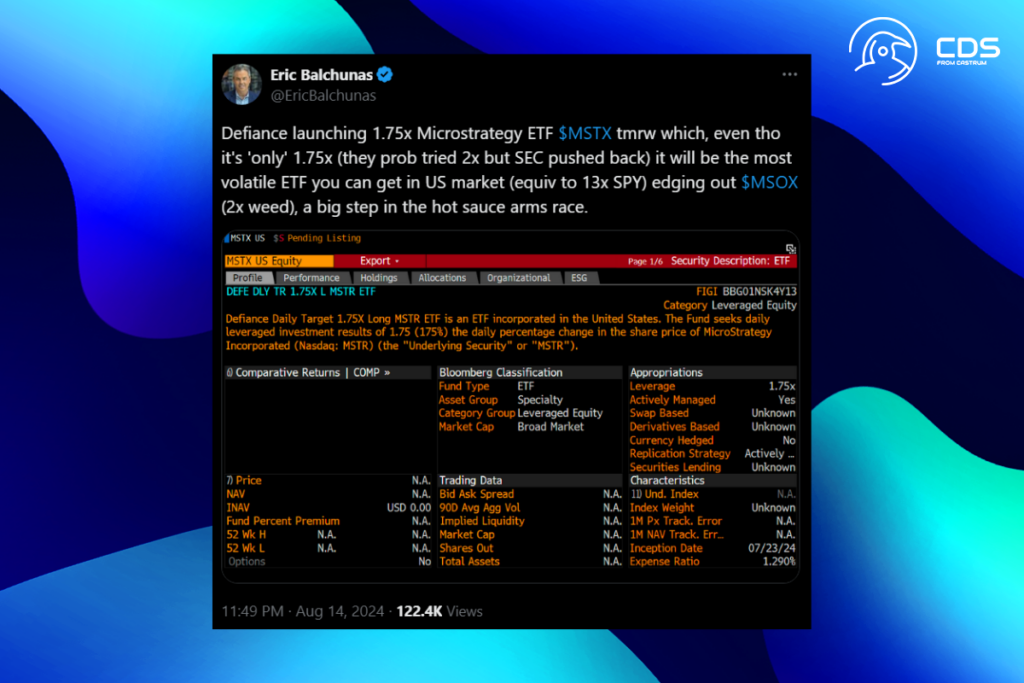

The daily investing objectives of leveraged exchange-traded funds (ETFs) result in daily performance amplification with longer-term fluctuations. The use of leverage and concentration in a single stock increases the risks associated with MSTX. As noted on X by Eric Balchunas, Senior ETF Analyst at Bloomberg, a leveraged MicroStrategy ETF “will be the most volatile ETF you can get in the US market.”

With less than 1% of all ETF assets, leveraged equity ETFs continue to be a niche product. With the Bitcoin link, Defiance believes MSTX can separate itself from the competition. The ultimate success of the first-of-its-kind ETF, however, will depend on how investors react to it and how well MicroStrategy performs in place of Bitcoin.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment