Cardano Price Struggles to Overcome Key Resistance Levels Amid Mixed Market Signals

Cardano (ADA) price is currently grappling with significant resistance from key moving averages, struggling to break above these critical levels. The much-anticipated Chang hard fork upgrade, which many hoped would inject volatility into the market, has so far failed to drive significant price movements. Following Bitcoin’s price fluctuations on August 14, ADA experienced a brief dip, although it quickly recovered. Despite this, bearish sentiment continues to dominate Cardano’s spot trading data, further weighed down by a stagnant userbase.

Conflicting Indicators Shape Cardano’s Price Outlook

In the last 24 hours, ADA’s price has slipped by 1.1%, now trading at $0.337. However, despite this decline, ADA has shown relative strength against Bitcoin (BTC), gaining 3.8% against the leading cryptocurrency. This trend mirrors a broader market movement, with XRP up 2.8% and Solana rising 4.3% against BTC.

An in-depth analysis of Cardano’s network and trader behavior reveals some concerning trends. Despite the buzz surrounding the Chang hard fork, the underlying metrics paint a bleak picture.

According to data from IntoTheBlock, the number of active addresses holding ADA has stagnated at around 4.45 million for over a year, highlighting the network’s lack of growth. However, there is a silver lining: long-term holders now account for over 40% of ADA’s total supply, indicating strong confidence in the network’s future, which could be a bullish signal for the price.

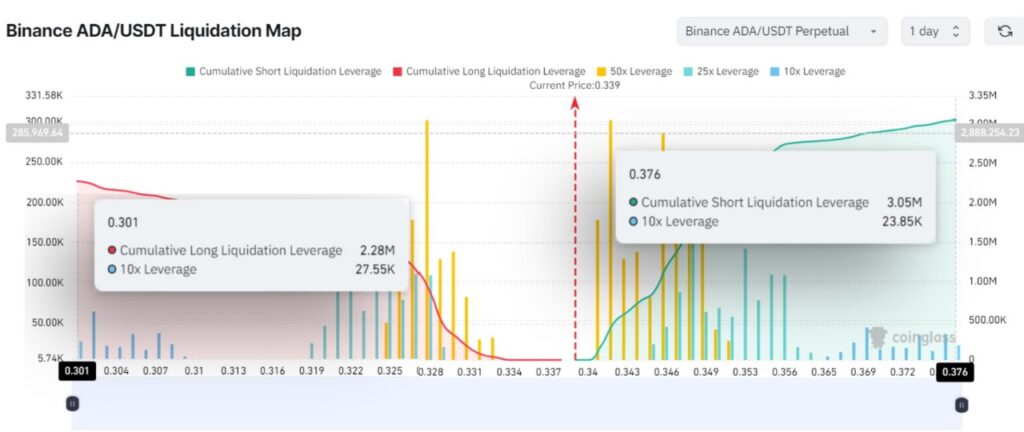

Conversely, traders appear to be less optimistic. Data from Coinglass’s Liquidation Map reveals a prevailing bearish sentiment. On August 14, the cumulative long liquidation leverage was $2.28 million, significantly lower than the short liquidation leverage of $3.05 million. This imbalance suggests that traders are expecting further downside for ADA, possibly driven by concerns over the U.S. government’s movement of Bitcoin from the Silk Road wallet.

This bearish outlook is further supported by ADA’s proximity to the critical resistance level of $0.34, where considerable selling pressure has been observed.

ADA Price Outlook: Key Support Levels to Watch

Cardano is currently in a downtrend, with immediate support likely around $0.31, and the key psychological level of $0.3. The narrowing Bollinger Bands suggest a period of reduced volatility, which could precede a breakout from the current rising channel and lead to a significant expansion in price movement.

The Moving Average Convergence Divergence (MACD) indicator remains negative, reflecting ongoing bearish momentum. While a potential crossover of the MACD line above the signal line could signal a bullish reversal, this has yet to occur. Additionally, the Chaikin Money Flow (CMF) indicator shows mild buying pressure at 0.08, but this is insufficient to trigger a trend reversal.

In conclusion, despite a 21% gain over the past two weeks, Cardano is under pressure from bearish trader sentiment and stagnant network growth. This could drive the price down to the $0.3 level, which may present an attractive buying opportunity for investors looking for a potential rebound.

Leave a comment