Pyth Token Sees Record Declines Across Multiple Metrics

The Pyth Network’s native token, PYTH, has recently experienced a dramatic drop in its derivatives market, with total open interest plummeting to an unprecedented low. This downturn coincides with broader market struggles, which led the token’s price to close at an all-time low of $0.22 during Monday’s trading session.

Pyth Hits New Lows on Several Fronts

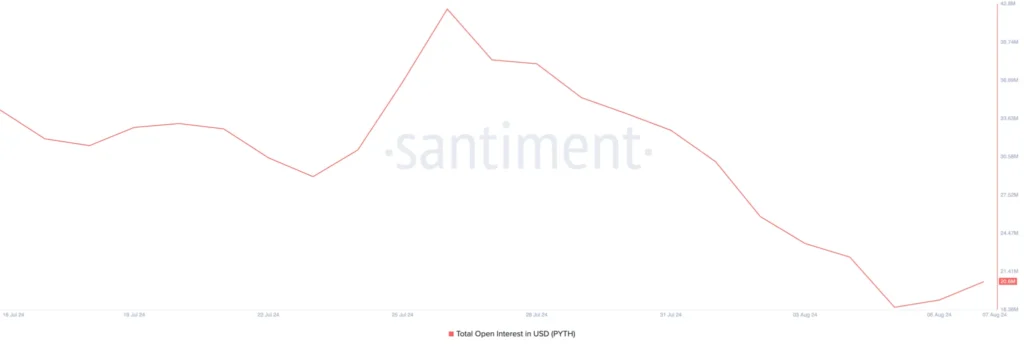

Data from Santiment indicates that PYTH’s open interest peaked at $113 million on March 17, 2024. Since then, it has encountered significant volatility, with a series of lower highs and lower lows. The general market sell-off on Monday caused a wave of closures in PYTH derivative positions, driving open interest down to a record low of $19 million.

Open interest represents the total number of unsettled derivative contracts, such as options or futures, that are still active. A decline in this metric suggests that traders are exiting the market, closing positions without opening new ones.

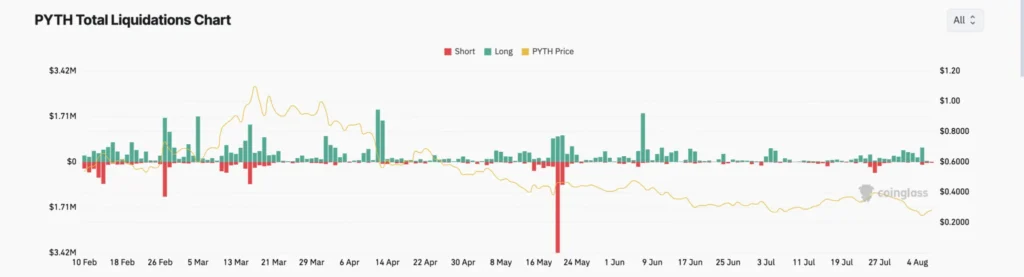

Additionally, PYTH’s price has seen a double-digit decline over the past week, leading to the liquidation of several long positions. According to Coinglass, long liquidations for PYTH have surpassed $1.8 million in the past seven days.

As anticipated, market sentiment has turned increasingly bearish, with a growing number of traders taking short positions since the start of August. This shift indicates that more traders are betting on a further decline in PYTH’s price rather than buying the token with the hope of selling it at a higher value.

PYTH Price Forecast: Will It Retest the All-Time Low?

The spot market for PYTH reflects the same bearish sentiment. The token’s Relative Strength Index (RSI), measured on a daily chart, currently sits at 40.35, below the neutral 50 line. This RSI level suggests that selling pressure outweighs buying interest.

Moreover, PYTH’s Chaikin Money Flow (CMF), a metric that tracks the flow of capital into and out of the market, is currently at -0.01, below the critical zero line. A negative CMF reading indicates market weakness and is often a precursor to further price declines.

If demand for PYTH remains subdued and capital continues to exit the market, the token is at risk of revisiting its all-time low of $0.22. Conversely, if a bullish sentiment reemerges, PYTH may rally toward its recent 30-day high of $0.44.

Leave a comment