Worldcoin (WLD) Price Analysis: Bulls and Bears in a Stalemate

As of the latest data, Worldcoin (WLD) is trading at $2.02, reflecting a 5.30% decrease over the past 24 hours. The ongoing battle between bulls and bears appears to be evenly matched, raising the question of who will ultimately prevail.

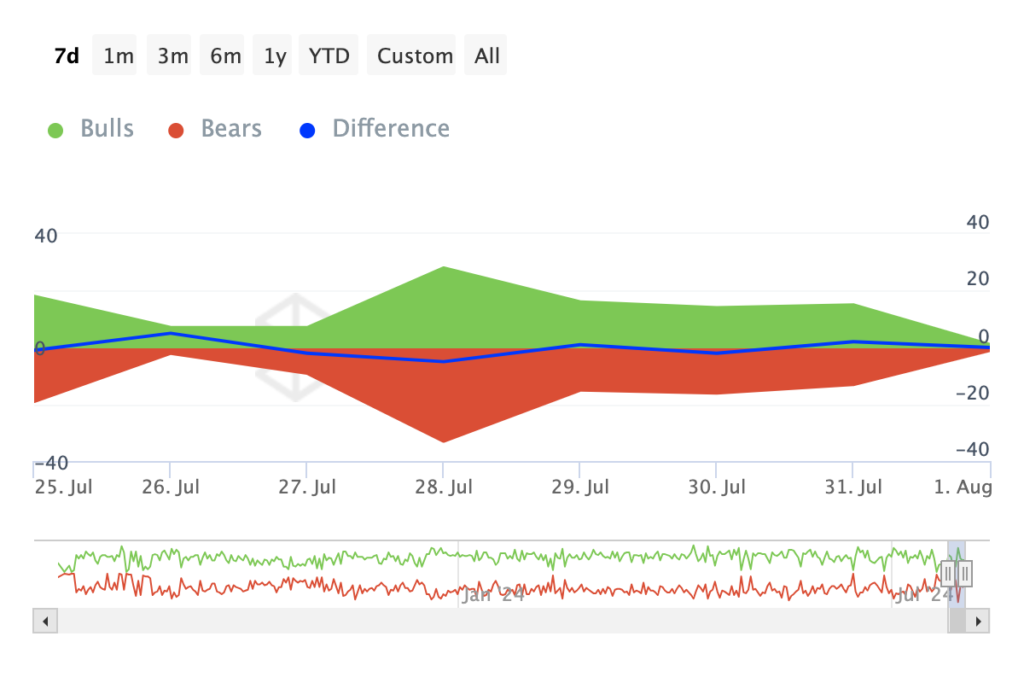

A Balanced Contest Between Worldcoin Bulls and Bears

The Bulls and Bears Indicator reveals a near-zero difference between WLD bulls and bears over the past seven days. For this analysis, bulls are defined as addresses responsible for buying 1% of a cryptocurrency’s total trading volume, while bears are those that sold a similar percentage.

In WLD’s case, bulls participated in trading approximately 124.40 million tokens, whereas bears traded 124.48 million tokens. This narrow margin suggests that the price may consolidate in the short term, as the selling pressure has not significantly outweighed the buying interest. The recent decline in WLD’s price might be linked to the continuous unlocking of tokens, which, despite initially boosting the price, has prevented the cryptocurrency from experiencing a supply shortage.

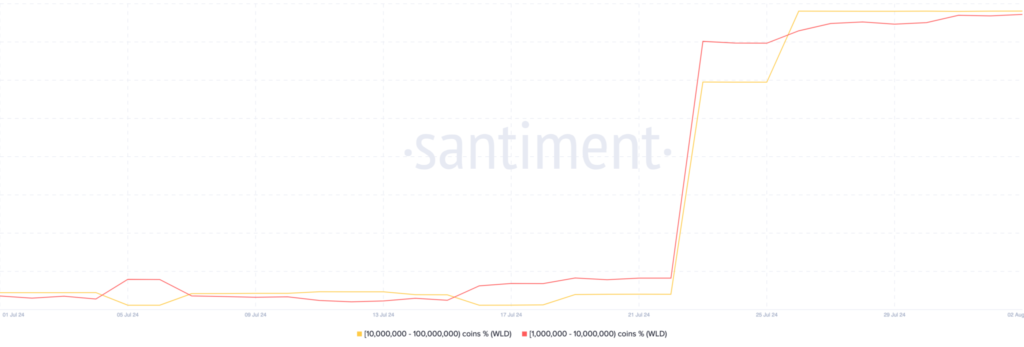

Supply Distribution and Potential Price Movement

Data from Santiment highlights a shift in supply distribution that could support a price rebound. Specifically, the balance of addresses holding between 1 million to 10 million WLD tokens has been increasing since July 27. This accumulation could reduce downward pressure and set the stage for a potential price recovery.

WLD Price Forecast: Will It Break Above $3 or Fall Below $2?

On July 13, WLD broke out of a falling wedge pattern on the daily chart—a bullish signal indicating that sellers were losing momentum, allowing buyers to push the price upward. This breakout led to a price increase, peaking at $3.26 on July 17. Since then, however, WLD has been in a steady decline.

Currently, WLD is approaching a demand zone that previously triggered an upward price movement. If the token reaches this zone, it could rebound. Additionally, the Relative Strength Index (RSI), which measures market momentum, is nearing the oversold threshold.

An RSI reading of 70 or above indicates an overbought condition, while a reading of 30 or below suggests oversold conditions. With WLD’s momentum currently bearish, a further decline could push the RSI into oversold territory, potentially sparking a price bounce. Should this occur, WLD could revisit the $2.81 level. However, if bears dominate the 1% of total trading volume, the downside pressure may persist, potentially driving the price down to $1.73.

Leave a comment