BTC Falls to $62.7K as Fed Signals Possible Rate Cut and Trump’s Victory Odds Fade

Bitcoin (BTC) has extended its sharp pullback after an initially strong start to the week, with the price dropping to a two-week low of $62,700.

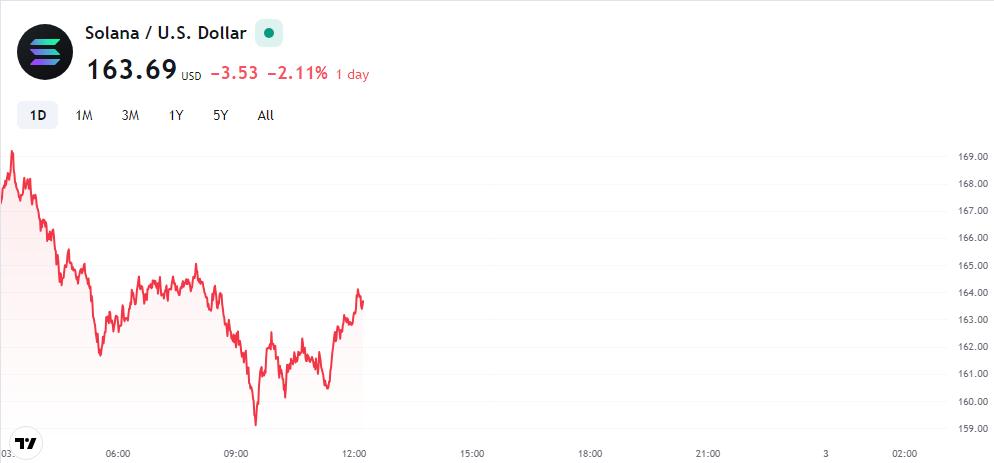

As of the latest update, BTC has declined by 5.5% over the past 24 hours, outperforming the broader CoinDesk 20 Index, which has seen a 6.1% drop. Other major cryptocurrencies have also experienced significant losses, with Ether (ETH) down 5.8%, Solana (SOL) falling 10%, and XRP (XRP) declining 10%. This retreat comes just 72 hours after Bitcoin reached a four-month high, briefly surpassing the $70,000 mark.

The market reaction came despite seemingly positive economic news. On Thursday morning, the U.S. July ISM Manufacturing PMI dropped significantly more than expected, leading to multi-month lows in interest rates across the board. Additionally, U.S. initial jobless claims hit their highest level in about a year. These factors contribute to growing speculation that the U.S. might be on the verge of a monetary easing cycle by the Federal Reserve, a scenario typically seen as bullish for risk assets, including Bitcoin.

Federal Reserve Chairman Jerome Powell, speaking after the Fed’s policy meeting yesterday, suggested that a rate cut in September is a possibility if data continues to point to slowing economic growth and inflation.

In a related development, the Bank of England joined the global monetary easing trend on Thursday, reducing its benchmark lending rate for the first time in four years, following similar moves by the Bank of Canada and the European Central Bank earlier in 2024.

BTC bulls are now facing a broader challenge. The cryptocurrency’s surge to $70,000 on Monday was fueled by the excitement surrounding the Bitcoin 2024 conference in Nashville and the commitment from GOP nominee Donald Trump to support Bitcoin, including considering the U.S. government holding the cryptocurrency as a strategic asset.

However, BTC enthusiasts must now grapple with the fact that Trump’s chances of victory in the upcoming election are not as strong as they were two weeks ago when he was set to face Joe Biden. The emergence of Kamala Harris as the new Democratic nominee has shifted the dynamics, with her odds of winning steadily increasing to 44%, while Trump’s victory chances have decreased from 70% to 55% over the same period, according to Polymarket.

The question remains whether a Harris administration would adopt a similarly adversarial stance toward BTC and cryptocurrency as the Biden administration did, but the likelihood of an industry-friendly president in 2025 has now diminished.

Leave a comment