Bitcoin Surges- Market Reacts to Biden’s Exit: Bitcoin and Major Altcoins See Gains

Bitcoin Surges– On Sunday, Bitcoin surged briefly above $68,000 after President Joe Biden announced he would not seek re-election. Initially, BTC saw a slump following the news but quickly recovered to trade at over $68,400. At the time of writing, Bitcoin settled around $67,450, marking a 0.7% increase over the past 24 hours. The broader digital asset market, as measured by the CoinDesk 20 Index (CD20), also saw a rise of 1.25%. Leading the gains were Solana (SOL) and Dogecoin (DOGE), which increased by approximately 4.3% and 5%, respectively.

Market Implications of Biden’s Withdrawal

President Biden’s decision to step down from the 2024 presidential race had notable implications for the crypto market. Pro-crypto candidate Donald Trump’s probability of winning the November election dropped from 71% to 65% on Polymarket. Conversely, Vice President Kamala Harris saw her odds almost double, rising from 16% to 30%. Despite the political uncertainty, the market responded positively. According to a note from Singapore-based crypto research firm Presto, Biden’s withdrawal opens up the possibility of the U.S. government adopting a more constructive stance towards the digital asset industry post-November.

JPMorgan’s Analysis on Bitcoin’s Valuation

Despite the recent surge, JPMorgan expressed caution regarding Bitcoin’s valuation. The bank’s report last week suggested that Bitcoin’s price is significantly higher than its production cost, estimated at $43,000. They also indicated that any price increases are likely to be short-term. Further, JPMorgan’s volatility-adjusted comparison to gold placed Bitcoin’s fair value at $53,000, suggesting that BTC is currently overpriced.

Impact of Recent Liquidations

JPMorgan also noted weak momentum in Bitcoin futures in recent weeks, attributing this to BTC liquidations by creditors of Gemini, Mt. Gox, and the German government. However, these liquidations are expected to subside this month. The bank anticipates a rebound in Chicago Mercantile Exchange (CME) Bitcoin futures positioning into August, potentially supporting Bitcoin’s price stability.

Trending crypto chart today

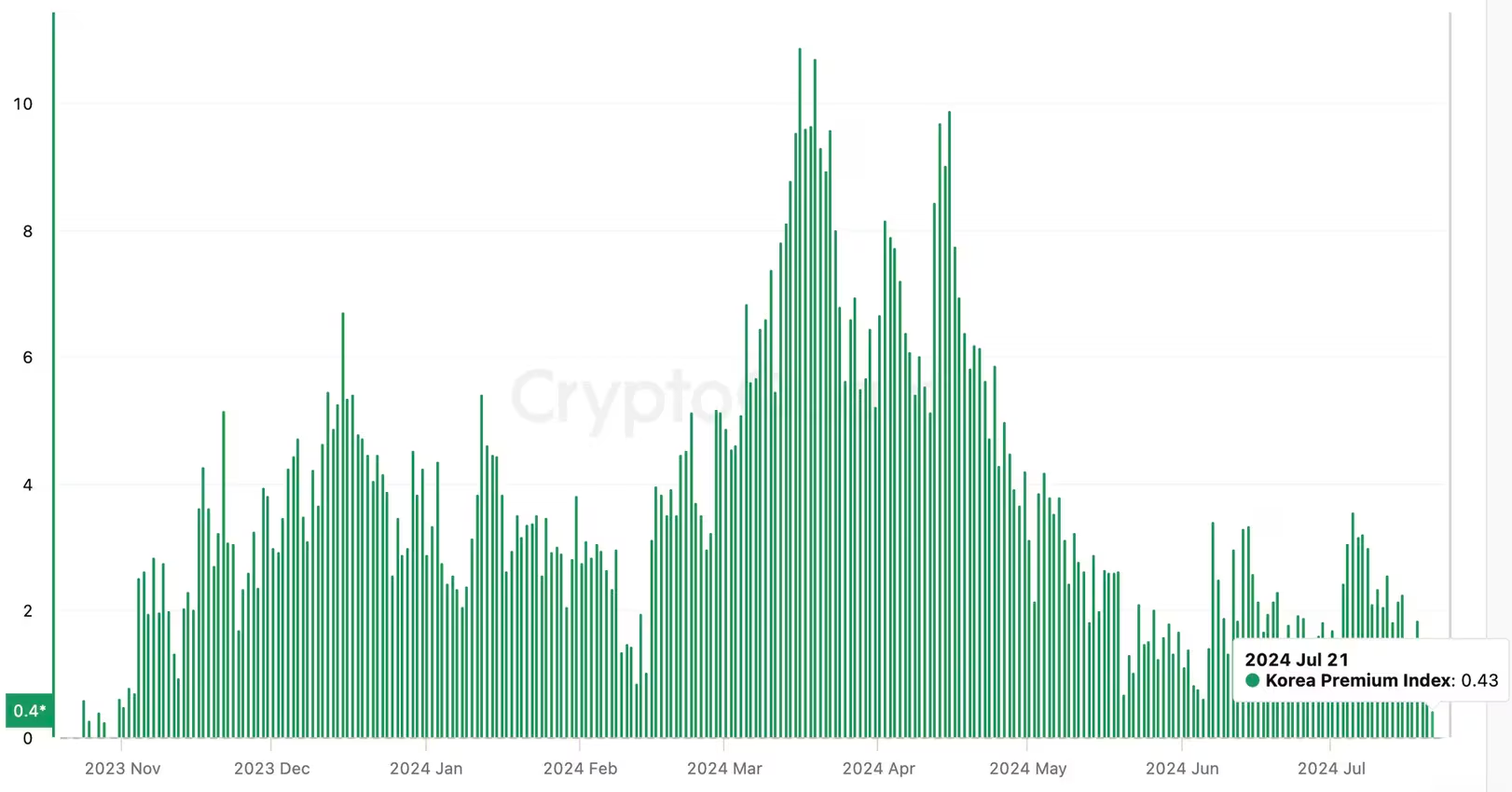

- Korea Premium Index Overview: The chart displays the Korea Premium Index for Bitcoin, which tracks the price difference between South Korean and Western exchanges.

- Current Index Level: The index has now dropped to nearly zero for the first time since November.

- Retail Investor Activity: This decline indicates a significant decrease in retail investor participation in the market.

- Source: The data is sourced from CryptoQuant.

Trending Posts

- Crypto News Today- Crypto Sector Awaits Potential Trump Presidency

- Biden Withdraws From 2024 Presidential Race

- Metaplanet Stock Soars 21% After Major Bitcoin Purchase

For the latest in crypto updates, keep tabs on Crypto Data Space.

Leave a comment