The Future of BTC Price: Analyzing Record Pace Accumulation

Since last weekend, there has been an erratic trend in the BTC price. The demand pressure at $55,000 has kept the general negative mood in check, but despite the German government‘s BTC liquidation, the overhead supply remains intact. Given that the linked address has just emptied its Bitcoin holdings, a short-term upward trend is anticipated.

- Between June 5 and July 7, there was a consistent decline in the price of Bitcoin, with a 25.57% fall in value from $71949 to $53550.

- Several unfavorable events, including the strong withdrawal from Bitcoin ETFs, the liquidation of Bitcoin from the defunct Mt. Gox exchange, and the sell-offs by the German and US governments, contributed to the downward pressure.

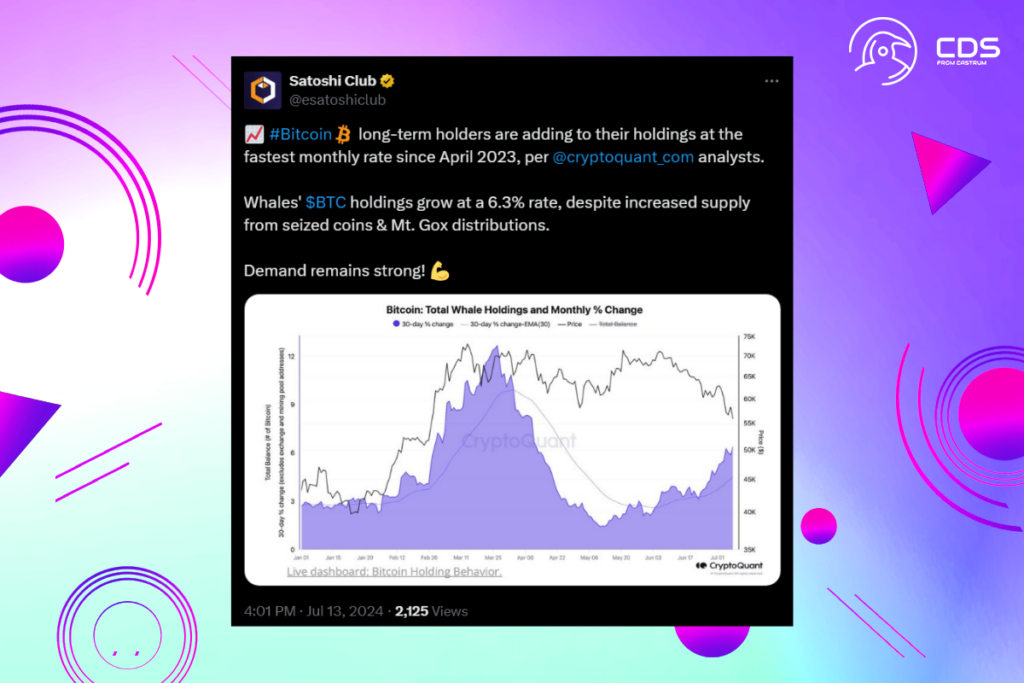

CryptoQuant: Long-Term Bitcoin Investors Increase Holdings at Record Pace

According to experts from CryptoQuant, long-term Bitcoin investors are growing their holdings at the quickest monthly rate since April 2023. Whale Bitcoin (BTC) holdings have expanded at a remarkable 6.3% rate, despite the additional supply from confiscated coins and the Mt. Gox distributions. Whale holdings have climbed significantly, indicating that there is still a robust market for Bitcoin despite its increased supply. Long-term investors’ and whales’ strong accumulation shows ongoing faith in the worth and promise of Bitcoin.

- EMAs: The price of Bitcoin is attempting to recover the 200D Exponential Moving Average, gaining the trend reversal beginning signal, with an intraday gain of 1.68%.

- Vortex Indicator: The approaching bullish crossover of the VI+ (blue) and VI- (pink) slopes indicates that the asset is once again experiencing bullish momentum.

FAQ

Can the Bitcoin Price Reach $70,000?

The Bitcoin price reaching $70,000 depends on market conditions, demand, and investor behavior. Current trends and analysis support this possibility.

How Would an Increase in the Bitcoin Price Affect Other Cryptocurrencies?

A rise in the price of Bitcoin usually has a positive impact on the prices of other cryptocurrencies, as Bitcoin is the leading cryptocurrency in the market and sets the overall market trends.

What Should Investors Do If the Bitcoin Price Reaches $70,000?

When the Bitcoin price reaches $70,000, investors should monitor market conditions and make decisions based on their own investment strategy. Some may take profit realizations, while others may continue to hold for the long term.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment