12 July Crypto News- Today’s Developments In The Crypto Markets

12 July Crypto News- A wallet associated with Genesis Trading has begun transferring Bitcoin to Coinbase, potentially signaling the start of asset liquidations. This development coincides with Bitcoin entering the extreme fear zone, the lowest sentiment score since January of last year when the industry was reeling from the FTX collapse. Meanwhile, an investment manager informed Cointelegraph that once Ethereum exchange-traded funds (ETFs) start trading, we can anticipate $10 billion in inflows.

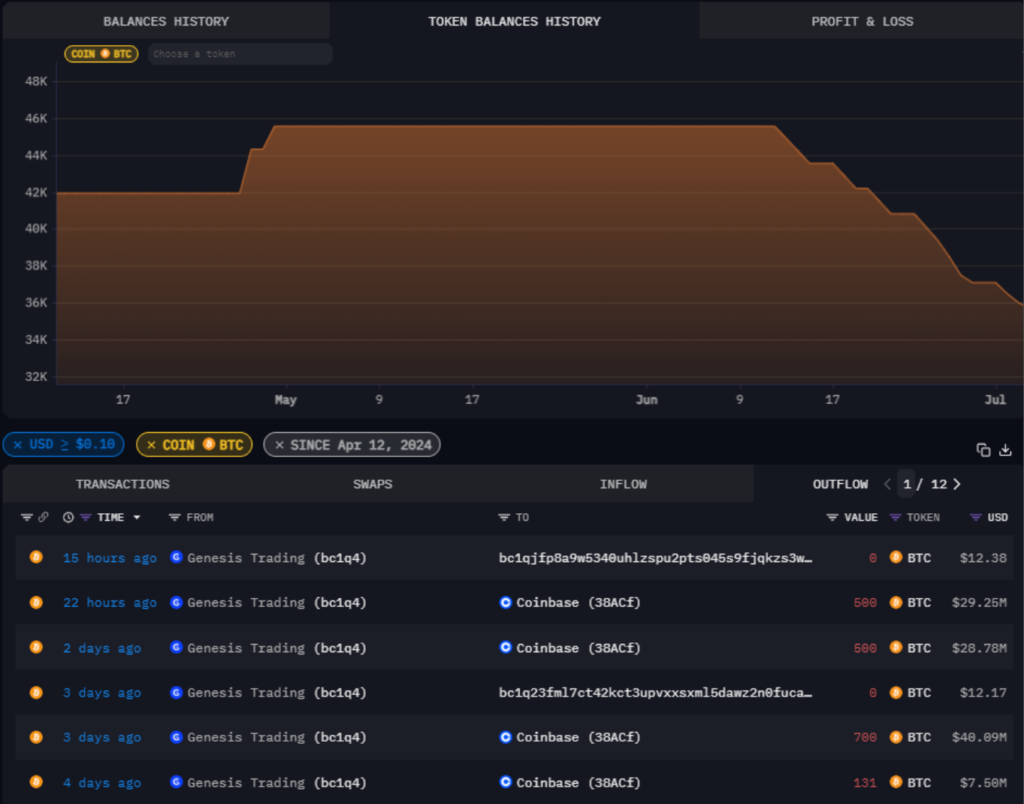

Genesis Trading Wallet Transfers $720M in Bitcoin to Coinbase

A cryptocurrency wallet associated with Genesis Trading has transferred nearly $720 million worth of Bitcoin to Coinbase over the past month, signaling the potential start of asset liquidations.

This Genesis Trading-labeled wallet has moved over 12,600 Bitcoin, worth approximately $719.9 million, in the last 30 days, primarily through transactions ranging from 500 to 700 BTC.

According to data from Arkham Intelligence, the address currently holds 33,356 Bitcoin, a significant drop from over 46,000 BTC it held a month ago on June 12.

The multi-million dollar Bitcoin transfers come two months after New York State Attorney General Letitia James announced a settlement with Genesis. The settlement requires Genesis to pay $2 billion to investors defrauded through its Earn program.

As part of the settlement, Genesis is mandated to return the funds to its investors and is prohibited from operating in New York.

Bitcoin Index Hits ‘Extreme Fear’ as BTC Struggles to Break $60,000 Twice

The Crypto Fear & Greed Index, which measures market sentiment toward Bitcoin and other cryptocurrencies, has plunged to extreme fear, marking its lowest level since January of last year. This sharp decline in sentiment follows Bitcoin’s failure to surpass the $60,000 mark for the second time in the past 48 hours.

In a July 11 post on X, crypto and forex trader Justin Bennett informed his 111,000 followers that Bitcoin’s price had once again failed to breach the $60,000 mark, highlighting the formation of a potential rising wedge, which could indicate further downside in the coming days.

Bitcoin surged to $59,485 on July 10 before falling back to $57,000 within the next 12 hours. On July 11, BTC briefly rallied to $59,529 but couldn’t sustain that level.

As of now, Bitcoin is trading at $57,499, down 23% from its all-time high reached on March 14 this year, according to TradingView data.

Investment Manager Predicts $10 Billion Inflows for Ether ETFs

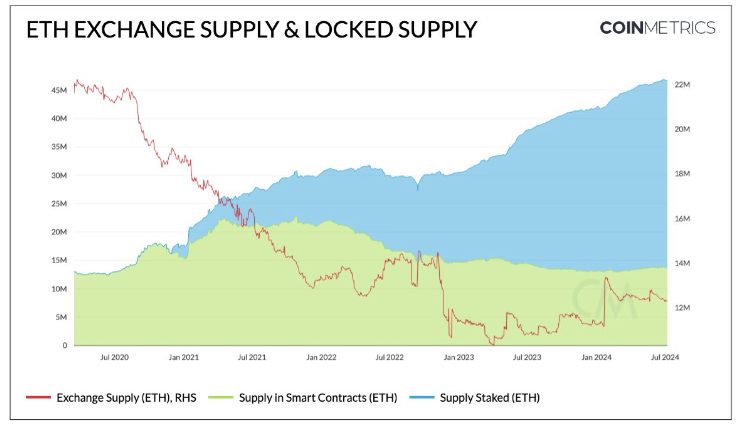

Tom Dunleavy, managing partner at crypto investment firm MV Global, anticipates significant inflows into spot Ether exchange-traded funds (ETFs) once they start trading.

In an interview with Cointelegraph, Dunleavy projected, We saw $15 billion in flows for Bitcoin. I think we’re probably going to see $5 billion to $10 billion for Ethereum. I expect a very positive price impact sending us to new all-time highs by early Q4.

In his assessment, Ether ETFs could attract around $1 billion monthly in inflows after their launch. He noted that compared to Bitcoin, Ether is less readily available on exchanges, leading to thinner order books and less liquidity. Dunleavy also highlighted that spot ETH holders are likely to include traditional market participants with 401(k) accounts, differing from early Ether investors.

The US Securities and Exchange Commission (SEC) has granted approval to eight spot Ether ETFs, though trading has not yet commenced. Industry insiders expect the final go-ahead to potentially arrive later in July.

For the latest in crypto updates, keep tabs on Crypto Data Space.

Leave a comment