Bitcoin Market Analysis: Sentiment, Liquidations, and Recovery Prospects

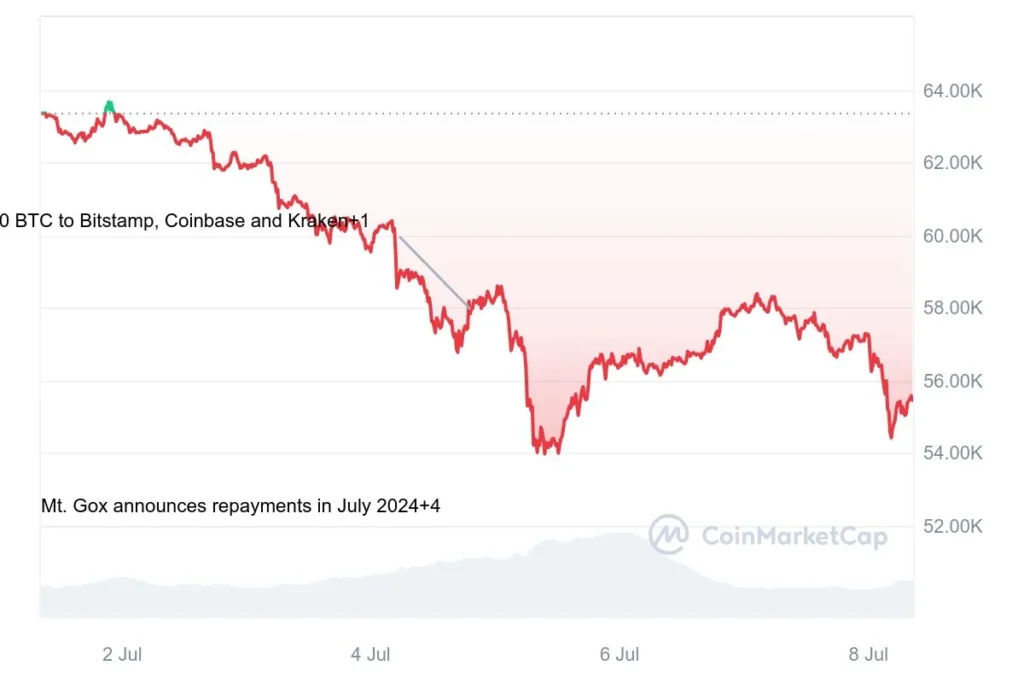

Bitcoin Market Analysis – This past week, Bitcoin experienced a significant decline of over 10.5%, dropping to around $57,000. At its lowest point, BTC touched $53,550, driven by concerns surrounding market dynamics, including Mt. Gox’s ongoing BTC reimbursements and the German government’s liquidation activities.

Market Impact and Sentiment Shift

According to CoinGecko data, the entire cryptocurrency market lost over $170 billion in market capitalization within a 24-hour period, signaling a shift towards extreme fear sentiment among investors. Despite this, Bitcoin bulls managed to regain some ground over the weekend, closing at $58,250, just shy of the desired $58,450 mark.

German Government’s Bitcoin Liquidations

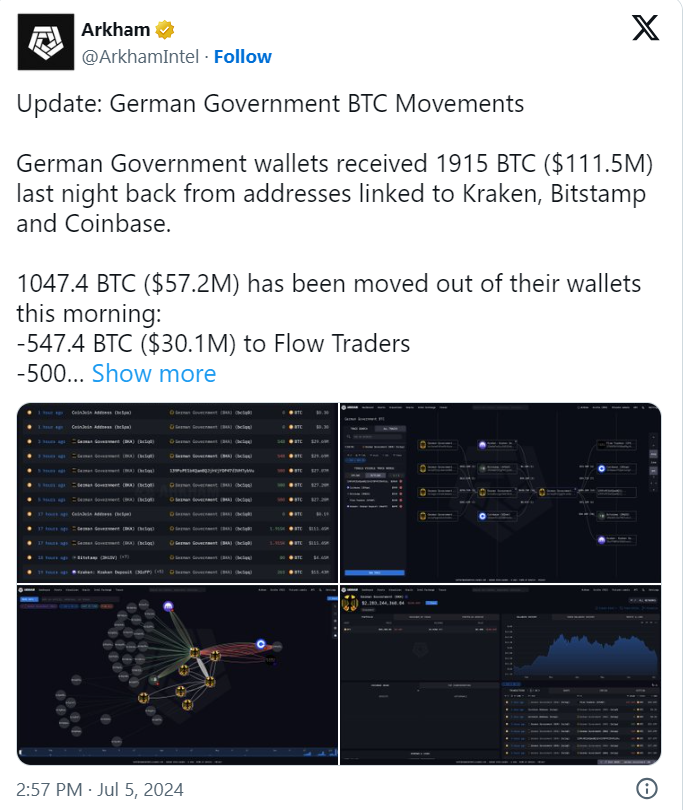

Sentiment has been further influenced by reports of the German government’s ongoing sales of seized Bitcoin. Germany’s continued sell-offs suggest a strategic move to liquidate portions of its reserves. Arkham, which tracks Germany’s Bitcoin holdings, reports that the government still retains over 40,000 Bitcoin, valued at more than $2 billion.

Technical Indicators and Market Insights

Bitcoin’s daily Relative Strength Index (RSI) is nearing the oversold threshold of 30, indicating a potential reversal or slowdown in the current downtrend, hinting at a possible rebound. Analysts point to several bullish signs, including expectations of U.S. interest rate cuts, which tend to favor riskier assets like Bitcoin due to reduced attractiveness of traditional safe investments.

Resurgence in U.S.-based Spot Bitcoin ETFs

Another positive indicator is the resumption of inflows into U.S.-based spot Bitcoin ETFs, marking the largest net inflows in a month, totaling $143.1 million. However, crypto analyst Willy Woo cautions against over-reliance on these numbers, noting the impact of BTC futures flooding the market on price predictions.

Bitcoin Hashrate and Miner Activity

The hashrate recently dropped by 7.7%, hitting a four-month low of 576 EH/s after reaching a record high in late April. This decline suggests that some miners are scaling back operations, reflecting financial pressures post-halving within the mining community.

Market Outlook and Conclusion

These metrics collectively indicate that the Bitcoin market may be approaching a potential bottom, reminiscent of previous cycles where miner sell-offs and operational adjustments preceded market recoveries.

FAQ

Why did Bitcoin experience a significant decline recently?

Bitcoin’s recent decline was influenced by factors including ongoing BTC reimbursements by Mt. Gox and the German government’s liquidation of seized Bitcoins.

How are the German government’s Bitcoin liquidations impacting the market?

The German government’s ongoing Bitcoin sales are affecting market sentiment by signaling a strategic decision to liquidate part of its reserves.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment