Coin Market Cap Declines: Bitcoin and Meme Coins Suffer Heavy Losses

Bitcoin (BTC) derivatives traders experienced over $226 million in liquidations within the last 24 hours, according to data from Coinglass. This event represents the second-largest liquidation in Bitcoin’s history, surpassed only by the one caused by the collapse of the now-defunct crypto exchange FTX.

Simultaneously, meme coins on Coinbase’s Layer 2 chain, Base, saw a significant decline, with their market capitalization dropping by over 25% in the past day, as per CoinGecko data.

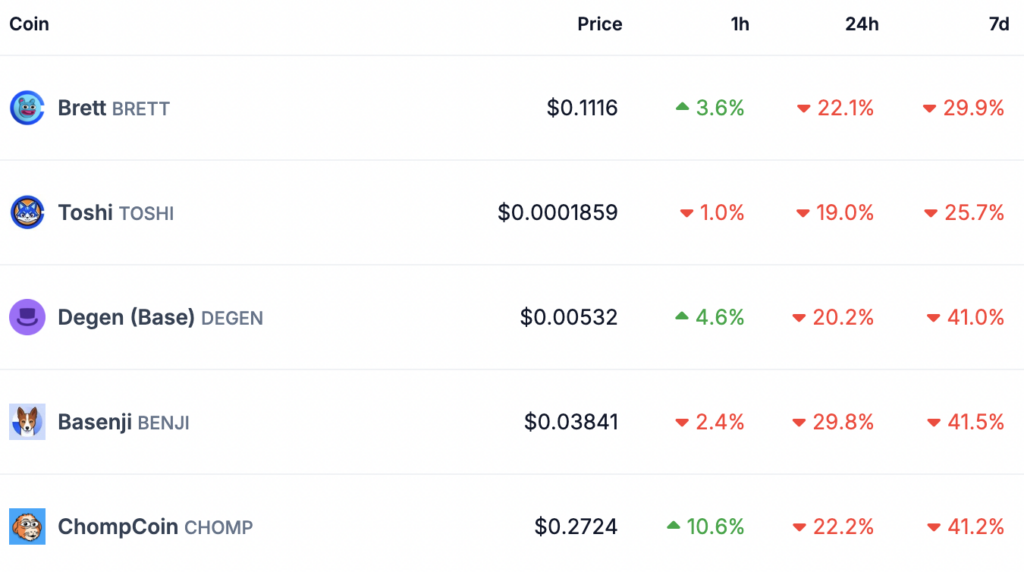

The meme coins Brett (BRETT), Toshi (TOSHI), Degen (DEGEN), Basenji (BENJI), and ChompCoin (CHOMP) have each lost between 19% and 30% of their value in the last 24 hours, presenting an opportunity for traders on the sidelines to enter the market.

Base meme coins have experienced a steep correction amidst Bitcoin’s downturn. The recent liquidation event wiped out nearly $226 million in Bitcoin derivatives positions. This correction in the largest cryptocurrency by market capitalization has led to declines across altcoins and various token categories.

On-chain data reveals that this ongoing liquidation event is the second largest in Bitcoin’s history, following the FTX collapse in November 2022. This recent downturn is likely influenced by significant market events, such as Bitcoin transfers by the German government and the impending repayment to Mt.Gox creditors in July.

The market capitalization of Base meme coins fell by 25.2% over the past 24 hours, standing at $1.476 trillion early Friday, according to CoinGecko.

BRETT, TOSHI, DEGEN, BENJI and CHOMP have extended their weekly losses, with each token declining between 30% and 41% over the past seven days.

Despite the recent decline, meme coins remain a prominent narrative in the current cycle, providing traders with opportunities to multiply their capital and achieve gains. The price drop offers a potential “buy the dip” scenario for traders looking to capitalize on the correction and open new positions in these assets.

Leave a comment