Breaking Crypto News – Price Drop Insights: Selling Ether Futures Aggressively

Breaking Crypto News – Selling pressure has caused the price of Ethereum to decline 3.99%, reaching $3,523 levels, amidst the fall in the larger cryptocurrency market. In addition, the daily volume of Ethereum trades has increased to $15.8 billion, a 78.29% increase.

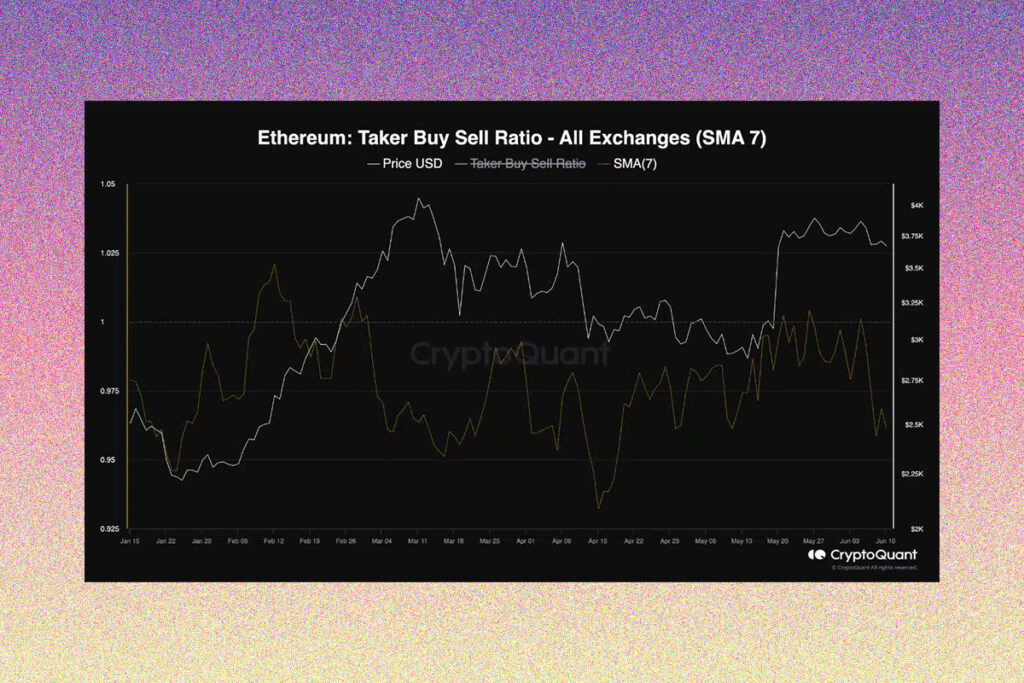

According to the CryptoQuant research, traders may want to pay attention to how futures market participants behave while Ethereum’s price struggles to break the $4,000 level. The Taker Buy Sell Ratio’s 7-day moving average, which gauges how aggressively buyers and sellers are compared, is seen in the chart above. Buyer dominance is indicated by a number above one, and aggressive selling is indicated by a value below one.

Ethereum Could Fall Further If the Selling Trend Continues

The ratio has been falling dramatically in recent days and has not been able to recover beyond one, as the above graphic illustrates. According to this pattern, the majority of futures dealers appear to have been selling Ethereum aggressively in order to realize profits or engage in speculative trading. This substantial decline in the measure is a negative indication, suggesting that if the current trend holds, the downward retracement may continue.

Conversely, severe falls show holders realizing losses and may signify panic sell-offs and investor surrender, according to Santiment’s Network Realized Profit/Loss (NPL), which indicates that holders are selling at substantial profits.

FAQ

What are Ether Futures?

Legal contracts to purchase or sell ether at a later time are known as ether futures. The second-largest cryptocurrency in the world, Ether, is the source of value for ether futures. Ether futures are a contractual representation of Ether; when the contract is exercised, Ether (or cash) will actually be settled.

What is Taker Buy-Sell Ratio?

A statistic used to examine the buy and sell volumes in the Bitcoin market is the taker-buy-sale ratio, also known as the taker/buyer ratio. This ratio, which indicates the mood of the market, aids traders and investors in determining the timing of buying and selling activity.

What is Network Realized Profit/Loss (NPL)?

The net realized profit/loss is a measure that determines the net profit or loss (in US dollars) for every coin that has been spent during the period under consideration. This offers a reflection of capital inflows and outflows, the overall market mood, and network profitability patterns.

For more up-to-date crypto news, you can follow Crypto Data Space.

Leave a comment