Bracebridge Becomes Top ARKB Holder with $363 Million Bitcoin ETF Investment

Crypto News– A recent SEC filing disclosed Bracebridge Capital’s $363 million investment in spot Bitcoin exchange-traded funds (ETFs). The Boston-based hedge fund holds significant positions in the Ark 21Shares Bitcoin ETF (ARKB), Grayscale Bitcoin Trust ETF (GBTC), and BlackRock’s iShares Bitcoin Trust (IBIT).

This action underscores the increasing institutional interest in cryptocurrency.

Rise in Institutional Bitcoin ETF Investments Amid Significant Outflows

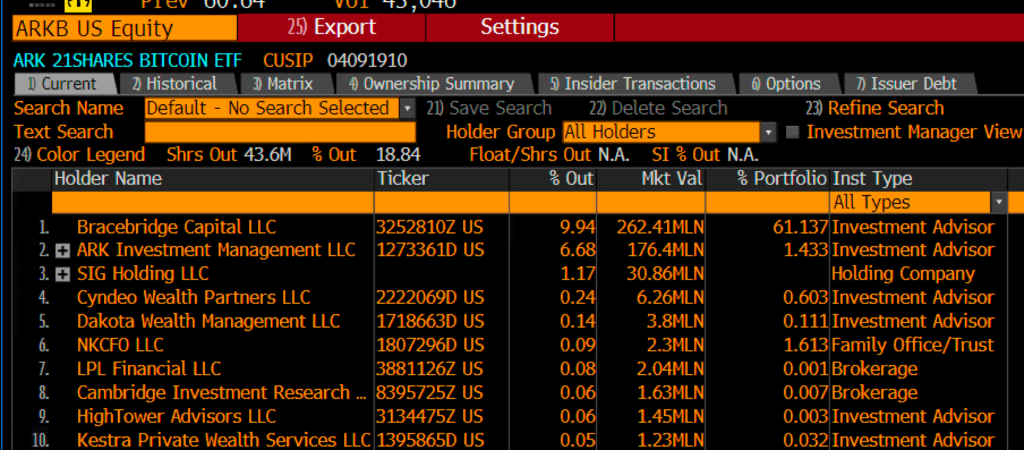

Bloomberg Intelligence data reveals that Bracebridge Capital holds $262 million in ARKB, $81 million in IBIT, and $20 million in GBTC. It’s noteworthy that Bracebridge Capital is the largest holder of ARKB.

This fact gains significance as Bracebridge manages funds for endowments for Yale University and Princeton University. Eric Balchunas, a senior ETF analyst at Bloomberg Intelligence, commented on Bracebridge Capital’s substantial investment.

A few days prior to Bracebridge’s revelation, another SEC filing disclosed that traditional banks are also embracing spot Bitcoin ETFs. Switzerland-based investment bank UBS Group AG invested $145,692 in IBIT (3,600 shares) through its subsidiaries and institutional investment managers. Edmond de Rothschild (Suisse) S.A., the family-owned banking giant, also holds $4.2 million in IBIT shares and $82,121 in GBTC shares.

Bracebridge Capital, UBS, and Rothschild’s actions align with a trend among institutional investors. BeInCrypto recently reported that Susquehanna International Group had invested over $1.1 billion in various Bitcoin ETFs.

New York-based asset manager Hightower has significantly increased its investments in Bitcoin ETFs, with a total investment of $68.35 million across spot Bitcoin ETFs.

However, James Seyffart, another ETF analyst at Bloomberg Intelligence, advised caution to the crypto community when interpreting recent Bitcoin ETF ownership trends.

FAQs

Why is Bracebridge in the spotlight in today’s crypto news?

Bracebridge has garnered attention in today’s crypto news for becoming the top holder of ARKB with a $363 million investment in Bitcoin ETFs.

What does it mean to be the top holder of ARKB?

Being the top holder of ARKB signifies that Bracebridge has the largest stake in this particular Bitcoin exchange-traded fund among all investors.

What prompted Bracebridge’s significant investment in Bitcoin ETFs?

Bracebridge’s decision to invest $363 million in Bitcoin ETFs likely reflects its confidence in the potential of cryptocurrencies as an investment asset.

For the latest in crypto updates, keep tabs on Crypto Data Space.

Leave a comment