Robinhood Remarkable Rebound: Q1 Sees $157M Profit, Crypto Revenue Skyrockets 232%

Crypto News– In the first quarter of 2024, Robinhood Markets Inc. showcased remarkable resilience, transitioning from a significant loss in the previous year to achieving its second consecutive quarterly profit.

Announced on Wednesday, the company reported a net income of $157 million, marking a stark turnaround from a net loss of $511 million in the same quarter the previous year. Moreover, Robinhood revealed a 40% increase in net revenues, soaring to $618 million in its latest quarterly report.

Crypto Transactions Driving Revenue Growth

A significant driver of revenue growth was the surge in crypto transactions, which contributed to a 59% increase in transaction-based revenues. Revenue from crypto transactions specifically skyrocketed by 232%, amounting to $126 million.

Robust Growth in Crypto Assets

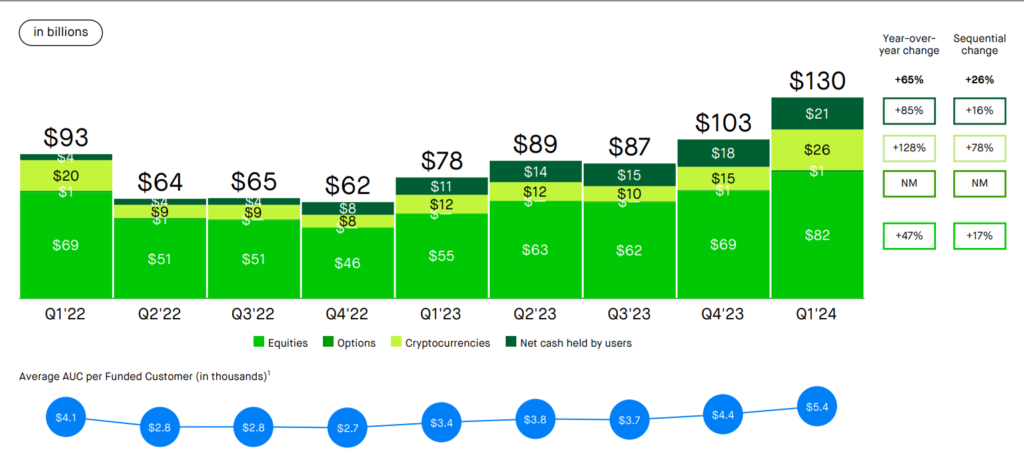

Robinhood reported a substantial increase in crypto assets under custody, reaching $26 billion by the end of March, representing a remarkable 78% rise from the previous year’s end.

The quarter witnessed Robinhood achieving all-time highs in both net deposits and Gold subscribers, signaling robust user engagement. Additionally, the company made significant strides in expanding its product offerings.

Jason Warnick, Robinhood’s Chief Financial Officer (CFO), expressed satisfaction with the results, which significantly surpassed Wall Street expectations. Earnings per share stood at 18 cents, far exceeding the anticipated 6 cents, while net revenue surpassed forecasts of $549 million.

Market Response and Scrutiny

Following the company’s growth and strong financial performance, Robinhood (HOOD) shares surged during after-hours trading, advancing by 6.3% to reach $19.01. However, amidst this success, Robinhood faces heightened scrutiny from the US Securities and Exchange Commission (SEC), with a recent Wells notice issued for potential violations concerning its crypto practices.

FAQs

What contributed to Robinhood’s remarkable rebound in Q1?

Robinhood’s resurgence in the first quarter of 2024 was fueled by several factors, including a significant increase in net revenues, driven by a 232% surge in revenue from crypto transactions. Additionally, the company’s strategic initiatives in expanding its product offerings and robust growth in crypto assets under custody contributed to its impressive performance.

How did Robinhood’s financial performance compare to the previous year?

In stark contrast to the previous year’s losses, Robinhood reported a net income of $157 million in Q1 2024, marking a substantial turnaround from a net loss of $511 million in the same quarter the previous year. This transition underscores the company’s resilience and adaptability in the face of challenges.

For the latest in crypto updates, keep tabs on Crypto Data Space.

Leave a comment