Crypto News– MicroStrategy, a business intelligence firm, has ramped up its Bitcoin investment by acquiring an extra 122 BTC in April.

MicroStrategy Boosts Bitcoin Holdings with Purchase of 122 More, Crossing 15.2 Billion Dollars Mark

This move further cements the company’s status as a significant player in the digital asset market.

MicroStrategy Keeps Adding to Its Bitcoin Portfolio

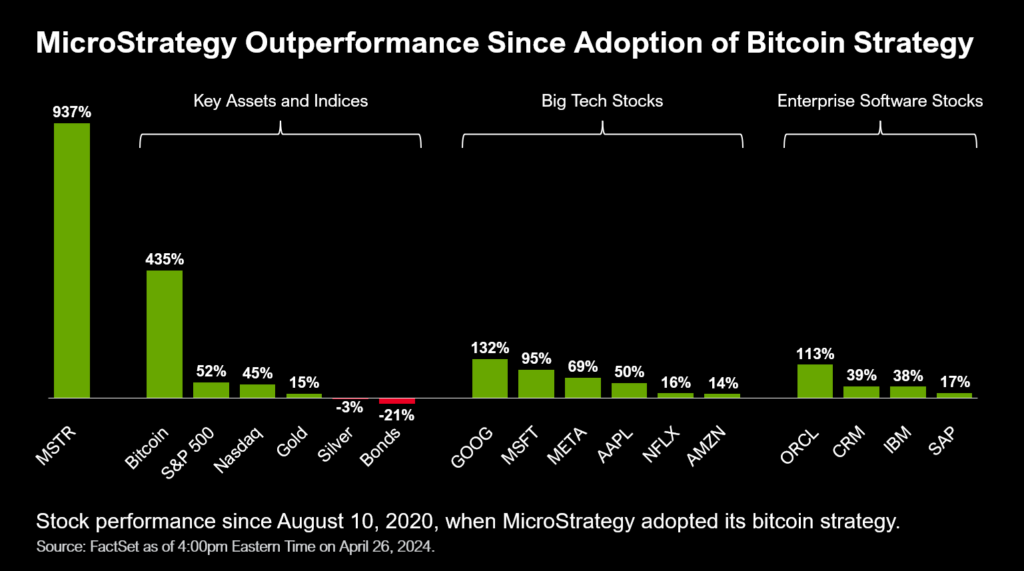

This latest acquisition, amounting to $7.8 million, brings MicroStrategy’s holdings to a significant 214,400 BTC, now valued at over $15.2 billion. Since its initial $250 million investment in August 2020, MicroStrategy has consistently expanded its Bitcoin portfolio, strategically accumulating approximately 1% of the total Bitcoin supply.

This deliberate accumulation of Bitcoin is a cornerstone of MicroStrategy’s treasury strategy, demonstrating its firm commitment to the cryptocurrency as a core investment. In 2024, the company’s strategic initiative remained steadfast. As per its first-quarter earnings report, MicroStrategy acquired around 25,250 BTC for $1.65 billion at an average price of $65,232 per BTC. Notably, this marks the 14th consecutive quarter in which the company has bolstered its balance sheet with Bitcoin.

Despite a 5.5% decline in overall revenue to $115.2 million in the first quarter, MicroStrategy’s focus on crypto assets remains resolute. The revenue decrease was even more pronounced when adjusted for constant currency, indicating a 5.7% drop.

Nonetheless, the company continued its Bitcoin investments despite a net loss of $53.1 million for the quarter, largely impacted by a $191.6 million impairment loss on its Bitcoin holdings.

Operating expenses for the company surged by 152.8% to $288.9 million, primarily driven by costs related to its Bitcoin investments. Despite these challenges, MicroStrategy’s subscription services revenue showed growth and resilience, increasing by 22% year-over-year to $23.0 million.

This uptick underscores a positive market response to its cloud-native software solutions.

Leave a comment