Crypto News – In order to prevent money laundering, the European Parliament enacted new legislation that imposes formal due diligence responsibilities on cryptocurrency enterprises.

Fighting Money Laundering: A New Crypto Regulation Added to This War by the EU

With an eye on enhancing customer due diligence procedures and identity verifications, the new laws also target organizations like cryptocurrency asset managers. Additionally, these organizations will have to notify the police of any questionable activity. The Markets in Crypto-Assets (MiCA) law would affect centralized crypto exchanges, which are under the purview of this new legislation that was enacted on April 24.

The Authority for Anti-Money Laundering and Countering the Financing of Terrorism (AMLA), a new organization, has been assigned to manage and supervise the new rule’s execution. Nevertheless, the law has not yet been published in the EU Office Journal or formally enacted by the Council.

This Law is Expected to Take Effect in 3 Years

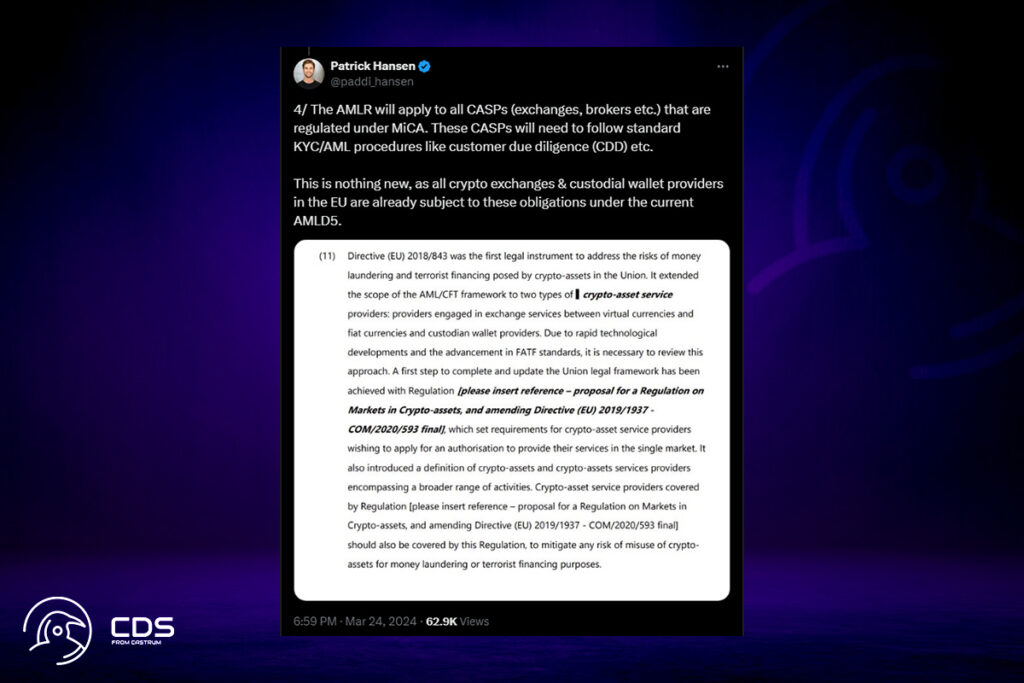

In an post on X, Circle’s director of EU strategy and policy, Patrick Hansen, stated his excitement for the result of the vote. After three years, he said, the package would be formally endorsed by the EU Council and go into force.

Regarding normal Know Your Client (KYC) and Anti-Money Laundering (AML) protocols, such as client due diligence, Hansen stated in another post that these CASPs must follow. He pointed out that this is not a new obligation because current EU legislation already requires all cryptocurrency exchanges and custodial wallet providers to abide by these rules. For the cryptocurrency industry, Hansen called the final version a “positive result.”

Leave a comment