Bitcoin Sees Modest Rise Post Halving, Mining Stocks Surge

Bitcoin saw a modest uptick at the beginning of the week following the completion of its fourth halving on Friday, which effectively reduces the incentives for bitcoin miners.

The cryptocurrency’s price edged up by 2.86% to reach $66,560.39, as reported by Coin Metrics. Meanwhile, Ether experienced a 1.24% increase, reaching $3,187.67.

Publicly traded cryptocurrency mining companies witnessed a surge in their stock prices, following a rally just before Friday’s halving event. Marathon Digital saw a 6% increase, while Riot Platforms surged by 23%. CleanSpark and Iris Energy also saw gains of approximately 11% each.

The Bitcoin halving slashes the rewards granted to miners by half and occurs roughly every four years, as stipulated in the Bitcoin protocol. Its purpose is to slow down the issuance of new bitcoins, creating a scarcity that enhances the cryptocurrency’s digital, gold-like properties.

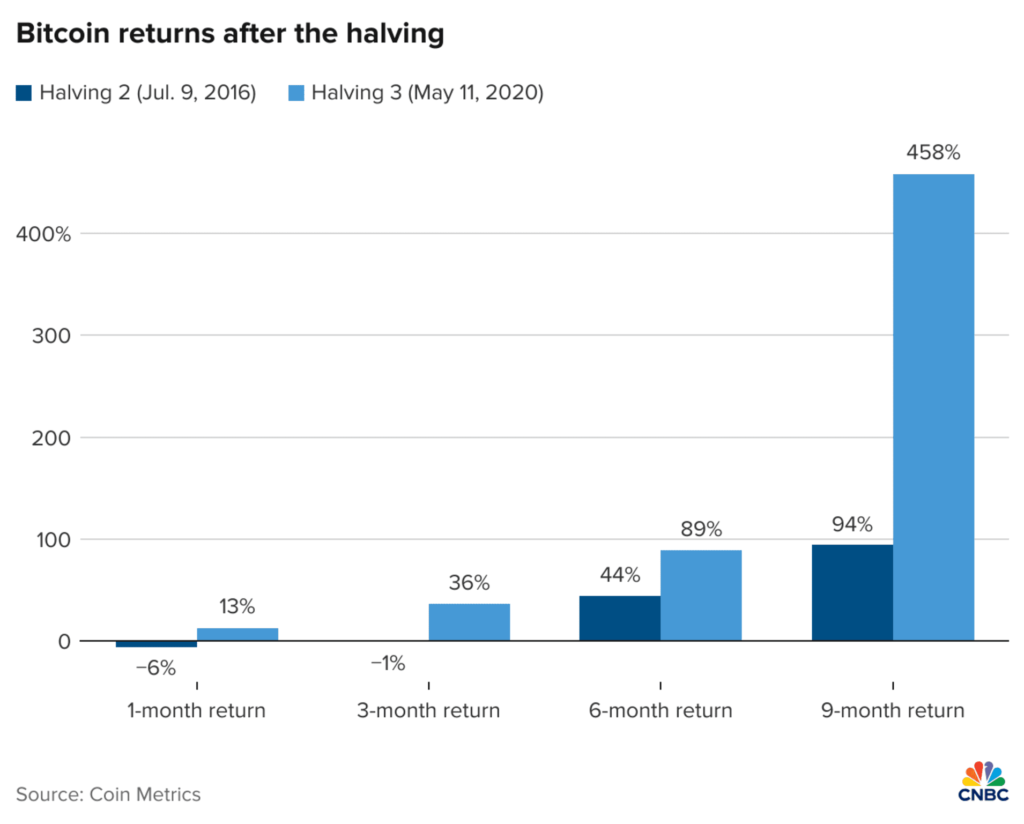

While many investors anticipated limited price movement around the halving itself, historical patterns suggest that it typically takes several months for its impact to be fully reflected in bitcoin’s price. Nonetheless, JPMorgan expressed concerns about potential near-term downside risks for bitcoin.

Major publicly listed bitcoin mining companies have been well-prepared for the event. They’ve spent months gearing up by placing significant orders for new and more efficient mining equipment, expanding their electricity capacity, and increasing their hash rates, which measure the computational efficiency of crypto miners.

However, smaller and less efficient mining operations may face challenges and could be forced offline. This would potentially allow the remaining miners to capture a larger market share, creating opportunities for mergers and acquisitions.

Leave a comment