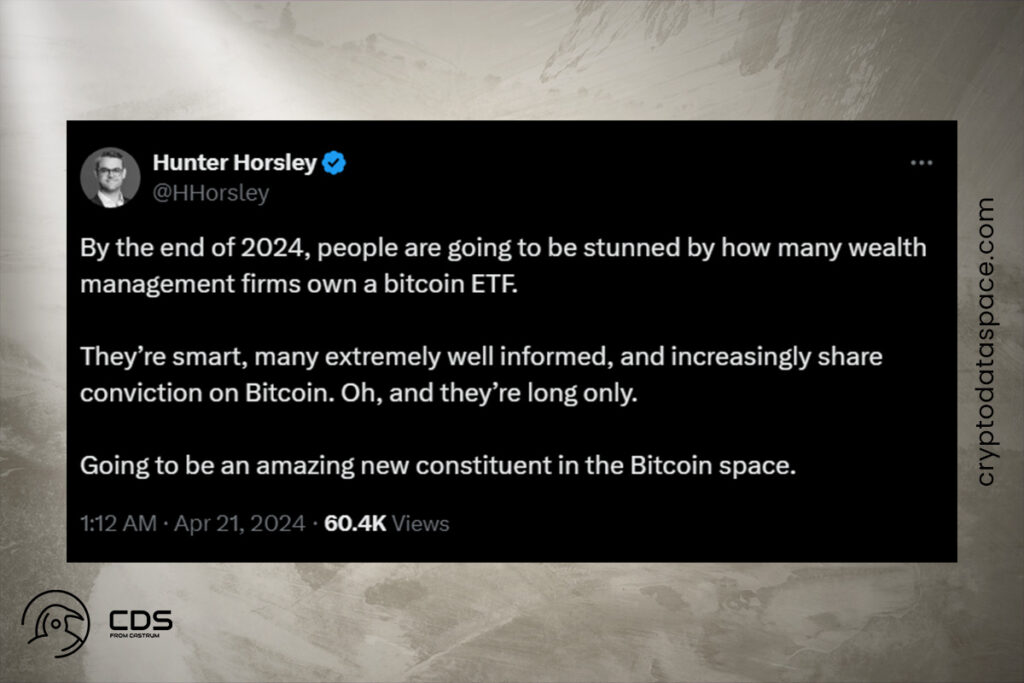

Crypto News – Hunter Horsley, the CEO of Bitwise, has forecast that wealth management companies will hold more Bitcoin ETFs. The forecast is made at a time when it is anticipated that after their halving, Bitcoin ETFs will become even more popular.

According to Bitwise CEO Hunter Horsley, Wealth Management Firms Tend to Increase Bitcoin ETF Holdings

Since Bitcoin investments in the US ETF market saw a net positive inflow just before the day of Bitcoin halving after five days of losses, Horsley’s prediction is consistent with the general market view that there is a growing demand for ETFs.

Only $2 billion separates BlackRock’s iShares Bitcoin Trust (IBIT) from Grayscale’s. This puts BlackRock in a position to overtake Grayscale as the biggest Bitcoin fund globally. Over 68 days, the value of Grayscale’s Bitcoin Trust (GBTC) dropped by around $16 billion, leaving its assets at $19.4 billion.

Grayscale Seems to be Losing Its Supremacy

Grayscale’s dominance in the Bitcoin ETF market appears to be waning despite its early advantage. From the beginning of trade, Fidelity and BlackRock rapidly increased their market shares. Some of the market’s liquidity problems were alleviated, for example, by the net inflows of $18.7 million and $37.3 million into the Fidelity and BlackRock Bitcoin ETFs in the same week.

“Stealthy but significant” is how the CEO of Bitwise defines the uptake of Bitcoin ETFs by multifamily offices and registered investment advisers (RIAs). Significant financial institutions are quietly evaluating the Bitcoin sector in-depth, he observes.

1 Comment