Crypto News– Ethereum, with a Q1 income of $365 million, is on track to reach $1 billion in annualized profits, driven by a 155% year-on-year quarterly revenue growth.

Ethereum Q1 Revenue Soars Driven by DeFi, On Course to Achieve 1 Billion Dollars Annual Profit

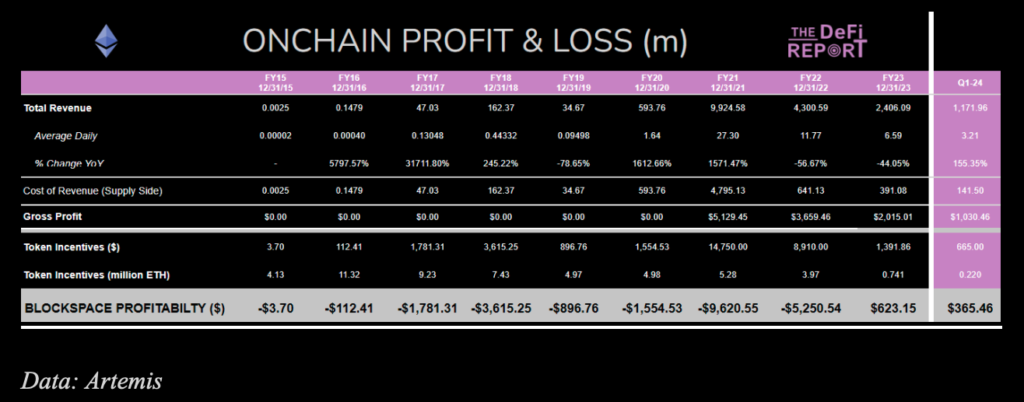

According to an April 17 report by analyst Michael Nadeau from The DeFi Report, Ethereum’s Q1 2024 income marks a nearly 200% increase from Q4 2023’s $123 million profit. Additionally, Ethereum’s fee revenue, generated from user transaction fees, surged to $1.17 billion, up 155% from Q1 2023 and an 80% increase from the previous quarter.

Nadeau stated that the increased network activity, primarily driven by a surge in DeFi activity during the quarter, was the main reason for the revenue increase.

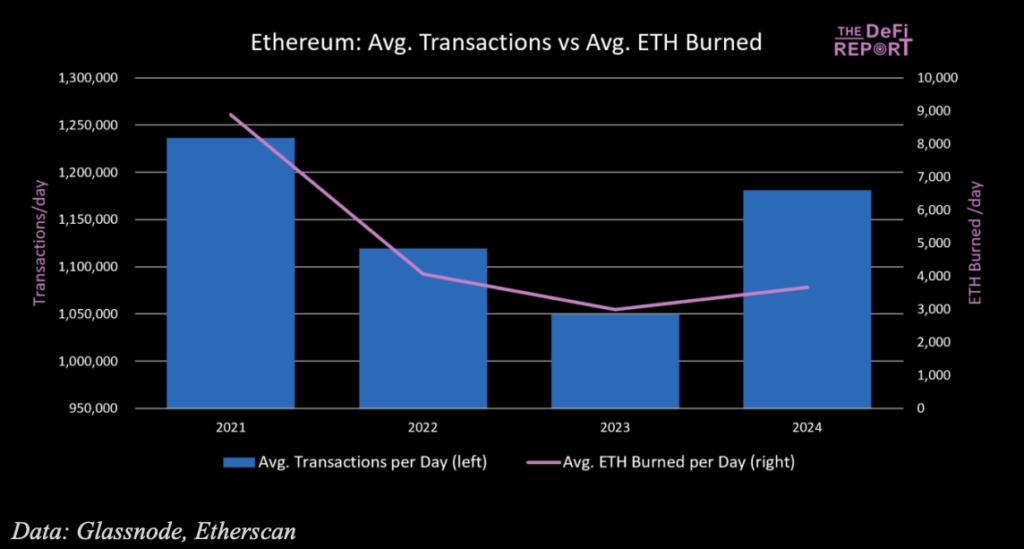

This surge in activity has already led to average daily transactions on the blockchain in 2024 surpassing last year’s figures and approaching Ethereum’s peak in 2021.

In 2024, there have been over 1.15 million average daily transactions, slightly higher than the 1.05 million recorded last year but just below the 1.25 million in 2021.

Ethereum was launched in 2015 but only achieved its first profitable year in 2023, earning $623 million, despite revenues that year being 75% lower than its peak revenues of $9.9 billion in 2021.

This is largely due to the move to proof-of-stake consensus in September of ’22 — in which token incentives paid to miners (now validators) dropped roughly 80%, explained Nadeau.

He further noted that Ethereum’s fees have grown at a rate of 58% since 2017.

In the years to come, cryptocurrency is poised to outperform all other asset classes

Nadeau offered his market forecasts for the upcoming years and ultimately asserted that crypto will surpass all other assets.

He anticipated a surge in liquidity over the next few years, particularly as the United States faces substantial debt requiring refinancing this year, coupled with the market’s anticipation of three rate cuts from the Federal Reserve.

1 Comment