Crypto News– After the upcoming Bitcoin halving, Bitcoin mining profitability may not necessarily decrease, despite a 50% reduction in Bitcoin supply issuance, according to Laurent Benayoun, CEO of Acheron Trading, in an interview with Cointelegraph.

After halving, Bitcoin mining profitability may not experience an inevitable decline

In dollar terms, it’s not obvious that miners would be worse off after the halving, quite the opposite […] The decrease in mining rewards is going to be compensated by an increase in network fees.

Laurent Benayoun

The Bitcoin halving, scheduled for April 20, will reduce block issuance rewards from 6.25 BTC to 3.125 BTC. Historically, smaller mining firms faced challenges and some were forced out of business due to reduced block rewards post-halving.

However, Benayoun believes the scenario will be different after the 2024 halving, attributing this to increasing network fees driven by Ordinals inscriptions and Bitcoin-native decentralized finance (BTCFi).

We’ve seen NFTs popping up on the Bitcoin blockchain, and we’ve seen a number of projects trying to build DeFi on the Bitcoin network. So all those elements are leading to an increase in network fees.

Laurent Benayoun

Bitcoin network fees are transaction fees paid to incentivize miners to include a transaction in the following block.

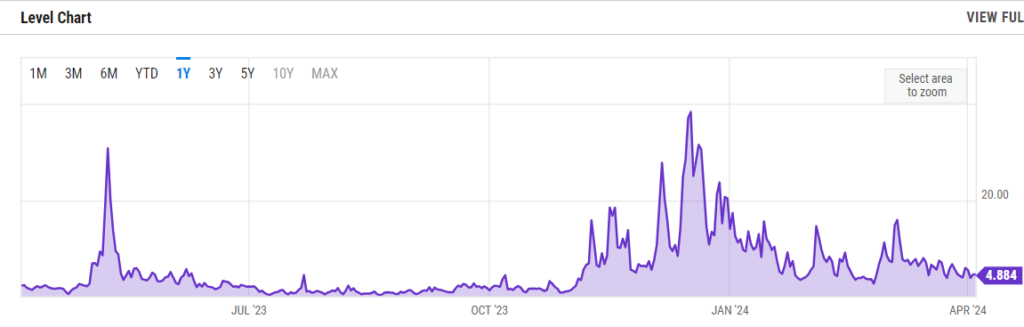

Currently, the average Bitcoin transaction fee stands at $4.88 per transaction, showing a decline from $16.13 per transaction reported a month ago, on March 5th. Over the past year, Bitcoin transaction fees surged by over 86%, as per data from YCharts.

According to Joe Downie, the chief marketing officer of NiceHash, Bitcoin mining companies would generally remain profitable as long as the Bitcoin price stays above the $70,000 threshold.

If the price stays above $70,000, most miners will continue to be profitable since, at current block rewards, they are profitable at a BTC price of over $35,000. Less than that and they likely lose money.

Joe Downie

As of 10:22 am UTC, Bitcoin’s price has experienced a 4.3% decline over the previous week, trading at $66,851. BTC has been trading below the $70,000 mark since April 1, according to data from CoinMarketCap.

Leave a comment