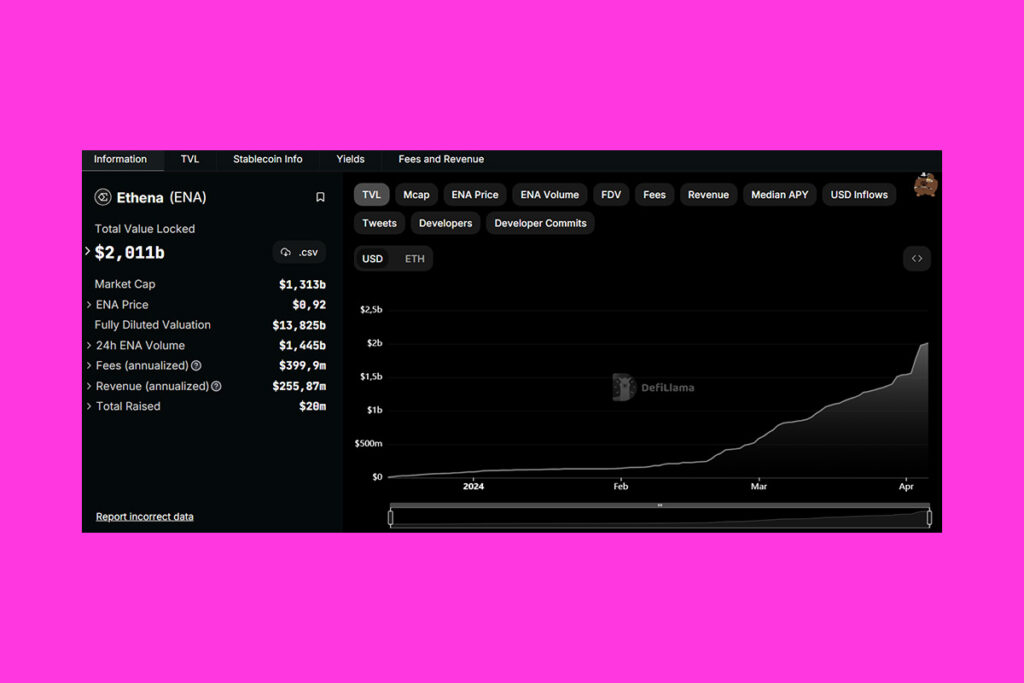

Crypto News – The total value locked (TVL) of the Ethena Protocol (ENA) has surged above $2 billion. Experts in the field with years of experience are growing increasingly skeptical, raising worries similar to those raised by the Terra (LUNA) scandal.

Ethena TVL Increased: With $2 Billion TVL, How Long Will Ethena’s Success Last?

As of April 1, Ethena‘s TVL was $1.54 billion, according to DefiLlama’s data. It has risen to $2 billion in just four days, representing a roughly 30% increase. Ethena’s expanding appeal to investors is demonstrated by this noteworthy uptick in interest.

The protocol is sure to draw investors with its enticing 27% annual percentage yield (APY) and newly announced ENA token airdrop. On April 2, Ethena offered 750 million tokens to qualified users as part of an airdrop.

Concerns Grow About Ethena’s Success

Prestigious backers like Delphi Digital, Wintermute, and Galaxy Digital have contributed significantly to Ethena’s rise. Because of this, the platform gains further perceived legitimacy.

There are cautions associated with Ethena’s rapid expansion, though. DeFi icon Andre Cronje expressed worries that the USDe would collapse like the disastrous TerraUSD (UST) situation. The fundamental causes of Cronje’s concern are Ethena’s utilization of yield-based collateral and perpetual contracts. Taking note of Ethena’s declared intentions to incorporate Bitcoin (BTC) as a USDe backing asset, CryptoQuant CEO Ki Young Ju repeated Cronje’s caution.

I’m just concerned about a repeat of LUNA’s scenario: selling BTC to stabilize USDe’s peg if their algorithm fails during bear markets,

Ki Young Ju

Leave a comment