Crypto News – On March 21, around $359 million left the Bitcoin ETF managed by cryptocurrency asset management Grayscale, marking yet another day of significant outflows from the fund. However, experts believe that the exodus may be nearing its conclusion.

GBTC Outflows Latest Developments: Analysts Expect Outflows of Up to $358 Million to End

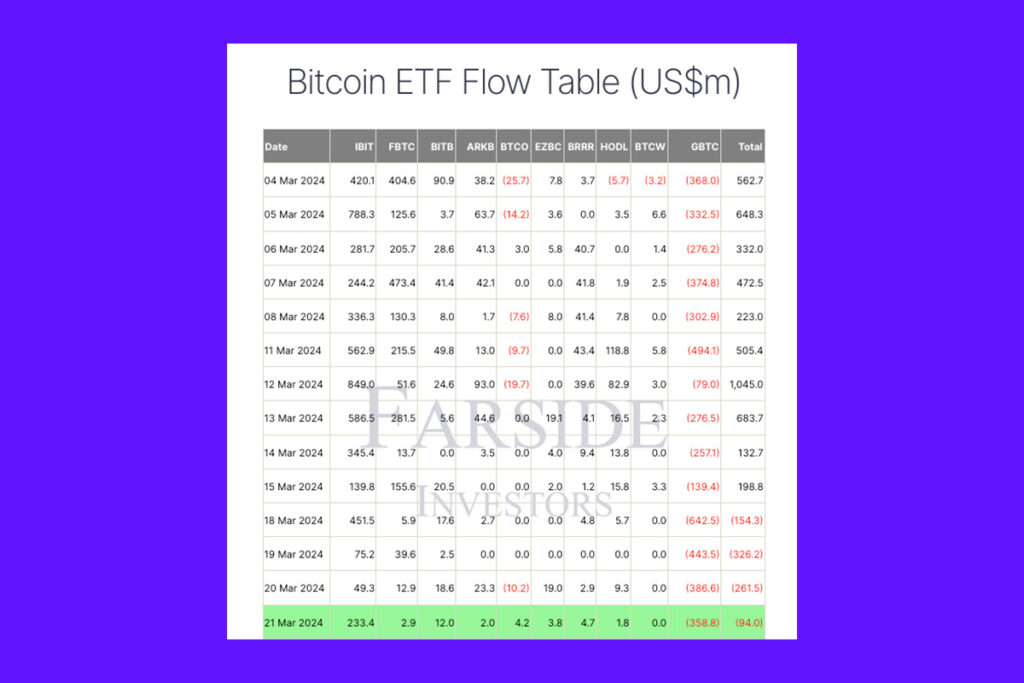

According to Farside Investors statistics, the Grayscale Bitcoin Trust (GBTC) had net outflows of $358.8 million on March 21. This comes after a tremendous week of outflows, with the highest day ever being March 18 with $642 million.

The most recent data indicates that GBTC has had net withdrawals for four days running across all 10 Bitcoin ETFs, bringing the total outflows for this week to $1.8 billion.

Eric Balchunas Believes Outflows May End Soon

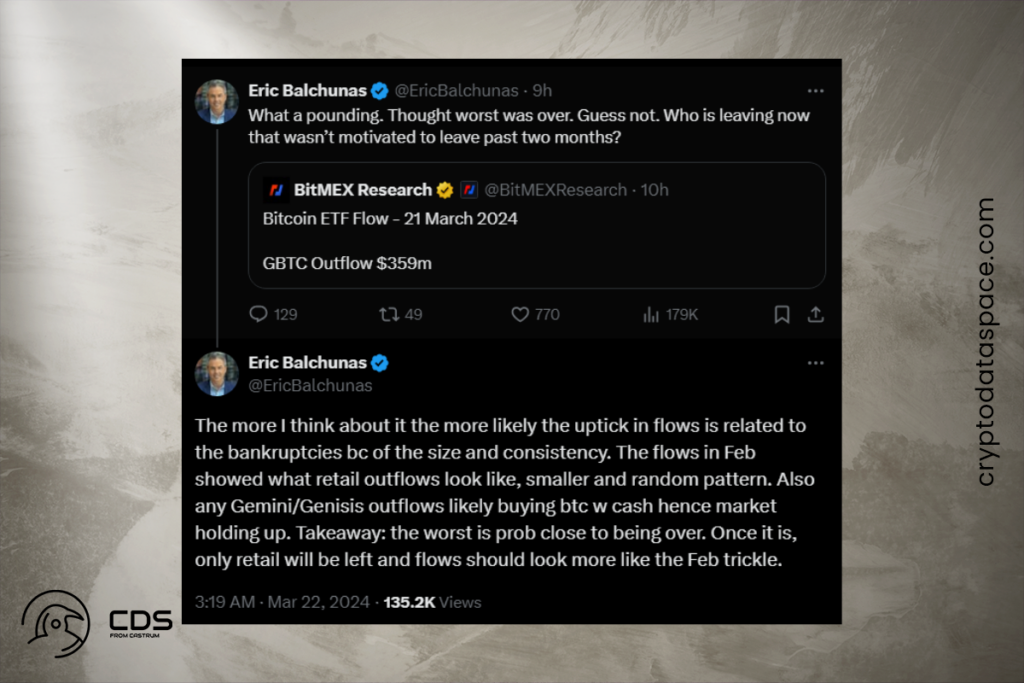

In a March 21 X post, senior Bloomberg ETF analyst Eric Balchunas conjectured that a significant portion of Grayscale’s outflows may soon come to an end, with the bulk originating from the bankruptcies of cryptocurrency startups because of their “size and consistency.”

Any Gemini/Genisis outflows likely buying BTC with cash hence market holding up. Takeaway: the worst is probably close to being over. Once it is, only retail will be left and flows should look more like the Feb trickle,

Balchunas

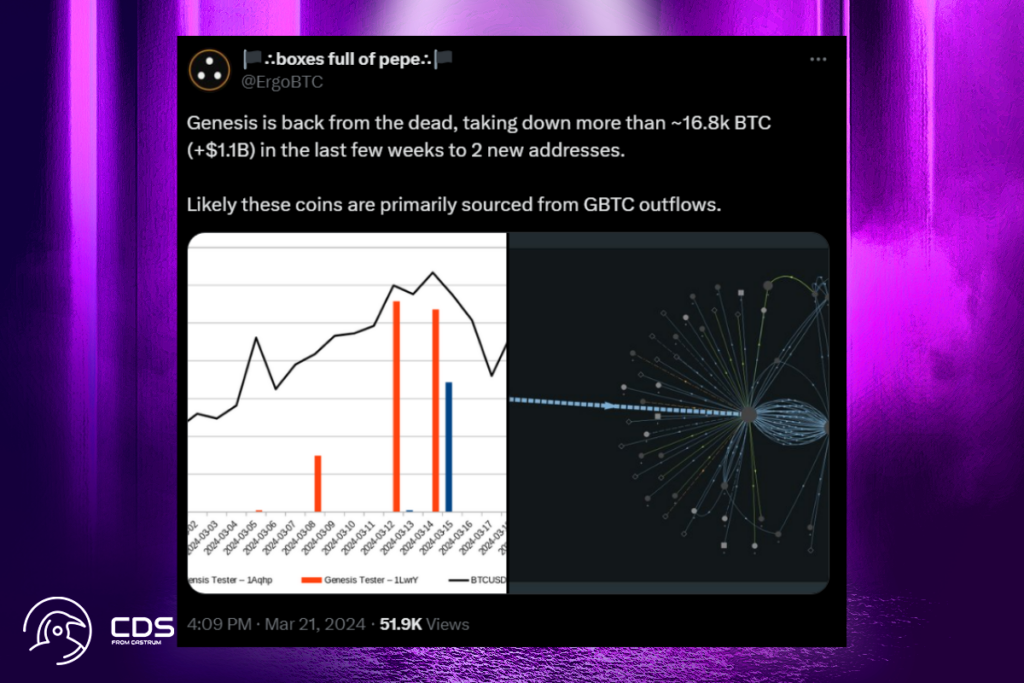

In agreement with Balchunas, anonymous independent researcher ErgoBTC proposed that bankrupt cryptocurrency lender Genesis looks to have been the source of almost $1.1 billion in GBTC outflows throughout the past several weeks.

Resulting activity volumes and timings of funds out of GBTC and into Genesis match pretty well. Simply there just aren’t that many 2k BTC txs per day so likely the GBTC outflows and Genesis inflows are related.

ErgoBTC

1 Comment