Crypto News – The impending halving of BTC is much anticipated in the cryptocurrency community. Because of the introduction of US spot Bitcoin ETFs, the active supply of BTC, and their significant influence on the market, Coinbase analysts believe that this event is set to be unlike any other.

The 2024 BTC Halving Will Be Different, But Why?

The halving process is intended to reduce inflation and affect Bitcoin’s market price. But investors need to look closely at the supply and demand dynamics in order to fully understand Bitcoin’s potential after its halving.

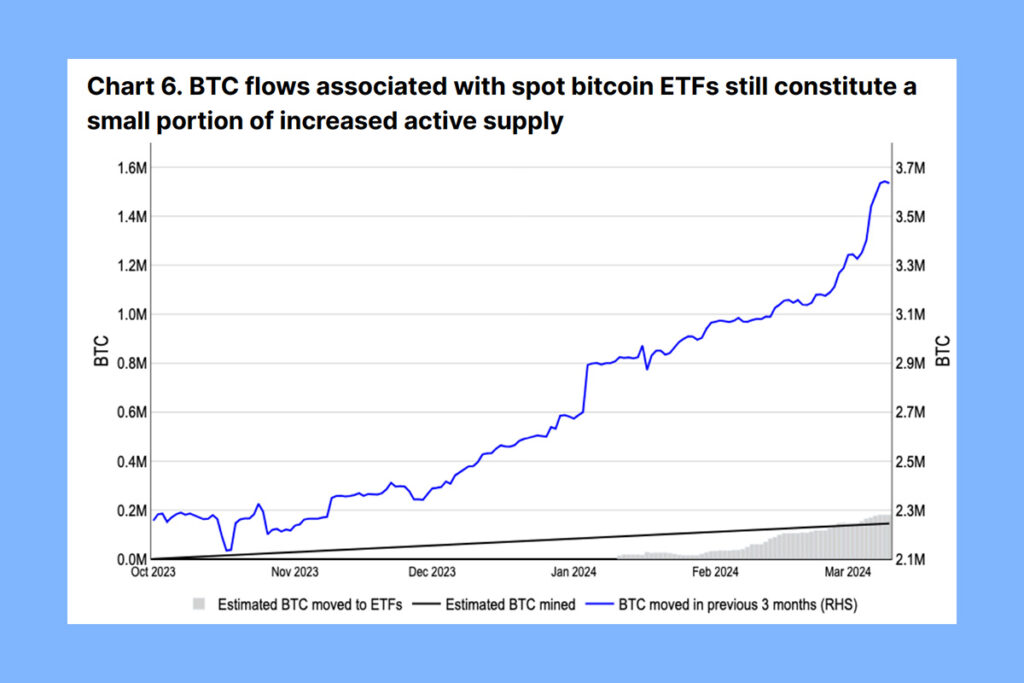

Unbelievably, the active supply of BTC has increased significantly from early Q4 2023—a gain of 1.3 million surpassing the total inflows into ETFs. This transformation implies a more profound alteration in market behavior, which is further complicated by the involvement of institutional investors via ETFs.

Supply-Demand Relationship Should Be Re-examined in the Current Cycle

There are usually rumors of a price hike when the supply of Bitcoin is reduced. However, such presumptions need to be reevaluated in light of this cycle. The intricacies of miner selling operations, long-term holder behaviors, and liquidity from Bitcoin collateral usage must all be taken into account in the research. Still, the situation has changed significantly with the advent of spot Bitcoin ETFs. Massive inflows into these financial products have changed investors’ perspectives on this issue.

Truly, this cycle may be different. Consistent daily net inflows into US spot bitcoin ETFs continue to be a massive tailwind for the asset class. However, this doesn’t necessarily indicate that we’re about to embark on a supply crunch scenario where that demand will outpace the selling pressure in this market,

Coinbase analysts

1 Comment