Crypto News – The growing interest in cryptocurrency in investment portfolios is demonstrated by the fact that over one million Bitcoin, presently valued at over $67 billion, are managed by international Bitcoin investment vehicles, including recently established spot exchange-traded funds in the United States.

More than 1 Million BTC is Available in Bitcoin Investment Vehicles

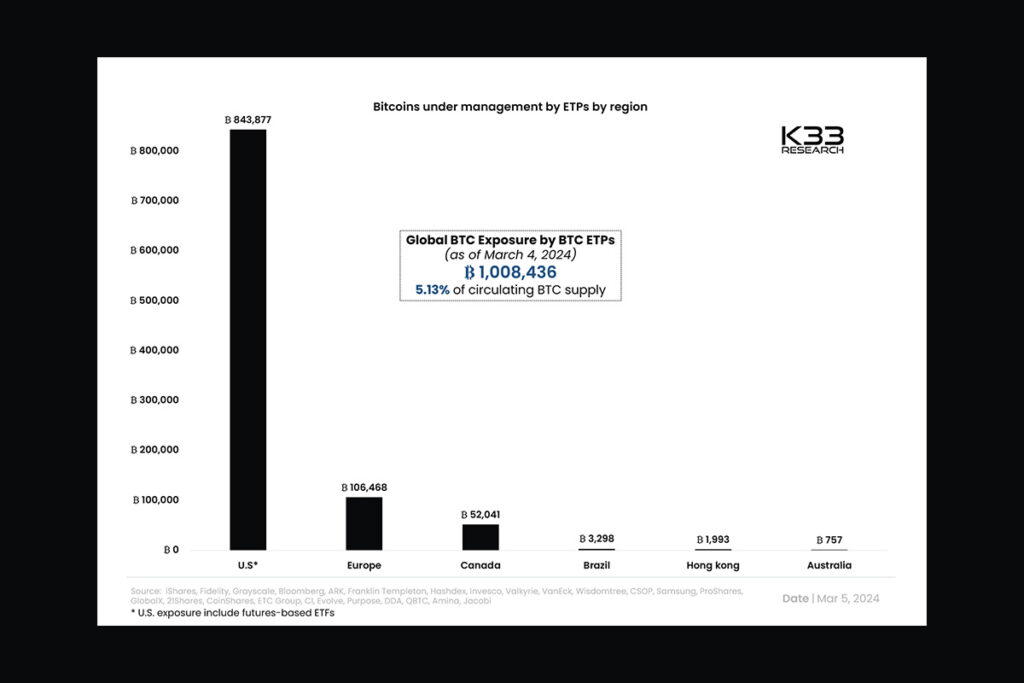

According to crypto research firm K33, U.S. spot and futures bitcoin ETFs account for the majority of those figures, or over 83% of them. The second and third largest markets for Bitcoin investment vehicles are Europe and Canada, respectively, after the United States. Together, these vehicles control 1,008,436 BTC, or 5.13% of the total quantity of bitcoin in circulation as of March 4, according to K33.

Crossing one million bitcoins under management in investment vehicles is a monumental threshold. These vehicles have shaken up the bitcoin market structure considerably. A few years ago, spot exchanges held 20% of the circulating supply; now, this figure has fallen to 11%, with ETFs/ETPs, wrapped bitcoin, and a developing derivatives market eating away market share.

Vetle Lunde, senior analyst at K33

Bitcoin ETFs in Race with Gold ETFs

According to Glassnode data, out of the more than one million BTC, almost 700,000 BTC are exclusively managed by the newly established spot bitcoin ETFs in the United States. ETFs are currently vying for market share against gold ETFs, which have been in existence since 2004. The competition began in January of this year. In contrast to gold ETFs, which have a total AUM of over $100 billion, U.S. spot bitcoin ETFs had combined assets under management of over $52.5 billion as of March 4, according to BitMEX Research data.

Leave a comment