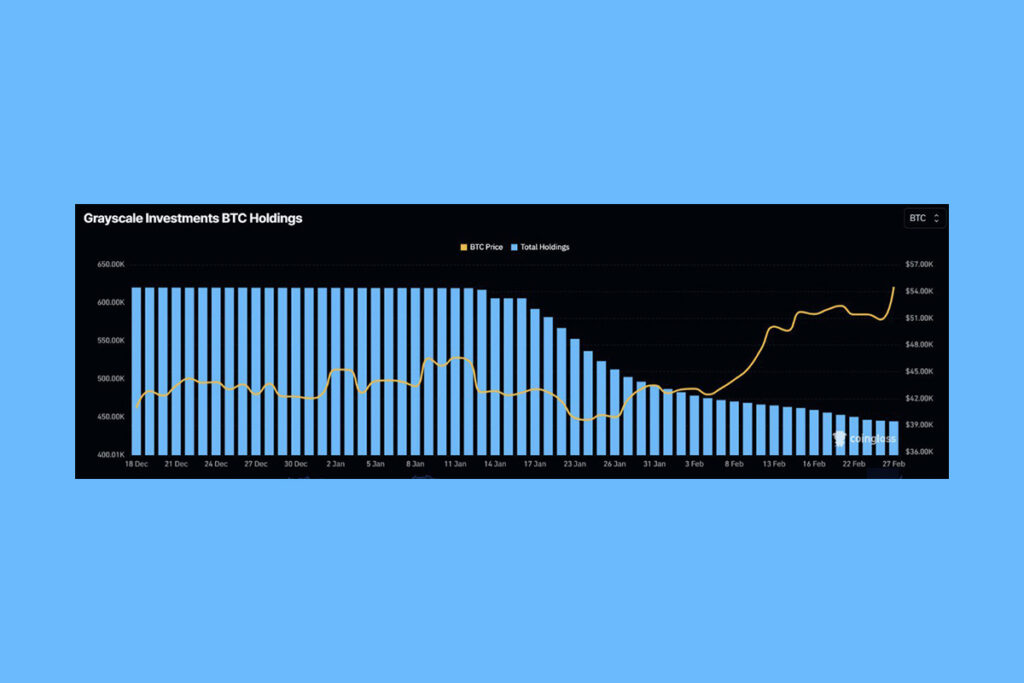

Crypto News – Since its conversion to an ETF in mid-January, Grayscale, the largest cryptocurrency asset manager in the world, has seen the removal of roughly 33% of its Bitcoin holdings on GBTC.

GBTC ETF Conversion Didn’t Benefit Grayscale: Bitcoin Holdings Down 33% Since Conversion

BitMEX Research reports that on March 4, GBTC had its 36th day of consecutive outflows, with 5,450 BTC ($368 million) leaving the trust, bringing the total outflow since its conversion to $9.26 billion.

According to Coinglass, Grayscale controlled about 620,000 BTC before converting the fund to an ETF. However, investors were now able to do something that was prohibited under the prior structure: redeem their shares for Bitcoin, thanks to Grayscale’s spot Bitcoin ETF launch. The fact that GBTC charges greater fees than certain other ETFs, like Fidelity’s FBTC and BlackRock’s IBIT, hasn’t helped either.

It’s Not Known When GBTC Outflows Will Stop

Market watchers haven’t stopped speculating about when GBTC’s “Bitcoin bleed” will stop. When GBTC outflows decreased in late January and early February, some observers hypothesized that they might be ending. But in an attempt to pay back investors, bankruptcy courts permitted cryptocurrency lender Genesis to sell off over $1.3 billion worth of GBTC shares in mid-February.

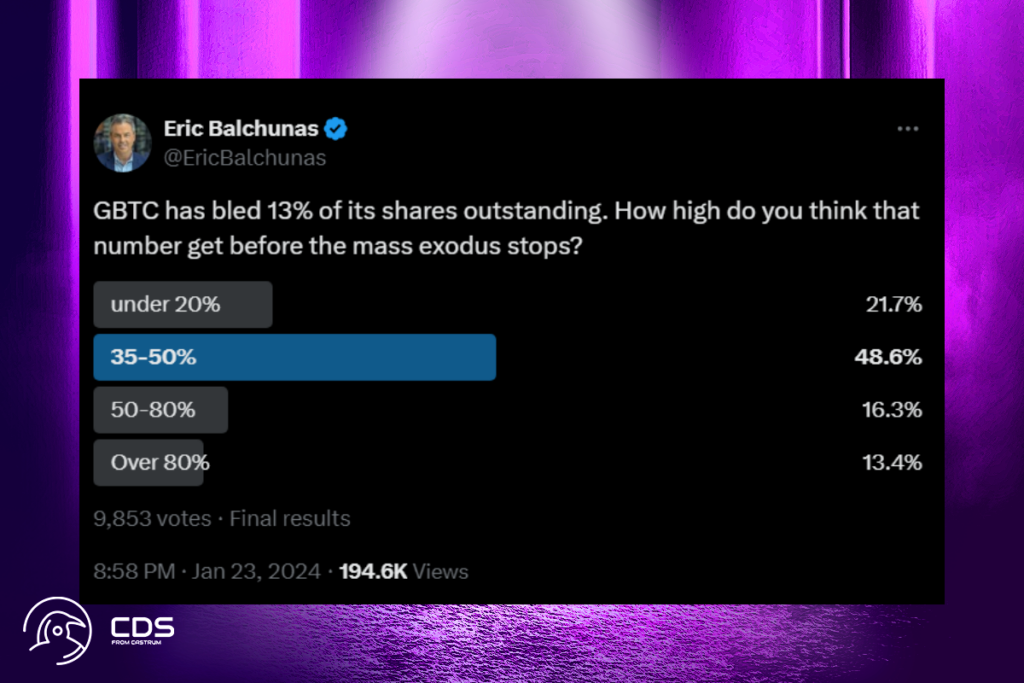

In the past, Bloomberg ETF analyst Eric Balchunas predicted that the bleeding would halt when GBTC reached 25% of outstanding shares; however, most participants in a self-selected poll on X predicted that it would occur between 35 and 50% of the time.

2 Comments