Bitcoin NFT Sales Soar, Overtaking Ethereum: NodeMonkes Leads Surge

Crypto News – Bitcoin’s non-fungible token (NFT) market witnessed a remarkable surge over the weekend, outperforming Ethereum in weekly sales. This surge was predominantly fueled by the sudden rise of Bitcoin Ordinals-based NFT collections, spearheaded by the prominent NodeMonkes collection.

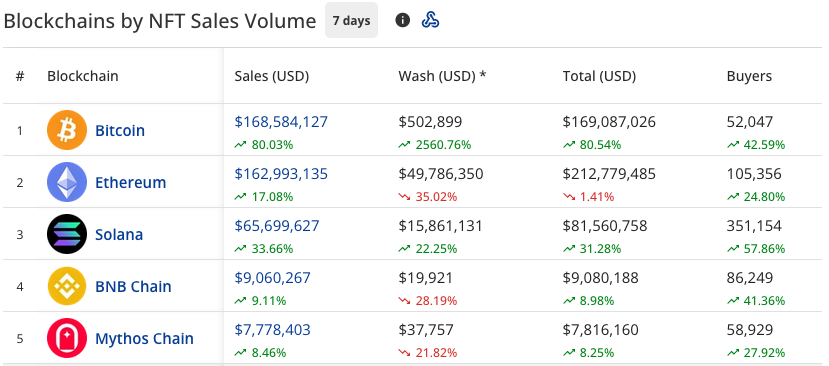

With an astounding 80% week-over-week increase, Bitcoin NFT sales surged to $168.5 million, eclipsing Ethereum’s $162 million in sales, according to data from CryptoSlam!.

The rise of Ordinals, introduced in January 2023, facilitated the creation of NFT-like assets by enabling users to embed files, such as images, into satoshis (sats) – Bitcoin’s smallest unit.

Uncategorized Ordinals, not affiliated with any specific collection, recorded the highest sales, exceeding $43 million across more than 47,000 transactions.

Following closely behind was NodeMonkes, a Bitcoin-based collection that saw over $41 million in sales, marking a nearly 170% increase from the previous week. The Natcats collection, another Ordinals-based series, secured the fourth position with over $10 million in sales.

NodeMonkes, comprising 10,000 unique pixelated profile pictures (PFP), proudly claims to be the pioneering 10,000-strong collection on the Bitcoin network. While other 10,000-count Ordinals collections had debuted earlier, NodeMonkes distinguished itself by embedding its collection onto the blockchain in February 2023, just a month after the Ordinals’ launch.

According to “NFTstats,” on March 2, NodeMonkes’ market capitalization surpassed $500 million, solidifying its position as the third-largest PFP-style NFT collection across all blockchains, trailing only the Ethereum-based Bored Ape Yacht Club (BAYC).

Despite the recent surge in attention, the exact catalyst for NodeMonkes’ rise remains unclear. Kevin Wu, founder of NFT collection GRAYCRAFT, speculated in a post on February 22 that NodeMonkes’ significance lies in its “meaningful provenance” as the inaugural PFP-style NFT collection on “the first chain ever.” This compelling narrative may be attracting speculative investors to the collection.

Leave a comment