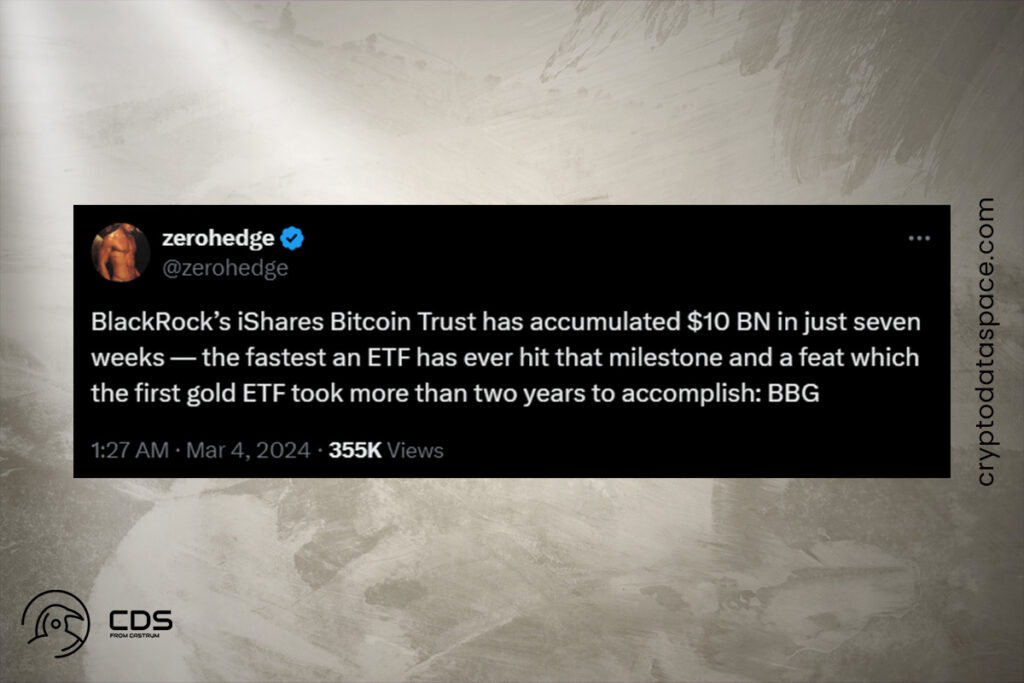

Crypto News – In just over seven weeks, BlackRock’s iShares Bitcoin Trust (IBIT) has surpassed $10 billion in assets under management (AUM), a milestone that took more than two years for the first gold-backed ETF in the United States to reach.

Gold ETF vs. Bitcoin ETF: One Took 2 Years to Reach $10 Billion, While the Other Did It in 2 Months, But How?

However, the Zero Hedge finance blog notes that it took more than two years for SPDR Gold Shares (GLD), the country’s first gold exchange-traded fund, to follow suit when it was introduced in 2004.

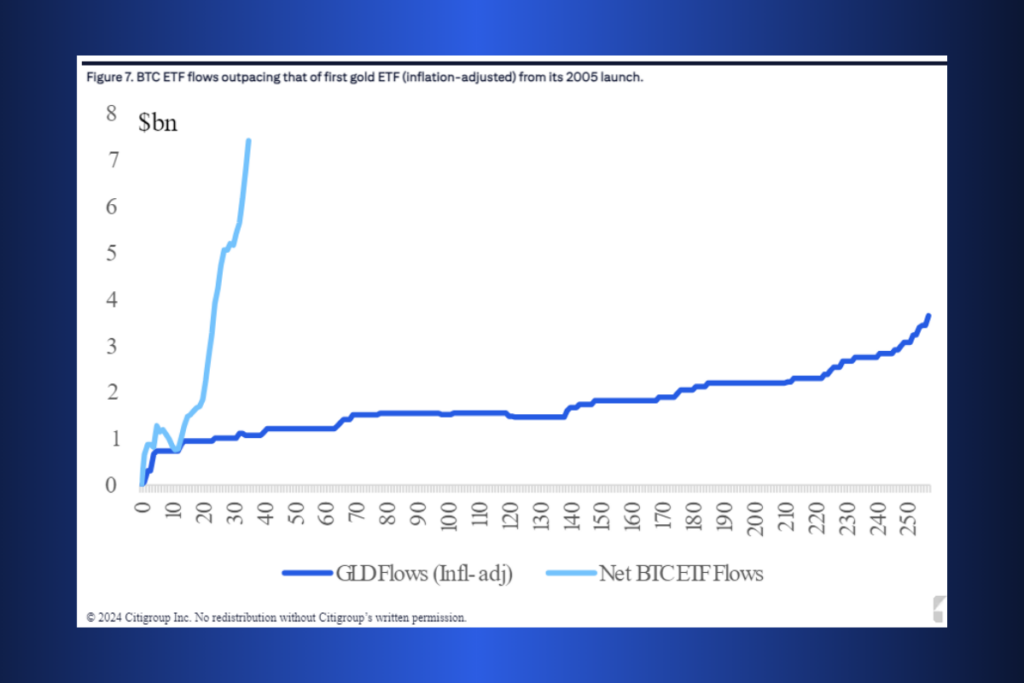

Last week, there were multiple days of record inflows into Bitcoin ETFs, with the new nine reaching over $500 billion on February 26, 27, and 28.

Bitcoin ETF inflows have absolutely blown gold’s out of the water. Not even close, utterly dwarfed, decimated,

Will Clemente, Reflexivity Research co-founder

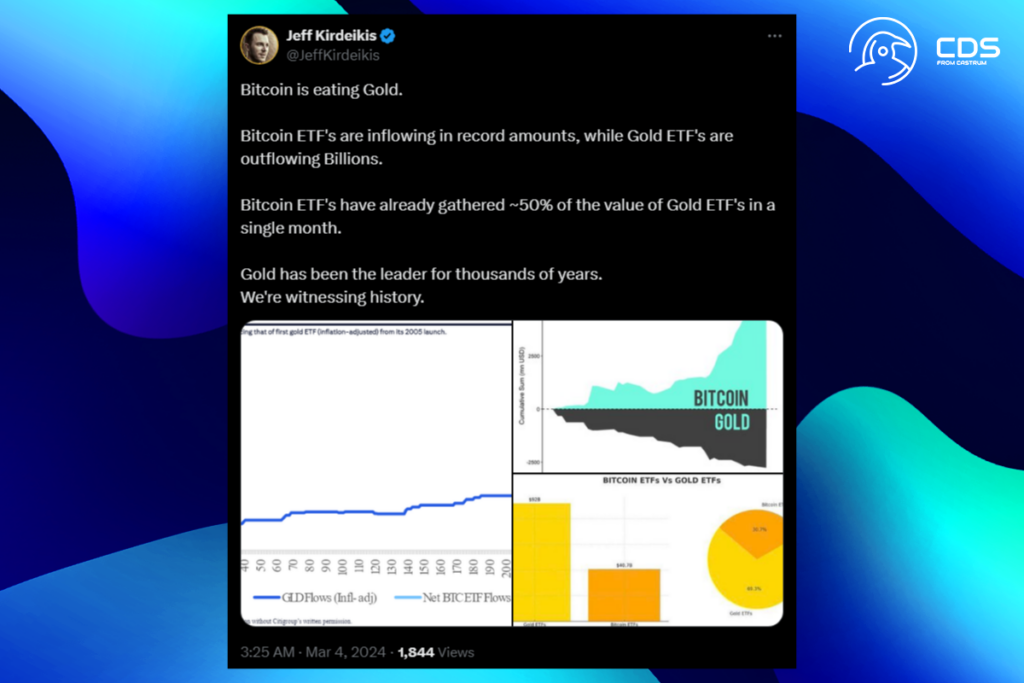

Jeff Kirdeikis Compares the Inflows and Outflows of Gold Funds

Former venture capitalist Jeff Kirdeikis published a chart on March 4 that contrasts the inflows and outflows of gold funds and shows that, since their inception in January, Bitcoin products have already amassed over half the value of gold funds.

On March 3, spot gold prices rose again to almost all-time highs of $2,081 an ounce; however, the price of the valuable yellow metal has only increased by 1% since the year’s start. In contrast, over the same time frame, the price of Bitcoin has increased by 50%. In less than two years, according to Eric Balchunas, there is a “decent chance” that AUM for Bitcoin ETFs will surpass that of gold ETFs.

Leave a comment