OpenLeverage’s Risk Analysis Reveals High Volatility: Investors on Alert Amidst Market Fluctuations

Crypto News – OpenLeverage undergoes a rigorous risk analysis conducted by InvestorsObserver, leveraging a proprietary system meticulously designed to gauge the susceptibility of a token to market manipulation. This sophisticated system meticulously scrutinizes the financial outlay required to influence a token’s price movement within the preceding 24-hour period.

Coupled with an in-depth examination of recent alterations in trading volume and market capitalization, this analysis provides a comprehensive risk assessment tool. The resulting risk score is delineated on a scale ranging from 0 to 100, wherein lower scores denote heightened risk levels, while higher scores imply a lower risk profile.

Trading Analysis of OpenLeverage (OLE)

Deciphering Market Trends

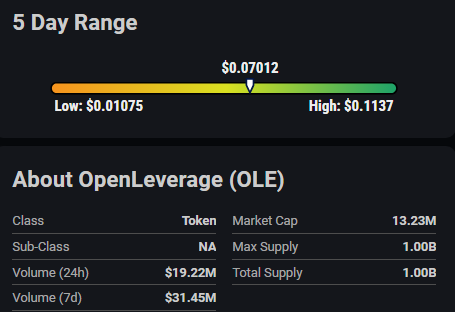

OLE’s current risk score positions it as a discernibly high-risk investment option. Investors with a paramount focus on risk assessment will find this score particularly illuminating, serving as a pivotal factor in decision-making processes aimed at navigating the realm of investments. Recent trading activities reveal a noteworthy price decline of 120.11% within the past 24 hours, precipitating a consequent reduction in its market value to $0.027058587 per token.

This price downturn is concomitant with a notable decrease in trading volume, indicating a deviation from the established norms. However, amidst these fluctuations, the token’s market capitalization has experienced an uptick, currently resting at $5,104,076.84. The juxtaposition of these variables underpins a high-risk assessment for OLE, suggesting a dynamic and volatile market environment.

Key Implications for Investors

Navigating the Risk Landscape

InvestorsObserver‘s evaluation assigns OpenLeverage (OLE) a medium-risk ranking, implying a degree of price volatility that is proportionate to the inherent value of the asset being traded. While acknowledging the potential for rapid price fluctuations, this medium rank signifies a reduced likelihood of deliberate manipulation. Notably, substantial price movements are anticipated to garner increased trading interest in OpenLeverage, further enriching the market dynamics.

Considerations for Stakeholders

Interpreting Risk-Reward Dynamics

The intersection of high risk and potential rewards underscores the significance of discerning market dynamics. A high-risk score intimates that even minimal financial investments can exert a significant impact on the cryptocurrency’s price, rendering it susceptible to manipulation or engendering an environment characterized by pronounced unpredictability.

In Summary

Interpreting Recent Price Movements

The recent price volatility exhibited by OpenLeverage (OLE) underscores its elevated risk profile, a consequence of pronounced price fluctuations vis-à-vis changes in trading volume. This heightened volatility prompts stakeholders to exercise prudence and vigilance amidst market uncertainties, acknowledging the potential for manipulative interventions in the current market landscape.

Leave a comment