Cryptocurrency Exchanges Shatter Records Amid Surging Demand and ETF Boom

Crypto News – Cryptocurrency exchanges have marked a historic end to February, with multiple platforms reporting unprecedented daily records.

Deribit, a leading crypto options and futures exchange, achieved several trading-related milestones on its platform just yesterday. Open interest soared to an all-time high of $29 billion, while platform client assets surged to a record-breaking $4 billion. Notably, the exchange’s 24-hour trading volume peaked at an astonishing $12.4 billion, setting yet another record.

In a moment of reflection, Deribit humbly remarked on the significance of these achievements: “Note to ourselves: Stay humble.”

Meanwhile, Coinbase Institutional‘s official account highlighted the remarkable performance of its U.S.-regulated futures exchange. On February 29th, the exchange witnessed an unprecedented number of unique users, surpassing 850 individuals. This influx of users contributed to the platform’s second-best-ever day, with approximately $380 million worth of bitcoin and ether contracts traded.

Expressing their dedication to fostering a fair and transparent marketplace, Coinbase Derivatives emphasized their commitment to meeting the growing demand. They pledged to continue developing new products and enhancing infrastructure to serve a diverse range of participants.

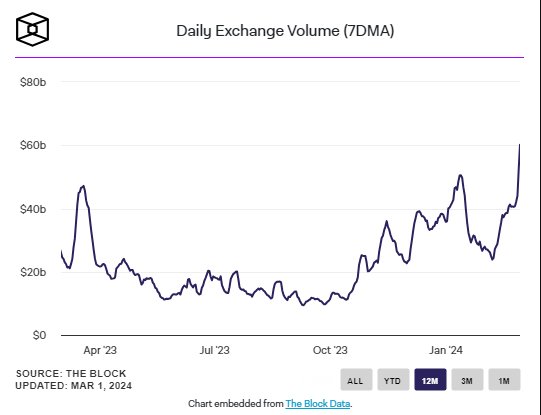

The fervent activity in the crypto markets is largely attributed to the demand for newly launched bitcoin exchange-traded funds (ETFs) in the United States. Eric Balchunas, a Senior ETF Analyst at Bloomberg, noted that coupled with the decreasing supply of bitcoin, this trend could fuel an upward spiral in the market for the foreseeable future.

Balchunas’ observations come in the wake of U.S. spot bitcoin ETFs witnessing a staggering net inflow of $673.4 million on Wednesday, surpassing the previous record set on their January 11th launch day.

Leave a comment