Hong Kong Crypto Crackdown: Exchanges Face Closure as Regulatory Deadline Looms

Crypto News – As of February 29, all crypto exchanges and trading platforms that failed to submit license applications to the regulatory authority must cease operations in Hong Kong by May 31.

Hong Kong’s cessation of accepting license applications for crypto exchanges signals the impending closure of non-compliant platforms.

The Securities and Futures Commission (SFC) of Hong Kong has underscored that all crypto exchanges in the region lacking license applications must shutter their businesses by May 31, 2024.

Encouraging early preparations, the Hong Kong SFC advises investors utilizing virtual asset trading platforms to transition to licensed entities or those in the process of obtaining licensure.

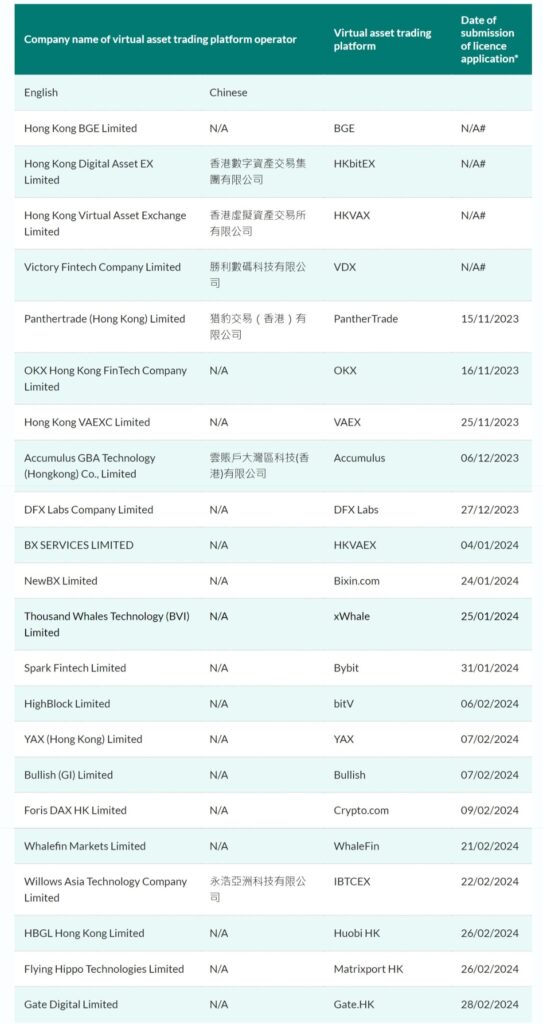

To date, the SFC has granted licenses to two crypto trading operators: OSL Digital Securities on December 15, 2020, and HashKey Exchange on November 9, 2022. While 22 crypto trading platforms submitted license applications, including four under the previous opt-in regime, four others—Huobi HK, Meex, BitHarbour, and Ammbr—withdrew or had their applications returned.

The SFC will maintain a public list of crypto platforms slated for closure, aiming to educate citizens about associated risks.

During the wind-down period, Hong Kong will curtail operational capabilities and enforce the cessation of marketing activities. The SFC will release a list of licensed crypto exchanges as of June 1, 2024, without guaranteeing licensure for all listed entities.

Upon obtaining SFC licensure, crypto exchanges can onboard retail investors for Bitcoin and Ether trading, with various altcoins and stablecoins undergoing SFC review for trading approval.

BitForex, a Hong Kong-based crypto exchange, has recently become unresponsive after suspending withdrawals for over three days.

With the exchange’s X account remaining stagnant since May 2023, users on its official Telegram channel report account access issues and asset dashboard discrepancies. Numerous users encounter pop-up screens blocking access to the company’s website, a concern corroborated by Cointelegraph’s internal investigation.

Leave a comment