Crypto News- The buzz around the nine recently launched spot Bitcoin exchange-traded funds (ETFs) shows no signs of slowing down. For the second day straight, these ETFs have collectively surpassed $2 billion in trading volume, fueling excitement among investors.

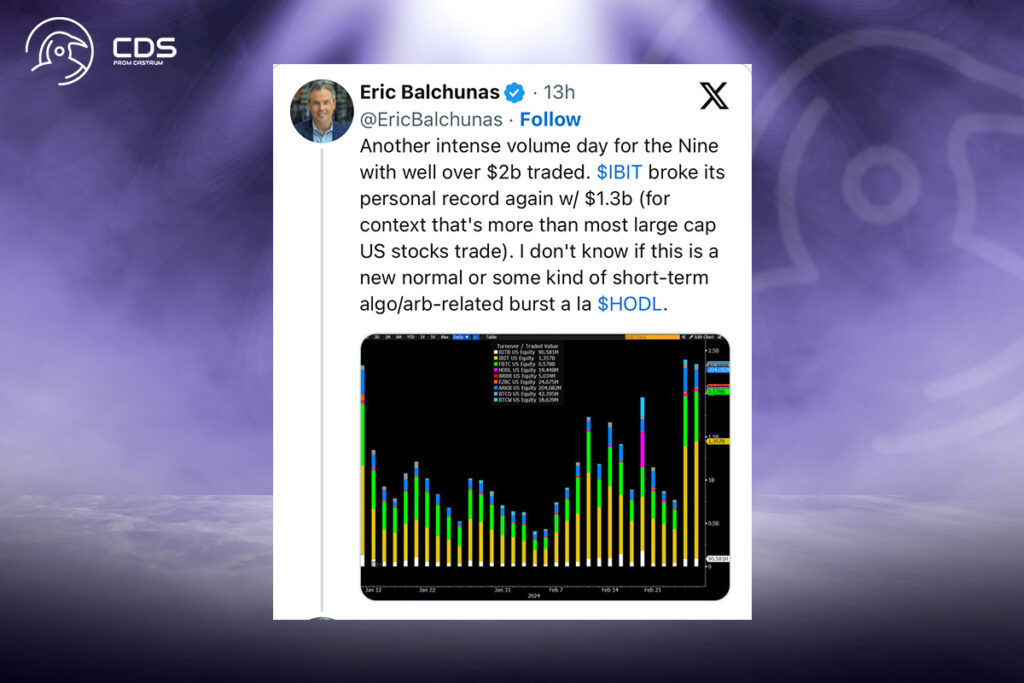

Bloomberg’s ETF analyst Eric Balchunas captured the fervor, describing it as “another intense volume day for the Nine.” Notably, BlackRock’s ETF reached a staggering $1.3 billion in daily volume, surpassing even some of the largest US stocks.

Bitcoin ETFs Surge: 2 Billion Dollars Traded Two Days in a Row

Speculation abounds about whether this surge represents a new market norm or a short-term algorithmic or arbitrage-driven phenomenon. Balchunas noted the remarkable uptick in individual trades, particularly in BlackRock’s iShares Bitcoin Trust ETF, which saw over 100,000 trades on February 27 compared to its average of 30,000 to 60,000.

Fidelity’s Wise Origin Bitcoin Fund and ARK 21Shares Bitcoin ETF also saw substantial trading activity, with daily volumes of $578 million and $204 million, respectively.

This streak marks the second consecutive day of $2 billion-plus trading volumes since the ETFs’ launch on January 11. On February 26, trading volumes soared to $2.4 billion, surpassing the initial record set on launch day.

Notably, these figures exclude volume from the Grayscale Bitcoin Trust (GBTC), which experienced significant outflows on February 26 and 27. Preliminary data from Farside Investors indicates a combined net inflow of $574 million into the ETFs on February 27, surpassing the previous day’s $520 million despite larger outflows from Grayscale.

BlackRock’s IBIT led in net inflows with $520 million, followed by Fidelity’s FBTC with $126 million. Bitwise’s fund also saw positive inflows of $18.3 million.

As illustrated by ETF Store President Nate Geraci’s chart, Grayscale’s ETF volume share continues to dwindle compared to its competitors, highlighting the growing popularity of the new ETFs.

With such fervent trading activity and substantial inflows, the spotlight remains firmly on the booming Bitcoin ETF market.

Leave a comment