Crypto News – A milestone that might see Bitcoin companies included in practically every portfolio is that MicroStrategy, the largest corporate Bitcoin holder, is steadily getting closer to meeting the standards to be listed on the S&P 500 index.

MicroStrategy in the S and P 500: Firm’s Index Entry Could Bring Bitcoin to the Masses

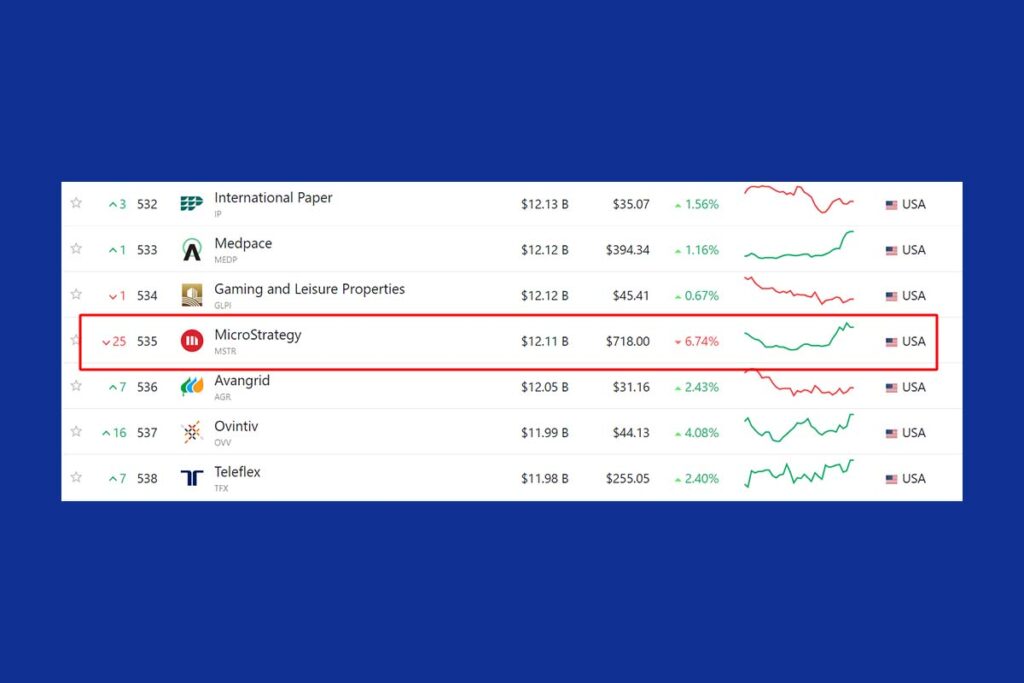

Nonetheless, the company that is centered around Bitcoin would still have to fulfill stringent requirements and obtain a significant increase in its market value. On February 15, MicroStrategy‘s stock price rose 46% over the course of eight trading days, propelling the company up to the 535th rank among the largest publicly-listed firms in the United States, according to data.

MicroStrategy Needs to Fulfill All Requirements

As of right now, candidate enterprises must have a $15.8 billion market capitalization in order to qualify. Given that MicroStrategy has a market capitalization of $12.1 billion, its current price of $718 would need to increase to $937 under all circumstances. All things considered, MicroStrategy’s stock has shown a positive total profit over the last four quarters, including the most recent one.

The 11-member S&P executive committee must approve MicroStrategy’s listing even if all requirements are completed. Every March, June, September, and December on the third Friday, the wide index fund rebalances. Until then, it looks like the wait will continue.

According to Joe Burnett, senior product marketing manager at Bitcoin financial services company Unchained, should MicroStrategy pursue and be successful in their S&P 500 listing, it may set off a large positive feedback loop of exposure to Bitcoin in almost every ETF portfolio.

If MicroStrategy is included in the S&P 500, Bitcoin will begin automatically infiltrating nearly every portfolio. This includes your traditional 401k, your pension fund, and every 60:40 portfolio.

Burnett

Leave a comment