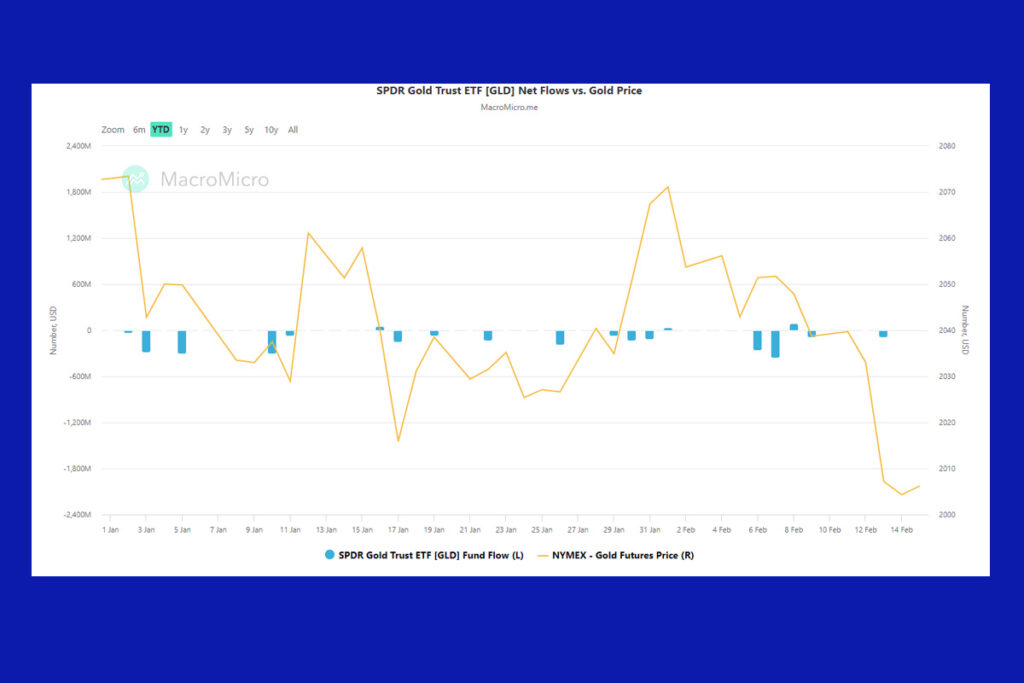

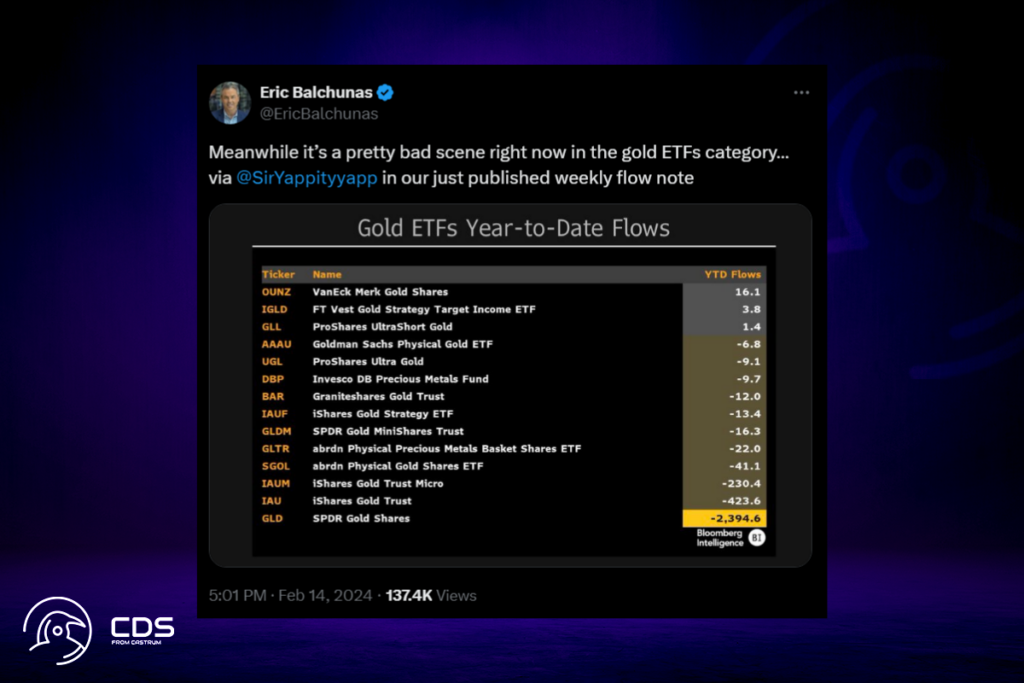

Crypto News – Around $2.4 billion has been removed from gold ETFs in 2024 due to outflows from BlackRock’s iShares Gold Trust ETF and SPDR Gold Shares (GLD) product.

Could $2 Billion in gold ETF Outflows Be Fueled by Equity FOMO?

Important shares of Abrdn’s Physical Gold Shares and Precious Metal Basket Gold Shares ETFs were also dumped by investors. The outflows from these were $22 million and $41.1 million, in that order.

In a post on X yesterday, Bloomberg analyst Eric Balchunas issued a warning, pointing out that these flows may not always represent investors switching from gold to Bitcoin. Instead, in light of recent high US inflation data, they can indicate investor FOMO.

Meanwhile, it’s a pretty bad scene right now in the gold ETFs category… To be sure I don’t think these are ppl migrating to BTC ETFs (maybe a tiny bit) but rather just us equity fomo although that could reverse given the new economic data,

Balchunas

Leave a comment