Crowded Competition Emerges in the Emerging World of Spot Bitcoin ETFs

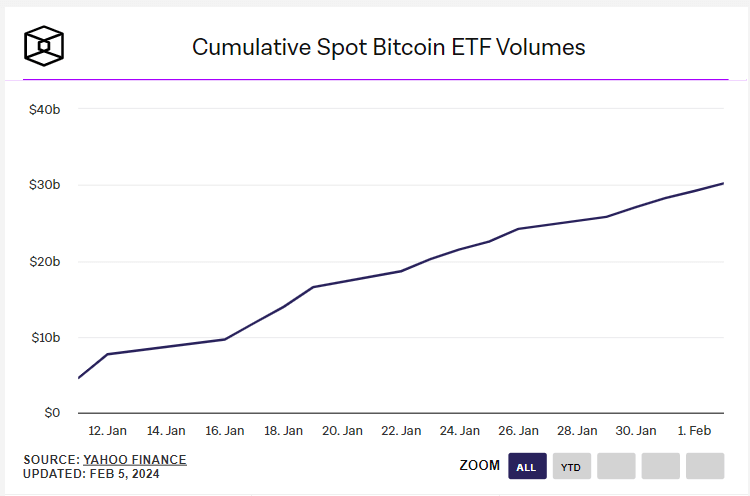

Crypto News – In the emerging landscape of spot Bitcoin ETFs, fierce competition is rapidly taking shape. In the first month alone, there was a notable influx of $1.5 billion, equivalent to approximately 32,000 Bitcoins, as reported by BitMEX Research. Furthermore, the combined trading volume of these ETFs has surpassed a significant milestone, reaching over $30 billion, according to data from The Block.

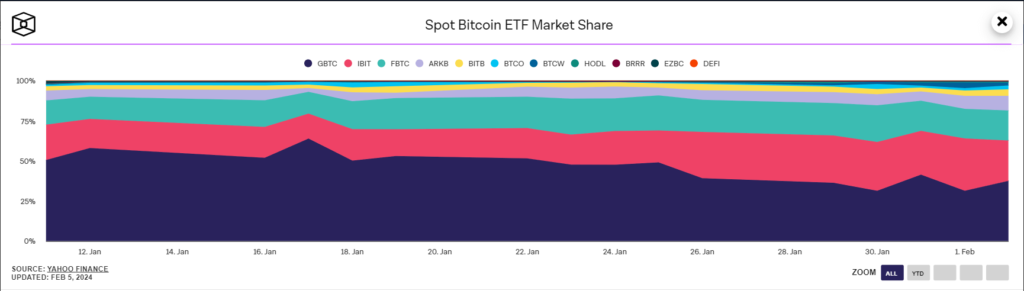

A notable shift in dominance among these Bitcoin ETFs has been observed. Grayscale Bitcoin Trust (GBTC), which initially held nearly 50% of the trading volume on its debut, has seen its market share decline to 38% by February 2nd.

In contrast, BlackRock‘s IBIT and Fidelity’s FBTC ETFs have witnessed substantial growth in their market share, with approximately 25% and 20% increases, respectively. This shift can be attributed primarily to the competitive fee structures offered by these ETFs, with GBTC charging 1.5% in fees, while FBTC and IBIT have more attractive fees of 0.25%.

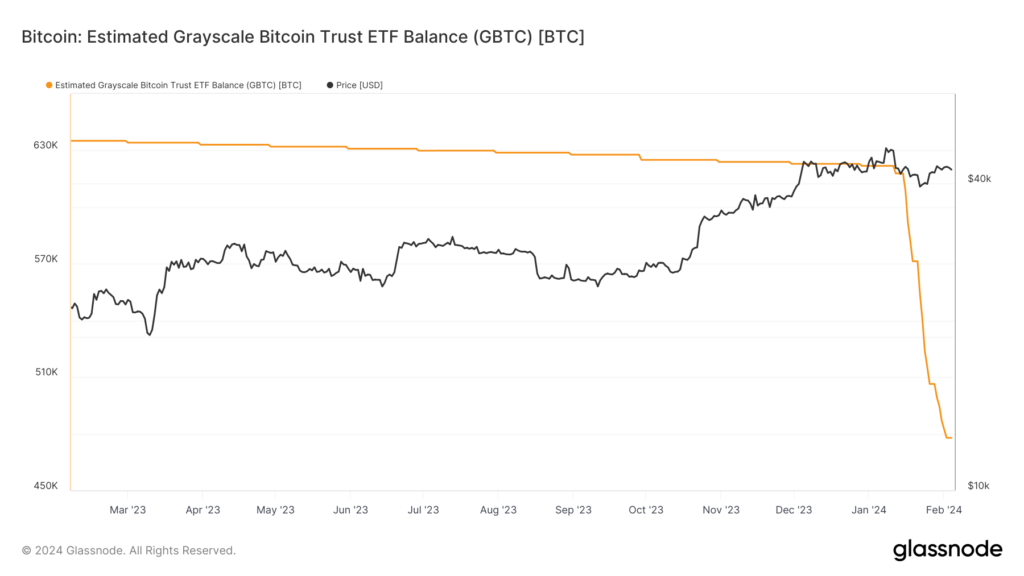

GBTC, which initially held 620,000 BTC before the ETFs began trading, now holds approximately 477,000 Bitcoins, representing a significant 26% drop from its peak.

This substantial decrease in GBTC’s holdings reflects persistent selling pressure, even though the outflows are gradually slowing down. Moreover, there is a growing likelihood of these Bitcoins flowing into the more cost-effective ETF options. Specifically, Bloomberg ETF analysts estimate that one-third of the outflows from GBTC are being redirected into these spot ETFs.

Leave a comment